Salary or Draw: How to Pay Yourself as a Business Owner

Similarly, there may be shareholders who trust the management potential and may prefer allowing them to retain the earnings in hopes of much higher returns (even with the taxes). But if a company is consistently unprofitable, its retained earnings may become negative. In this case, the board of directors have no funds in retained earnings, so it cannot pay out dividends.

Retained earnings, or retained profits, are the net income your company generates that are retained by your company and not distributed to the owners. Retained earnings are either reinvested in the company to assist with stabilization and expansion or retained to strengthen the company’s balance sheet. Profits retained by the company become equity and appear on the balance sheet as a component of owners’ equity. Specifically, owners’ equity includes initial investment capital, additional paid-in capital and retained earnings.

In short, retained earnings is the cumulative total of earnings that have yet to be paid to shareholders. These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt. Retained earnings represent the accumulated net income your business keeps after paying all costs, expenses and taxes. The retained earnings balance changes if you pay your stockholders a dividend.

What this means is as each year passes, the beginning retained earnings are the ending retained earnings of the previous year. Retained earnings are leftover profits after dividends are paid to shareholders, added to the retained earnings from the beginning of the year. Retained earnings represent theportion of net income or net profit on a company’s income statement that are not paid out as dividends. Retained earnings are often reinvested in the company to use for research and development, replace equipment, or pay off debt. Debit and credit refer to the left and right sides of the accounting ledger.

Your retained earnings balance is the cumulative total of your net income and losses. Retained earnings are accumulated and tracked over the life of a company.

Stock Dividend Payout

Both of these methods attempt to measure the return management generated on the profits it plowed back into the business. Look-through earnings, a method that accounts for taxes and was developed by Warren Buffett, is also used in this vein. Retained earnings are the portion of a company’s net income that management retains for internal operations instead of paying it to shareholders in the form of dividends.

Of the $7.50, Company A paid out $2 in dividends, and therefore had a retained earnings of $5.50 a share. Since the company’s earnings per share in 2012 is $1.35, we know the $5.50 in retained earnings produced $1.10 in additional income for 2012. Company A’s management earned a return of 20% ($1.10 divided by $5.50) in 2012 on the $5.50 a share in retained earnings. Typically, portions of the profits is distributed to shareholders in the form of dividends. Savvy investors should look closely at how a company puts retained capital to use and generates a return on it.

Retained earnings are business profits that can be used for investing or paying down business debts. They are cumulative earnings that represent what is leftover after you have paid expenses and dividends to your business’s shareholders or owners. Retained earnings are also known as retained capital or accumulated earnings.

How Are Retained Earnings Recorded?

All accounts, including retained earnings, possess a normal, positive balance that displays as either a debit or a credit. When their values increase, those increases appear on the side that is normal to that account while decreases appear on the opposite side.

What is a Balance Sheet?

It is also called earnings surplus and represents the reserve money, which is available to the company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also calledretention ratio and is equal to (1 – dividend payout ratio). Dividends are also preferred as many jurisdictions allow dividends as tax-free income, while gains on stocks are subject to taxes. On the other hand, company management may believe that they can better utilize the money if it is retained within the company.

