Straight Line Depreciation Method

Multiplying this rate by the asset’s output for the year gives you the depreciation expense. You cannot use units of production depreciation to get a tax deduction.

In later years, a lower depreciation expense can have a minimal impact on revenues and assets. However, revenues may be impacted by higher costs related to asset maintenance and repairs. The depreciation method chosen should be appropriate to the asset type, its expected business use, its estimated useful life, and the asset’s residual value.

Expensing an asset based on usage can provide a more accurate and timely picture of its decline in value. However, tracking equipment usage doesn’t work for a lot of businesses, plus you also can’t use units of production depreciation for tax purposes.

Generally the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. Such expense is recognized by businesses for financial reporting and tax purposes. Manufacturers like units of production depreciation because it matches revenues and expenses. This method is also used to measure the depletion of natural resources in industries like oil drilling. It is most applicable to assets where usage can be accurately measured.

How do you calculate units of production depreciation?

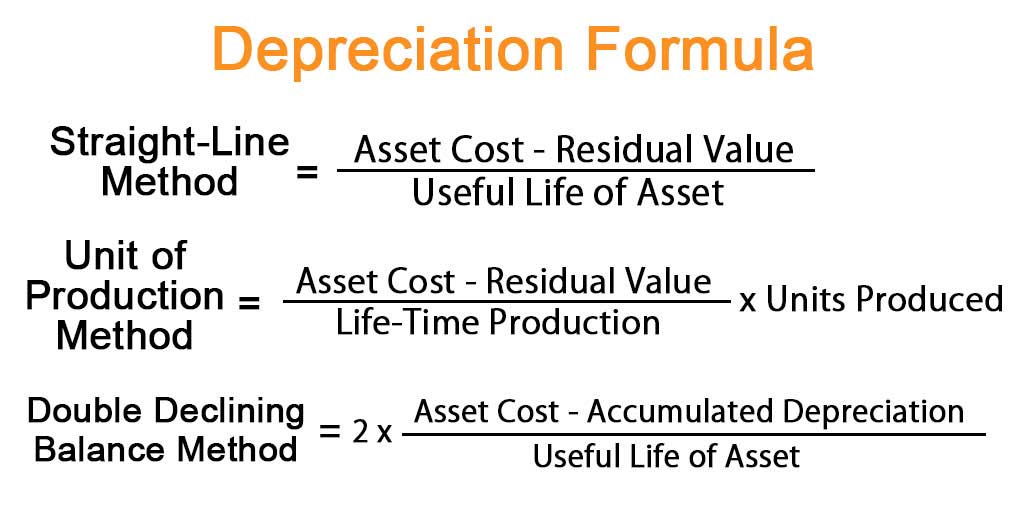

The Formula for the Unit of Production Method Is Depreciation expense for a given year is calculated by dividing the original cost of the equipment less its salvage value, by the expected number of units the asset should produce given its useful life.

There are various formulas for calculating depreciation of an asset. Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. The IRS does not allow units of production for tax purposes, so it is primarily used for internal bookkeeping.

Units of production depreciation is a depreciation method that allows businesses to determine the value of an asset based upon usage. Common in manufacturing, it’s calculated by dividing the equipment’s net cost by its expected lifetime production.

Depreciation is defined as the expensing of an asset involved in producing revenues throughout its useful life. Depreciation for accounting purposes refers the allocation of the cost of assets to periods in which the assets are used (depreciation with the matching of revenues to expenses principle). Depreciation expense affects the values of businesses and entities because the accumulated depreciation disclosed for each asset will reduce its book value on the balance sheet.

You’ll also want to make sure you’ve looked into Section 179 depreciation, which lets qualifying businesses deduct the entire cost of some assets, up to $1 million in the year of purchase. Remember, too, that the unit of production depreciation method is not for tax purposes, so you need to choose an additional method for taxes.

What Is the Tax Impact of Calculating Depreciation?

The sale price would find its way back to cash and cash equivalents. Any gain or loss above or below the estimated salvage value would be recorded, and there would no longer be any carrying value under the fixed asset line of the balance sheet. If the estimated number of hours of usage or units of production changes over time, incorporate these changes into the calculation of the depreciation cost per hour or unit of production. A change in the estimate does not impact depreciation that has already been recognized.

