Substantive testing

External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited. Which statement best describes the interaction of the systems and substantive approaches in the audit plan? A) The systems approach focuses on testing controls to make sure they are effective, while the substantive approach is the detailed testing of specific accounts for accuracy.

No matter how strong internal controls over financial reporting are, the auditor could not rely 100% on those internal controls by ignoring substantive tests. For our company with $500,000, the cash ledger may report that $5,000 is kept onsite for petty cash and customer receipts, $245,000 is kept at ABC Bank in a checking account, and $250,000 is kept at XYZ Bank in a savings account. The final step is simply counting the cash in the petty cash safe and then calling the bank to get account statements for the date of the financial reports. If the bank statement reports the same amount as the cash ledger, then the conclusion is that the cash account is complete and correct.

Prepare a rough draft of the financial statements and of the auditors’ report. Tour the client’s facilities and review the general records.

The results of the internal audit are used to make managerial changes and improvements to internal controls. The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors. External audits can include a review of both financial statements and a company’s internal controls. Which of the following is the most likely first step the auditors would perform at the beginning of an initial audit engagement?

Consult with and review the work of the predecessor auditors prior to discussing the engagement with the client management. Which of the following is least likely to be considered a risk assessment procedure in a financial statement audit? Which of the following statements is not correct regarding the auditor’s determination of materiality? It is the smallest amount of misstatement that would probably influence the judgment of a reasonable person relying upon the financial statements. Auditing standards require auditors to consider materiality in planning the audit.

For example, let’s consider a kiosk in the mall that sells smartphone cases. They might report on their financial statements that they have $30,000 in inventory. To confirm that, the auditor would look at the inventory records and ensure that the value of each item was accurate and that the quantity and value of all the different products added up to $30,000. They might even select a sample of products and physically count the products to ensure the inventory ledger agrees with the actual physical count.

If the financial statements say that a company has $500,000 in the bank, the auditors want evidence that there is actually $500,000 in the bank. First, they obtain the final version of the balance sheet and look at the amount of cash the company reports. Second, they research the cash ledger and identify where that cash is located. The combination of inherent risk and control risk determines the level of detection risk the auditor is willing to accept and to still be able to conclude that the financial report is materially correct. Detection risk is reduced or increased in direct proportion to the amount of substantive testing performed.

Compliance and Substantive Procedures

What is the difference between audit procedures and substantive procedures?

There are two categories of substantive procedures – analytical procedures and tests of detail.

For this reason, substantive analytical procedures alone are not well suited to detecting fraud. External auditors follow a set of standards different from that of the company or organization hiring them to do the work. The biggest difference between an internal and external audit is the concept of independence of the external auditor. Auditing is a profession that lives by the adage ‘Trust, but verify.’ Auditors verify by performing substantive tests to obtain documented evidence that supports some assessment or conclusion about some aspect of an organization. Examples of common substantive procedures that auditors routinely perform are bank confirmations, account reconciliations, and document matching.

Substantive Tests

The planning level of materiality will normally be the larger of the amount considered for the balance sheet versus the income statement. The appropriate financial statement base for computing materiality may vary based on the nature of the client’s business. Substantive procedures are used during an audit to test for a material misstatement of the financial statements.

Types of procedures

- When designing substantive analytical procedures, the auditor also should evaluate the risk of management override of controls.

- For some assertions, analytical procedures are effective in providing the appropriate level of assurance.

Another substantive procedure performed by auditors is document matching. This is simply obtaining two documents from two different, independent sources and making sure they match, or agree, with one another. This is a common procedure for auditing accounts receivable (A/R). An accounts receivable balance means the company is saying that customers owe them money.

You must create an account to continue watching

If they do, they can then look for payments made by the customer. After accounting for any payments, the balance should be the same as reported in the A/R ledger.

Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete.

If sufficient appropriate audit evidence cannot be obtained, or the evidence points to a material misstatement in the FS, the auditor will have to issue a modified audit opinion. In this situation, auditors will decide not to test the key controls and they jump to a substantive test. Because control over financial reporting is not reliable, to minimize the risks of material misstatements, auditors need to have a large sample size and it could be reached to 100%. Substantive procedures (or substantive tests) are those activities performed by the auditor to detect material misstatement or fraud at the assertion level. Account reconciliations are substantive procedures that require the auditor to trace the components of one account to some source documentation.

