Solvency vs Liquidity

Solvency Ratio Definition

Other factors and ratios like debt ratio, debt-equity ratio, industry and economic conditions should be considered before lending. Solvency ratios indicate a company’s financial health in the context of its debt obligations.

Solvency Ratios (Summary)

Although they both measure the ability of a company to pay off its obligations, solvency ratios focus more on the long-term sustainability of a company instead of the current liability payments. The solvency ratio includes financial obligations in both the long and short term, whereas liquidity ratios focus more on a company’s short-term debt obligations and current assets. It measures this cash flow capacity in relation to all liabilities, rather than only short-term debt. This way, the solvency ratio assesses a company’s long-term health by evaluating its repayment ability for its long-term debt and the interest on that debt. The solvency ratio is a key metric used to measure an enterprise’s ability to meet its debt obligations and is used often by prospective business lenders.

The solvency ratio indicates whether a company’s cash flow is sufficient to meet its short-and long-term liabilities. The lower a company’s solvency ratio, the greater the probability that it will default on its debt obligations. Liquidity ratios gauge a company’s ability to pay off its short-term debt obligations and convert its assets to cash. It is important that a company has the ability to convert its short-term assets into cash so it can meet its short-term debt obligations. A healthy liquidity ratio is also essential when the company wants to purchase additional assets.

What Does the Solvency Ratio Tell You?

Higher the ratio better is the financial position of the Company and it is a better candidate to raise more debt. A ratio of more than 1 is favorable however lenders should not rely on the ratio alone to decide.

This means that they are able to close out their long-term debt obligations when they come due using operating income. Lenders looking through a company’s financial statement will usually use the solvency ratio as a determinant for creditworthiness. Liquidity indicates how easily a company can meet its short-term debt obligations. A highly liquid company generally has a lot of cash or cash-equivalent assets on hand, because you generally can’t meet short-term operating needs by selling off pieces of equipment.

This indicates whether a company’s net income is able to cover its total liabilities. Generally, a company with a higher solvency ratio is considered to be a more favorable investment.

Is current ratio a solvency ratio?

The solvency ratio is a key metric used to measure an enterprise’s ability to meet its debt obligations and is used often by prospective business lenders. The solvency ratio indicates whether a company’s cash flow is sufficient to meet its short-and long-term liabilities.

The solvency ratio measures a company’s ability to meet its long-term obligations as the formula above indicates. The current ratio and quick ratio measure a company’s ability to cover short-term liabilities with liquid (maturities of a year or less) assets. These include cash and cash equivalents, marketable securities and accounts receivable. The short-term debt figures include payables or inventories that need to be paid for. Basically, solvency ratios look at long-term debt obligations while liquidity ratios look at working capital items on a firm’s balance sheet.

Acceptable solvency ratios vary from industry to industry, but as a general rule of thumb, a solvency ratio of greater than 20% is considered financially healthy. The lower a company’s solvency ratio, the greater the probability that the company will default on its debt obligations. Looking at some of the ratios mentioned above, a debt-to-assets ratio above 50% could be cause for concern. A debt-to-equity ratio above 66% is cause for further investigation, especially for a firm that operates in a cyclical industry. A lower ratio is better when debt is in the numerator, and a higher ratio is better when assets are part of the numerator.

- The solvency ratio measures a company’s ability to meet its long-term obligations as the formula above indicates.

Solvency ratios are primarily used to measure a company’s ability to meet its long-term obligations. In general, a solvency ratio measures the size of a company’s profitability and compares it to its obligations. By interpreting a solvency ratio, an analyst or investor can gain insight into how likely a company will be to continue meeting its debt obligations.

What are solvency ratios and what do they measure?

Walmart Inc., solvency ratios

Based on: 10-K (filing date: 2019-03-28), 10-K (filing date: 2018-03-30), 10-K (filing date: 2017-03-31), 10-K (filing date: 2016-03-30), 10-K (filing date: 2015-04-01), 10-K (filing date: 2014-03-21). A solvency ratio calculated as total debt divided by total shareholders’ equity.