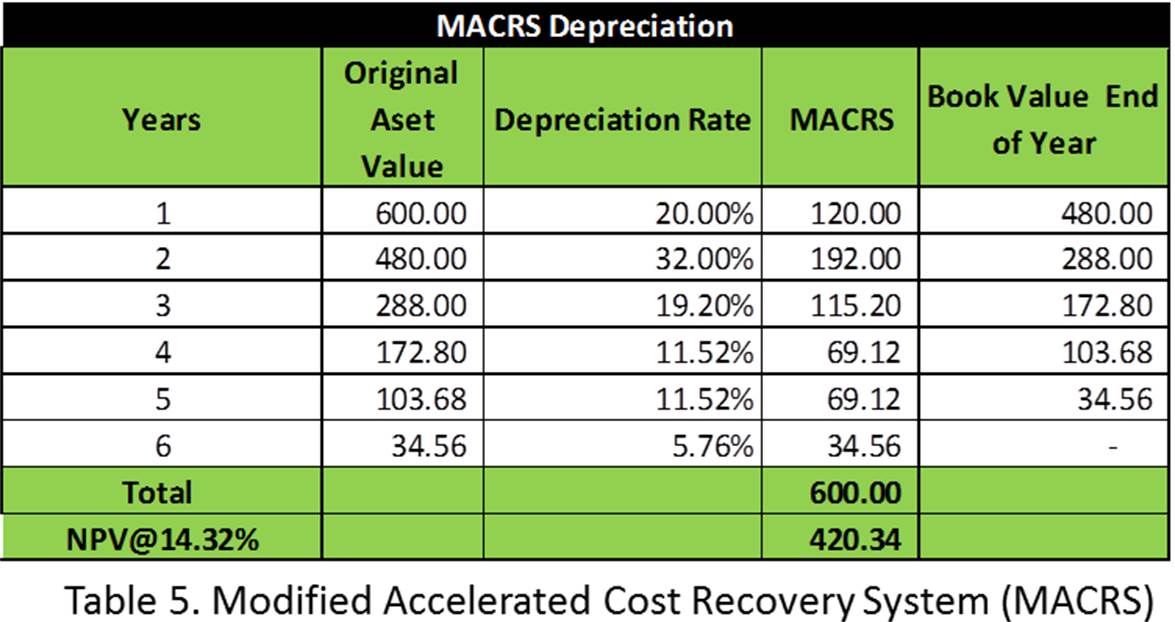

It is the most accurate method for charging depreciation, since this method is linked to the actual wear and tear on assets. However, it also requires that someone track asset usage, which means that its use is generally limited to more expensive assets. Also, you need to be able to estimate total usage over the life of the asset in order to derive the amount of depreciation to recognize in each accounting period. Some of the most common methods used to calculate depreciation are straight-line, units-of-production, sum-of-years digits, and double-declining balance, an accelerated depreciation method. The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system used in the United States.

Units of production depreciation work well for businesses that use machinery or equipment to make a product. It can provide a more accurate picture of profits and losses by spreading the cost of such assets over the years based on usage. This is helpful for manufacturers since production fluctuates with consumer demand. Most depreciation methods use time passed to determine the value an asset has lost, such as a car that depreciates 20% a year. Units of production depreciation reduces the value of equipment or machinery based upon its usage―often in units produced.

- You can calculate depreciation expense using an accelerated depreciation method, or evenly over the useful life of the asset.

- The advantage of using an accelerated method is that you can recognize more depreciation early in the life of a fixed asset, which defers some income tax expense recognition into a later period.

Double-declining balance is a type of accelerated depreciation method. This method records higher amounts of depreciation during the early years of an asset’s life and lower amounts during the asset’s later years. Thus, in the early years, revenues and assets will be reduced more due to the higher depreciation expense.

How does proration affect asset depreciation?

The primary method for steady depreciation is the straight-line method. Below are two examples of how to calculate depreciation for fixed assets using the units of production depreciation method.

The depreciation charges reflect actual wear and tear on such equipment and match revenues and expenses. However, this method can’t be used by all businesses or for tax purposes. To calculate units of production depreciation expense, you will apply an average cost per unit rate to the total units the machinery or equipment produces each year. This rate will be the ratio of the total cost of the asset less its salvage value to the estimated number of units it is expected to produce during its useful life.

So depreciation expense fluctuates with customer demand and actual wear on the asset. The modified accelerated cost recovery system (MACRS) is a standard way to depreciate assets for tax purposes. The carrying value would be $200 on the balance sheet at the end of three years. The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset.

Unit of Production Method Definition

You can calculate depreciation expense using an accelerated depreciation method, or evenly over the useful life of the asset. The advantage of using an accelerated method is that you can recognize more depreciation early in the life of a fixed asset, which defers some income tax expense recognition into a later period. The advantage of using a steady depreciation rate is the ease of calculation. Examples of accelerated depreciation methods are the double declining balance and sum-of-the-years digits methods.

However, it is one of the four methods of depreciation that you can use to report depreciation for accounting purposes. Units of production are especially appropriate for manufacturers whose usage of machinery varies with customer demand because it matches revenues and expenses. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

The amount reduces both the asset’s value and the accounting period’s income. A depreciation method commonly used to calculate depreciation expense is the straight line method. First, you divide the asset’s cost basis―less any salvage value―by the total number of units the asset is expected to produce over its estimated useful life. Then, you multiply this unit cost rate by the total number of units produced for the period.

The first is for a sewing machine, and the second is for a crane purchased for your factory. The units of production depreciation method requires the cost basis, salvage value, estimated useful life, total estimated lifetime production, and actual units produced for the sample calculations.

Under the units of production method, the amount of depreciation charged to expense varies in direct proportion to the amount of asset usage. Thus, a business may charge more depreciation in periods when there is more asset usage, and less depreciation in periods when there is less usage.

Whatever method you choose, you will also need to keep records for it because the IRS requires supporting documentation for fixed assets. In the event of an audit, you need to produce these records to back-up the cost basis of the asset and show that you owned it. Units of production depreciation can work very well for manufacturing firms that use assets to produce output.