The auditor saves the copies of the bank statements, the cash ledger, the financial statements, and their cash count sheet as evidence of their conclusion. Most of the work auditors do is aimed at conducting substantive procedures. If you’ve ever worked at an organization that has been audited by external or internal auditors, you likely remember the requests for documentation, reports, and other original information.

For some assertions, analytical procedures are effective in providing the appropriate level of assurance. For other assertions, however, analytical procedures may not be as effective or efficient as tests of details in providing the desired level of assurance. When designing substantive analytical procedures, the auditor also should evaluate the risk of management override of controls. As part of this process, the auditor should evaluate whether such an override might have allowed adjustments outside of the normal period-end financial reporting process to have been made to the financial statements. Such adjustments might have resulted in artificial changes to the financial statement relationships being analyzed, causing the auditor to draw erroneous conclusions.

B) The systems approach focuses on detailed testing of specific accounts for accuracy, while the substantive approach is the testing controls to make sure they are effective. C) The systems approach focuses on the use of computer systems to aid in the audit while the substantive approach focuses on more manual tests. D) A thoroughly designed systems approach to auditing can eliminate the need for any substantive procedures.

The timing of substantive procedures is most flexible when controls have been tested and assessed as effective, and can be performed up to six months before year-end. When controls are not tested or are not assessed as effective, the timing of substantive procedures is at or near year-end.

What are the two types of substantive procedures?

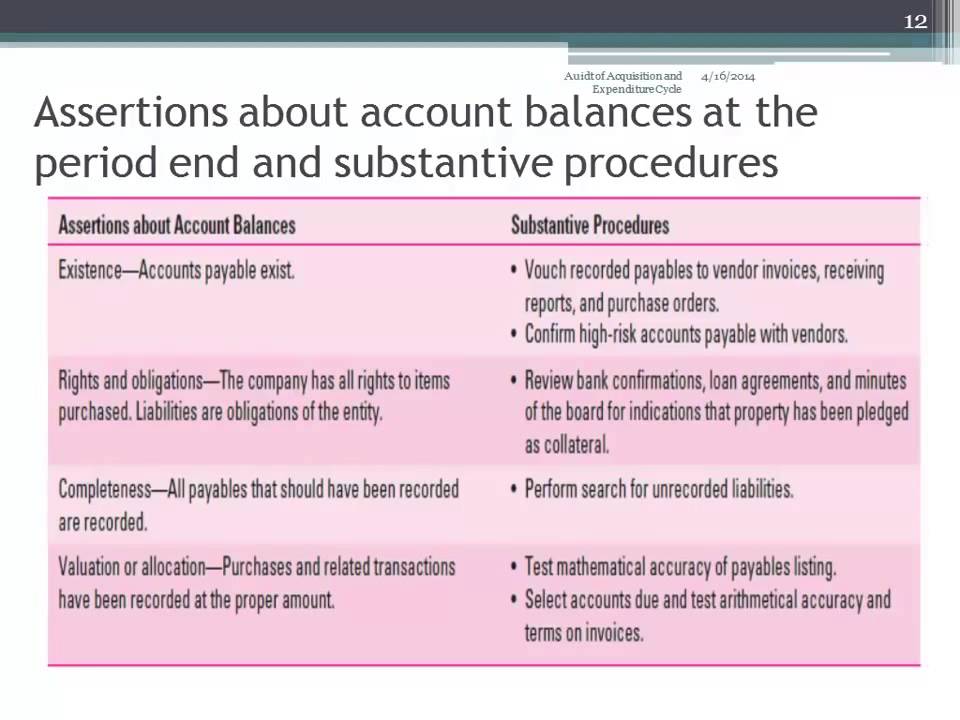

A substantive procedure is a process, step, or test that creates conclusive evidence regarding the completeness, existence, disclosure, rights, or valuation (the five audit assertions) of assets and/or accounts on the financial statements.

To qualify as a substantive procedure, enough documentation must be collected so that another competent auditor could conduct the same procedure on the same documents and make the same conclusion. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards.

Definition:

To test for that, the auditor would look at the A/R ledger and select a customer account. They would look at the balance for that account, and then find the customer’s order and company’s invoice. Those are two different documents from two different sources that should match.