Overall, a higher level of assets, or of profitability compared to debt, is a good thing. More complicated solvency ratios include times interest earned, which is used to measure a company’s ability to meet its debt obligations. It is calculated by taking a company’s earnings before interest and taxes (EBIT) and dividing it by the total interest expense from long-term debt. It specifically measures how many times a company can cover its interest charges on a pretax basis.

The solvency ratio is used often by prospective business lenders to discover whether a company’s cash flow is sufficient to meet its short-and long-term liabilities. Solvency ratio is one of the various ratios used to measure the ability of a company to meet its long term debts. Moreover, the solvency ratio quantifies the size of a company’s after tax income, not counting non-cash depreciation expenses, as contrasted to the total debt obligations of the firm. Also, it provides an assessment of the likelihood of a company to continue congregating its debt obligations.

Times interest earned ratio measures the Company’s solvency and its ability to service its debt obligations. The ratio is indicative of the number of times the earnings to the interest expenses of the Company.

Solvency ratios measure the ability of a company to pay its long-term debt and the interest on that debt. Solvency ratios, as a part of financial ratio analysis, help the business owner determine the chances of the firm’s long-term survival. Liquidity ratiosand the solvency ratioare tools investors use to make investment decisions. Liquidity ratios measure a company’s ability to convert its assets into cash.

On the other hand, the solvency ratio measures a company’s ability to meet its financial obligations. The solvency ratio is calculated by dividing a company’s after-tax net operating income by its total debt obligations. The net after-tax income is derived by adding non-cash expenses, such as depreciation and amortization, back to net income. Short-term and long-term liabilities are found on the company’s balance sheet.

For instance it might include assets, such as stocks and bonds, that can be sold quickly if financial conditions deteriorate rapidly as they did during the credit crisis. In contrast to liquidity ratios, the solvency ratio measure a company’s ability to meet its total financial obligations. The solvency ratio is calculated by dividing a company’s net income and depreciation by its short-term and long-term liabilities.

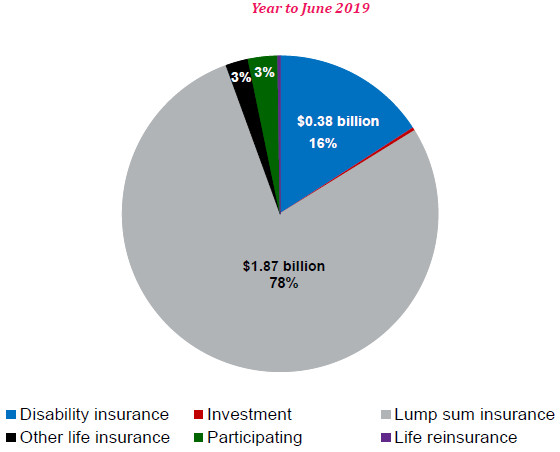

In liquidity ratios, assets are part of the numerator and liabilities are in the denominator. The report details that the European Union is implementing more stringent solvency standards for insurance firms since the Great Recession. The rules are known as Solvency II and stipulate higher standards for property and casualty insurers, and life and health insurers.

Limitations of Using the Solvency Ratio

In stark contrast, a lower ratio, or one on the weak side, could indicate financial struggles in the future. Solvency ratios, also called leverage ratios, measure a company’s ability to sustain operations indefinitely by comparing debt levels with equity, assets, and earnings. In other words, solvency ratios identify going concern issues and a firm’s ability to pay its bills in the long term.

As you might imagine, there are a number of different ways to measure financial health. Current assets reflect the company’s short-term liquidity or how much cash Costco can access within the year. Current liabilities can be likened to bills that will be paid within the year. Together, current assets and liabilities can paint a picture of how financially sound the company is within the current year. But to get a true understanding of these values and see if the trend is positive or negative, calculating financial ratios and comparing these with prior year ratios is necessary.