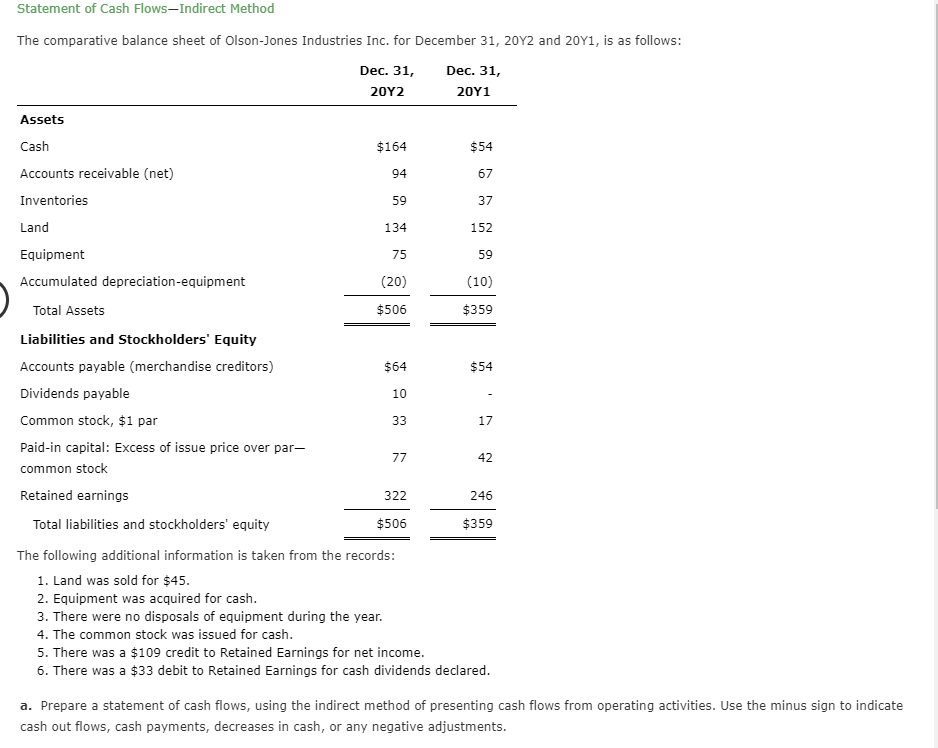

To calculate RE, the beginning RE balance is added to the net income or loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period. Retained earnings (RE) is the amount of net income left over for the business after it has paid out dividends to its shareholders.

Is it OK to have negative equity on a balance sheet?

Retained Earnings Defined If a company has negative retained earnings, it has an accumulated deficit. An accumulated deficit means a company has more debt than it has earned. As with many of the financial performance measurements, this must be taken into context with the company’s general situation.

- Retained earnings are business profits that can be used for investing or paying down business debts.

- Retained earnings are also known as retained capital or accumulated earnings.

A business generates earnings that can be positive (profits) or negative (losses). The retained earnings account and the paid-in capital account are recorded in the stockholders’ equity section on the balance sheet. The balance for the retained earnings account is taken from the income statement. The net income or net loss disclosed on the income statement for each accounting period is added to the existing retained earnings balance.

Retained Earnings Are Important, but How They’re Used Is Critical

Retained earnings are the portion of a company’s profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date. Retained earnings are related to net (as opposed to gross) income since it’s the net income amount saved by a company over time. Positive profits give a lot of room to the business owner(s) or the company management to utilize the surplus money earned. Often this profit is paid out to shareholders, but it can also be re-invested back into the company for growth purposes.

AccountingTools

If you are the sole owner, you may choose to forego dividend payments in favor of using the funds for your business. However, if you sold stock shares to raise capital, your stockholders may expect an occasional dividend. The dividend payment is reported on the balance sheet and reduces the amount in your retained earnings account. You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings.

Suppose a sole proprietor contributes cash to the business for operating costs. Similarly, in a public company, paid-in capital, the money investors spend to purchase shares of stock, is listed as invested capital. Retained earnings refer to the net income of a company from its beginnings up to the date the balance sheet is structured. For companies with multiple stockholders, any declared dividends are subtracted to obtain the retained earnings figure.

Retained earnings somewhat reflect a company’s dividend policy, because they reflect a company’s decision to either reinvest profits or pay them out to shareholders. Ultimately, most analyses of retained earnings focus on evaluating which action generated or would generate the highest return for the shareholders. under the shareholder’s equity section at the end of each accounting period.

Each accounting transaction appears as an even sum recorded on each side of the ledger. At the end of the accounting period when income and expenses are tallied up, if the business suffers a loss, this amount is transferred to retained earnings. This shortfall in retained earnings has an adverse affect on owner’s equity by reducing what is actually owned. It is important to understand that retained earnings do not represent surplus cash or cash left over after the payment of dividends.

As the company loses ownership of its liquid assets in the form of cash dividends, it reduces the company’s asset value in the balance sheet thereby impacting RE. By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments.

Rather, retained earnings demonstrate what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. These reinvestments are either asset purchases or liability reductions. A company’s board of directors may appropriate some or all of the company’s retained earnings when it wants to restrict dividend distributions to shareholders. Appropriations are usually done at the board’s discretion, although bondholders and other circumstances may contractually require the board to do so. Appropriations appear as a special account in the retained earnings section.

Many investors find it confusing that a company can pay a dividend even when it’s losing money. The reason is that when a company retains earnings from previous profitable periods, it effectively reserves the right to pay them out to shareholders as dividends in the future. Cash payment of dividend leads to cash outflow and is recorded in the books and accounts as net reductions.

If the company is not profitable, net loss for the year is included in the subtractions along with any dividends to the owners. The statement of retained earnings is afinancial statement that is prepared to reconcile the beginning and ending retained earnings balances. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders. Another factor that affects owner’s equity is invested capital for companies with multiple stockholders or an owner’s contributions for sole proprietorships and other small businesses.

Your company’s net income can be found on your income statement or profit and loss statement. If you have shareholders, dividends paid is the amount that you pay them. All of the net profit rolls over into retained earnings less any dividends or distributions you take as an owner.

Accumulated retained earnings are the profits companies amass over the years and use to foster growth. The basic accounting equation for a business is assets equal liabilities plus the owner’s equity; simply turned around, this means the owner’s equity equals assets minus liabilities. Shown on a balance sheet, the terms used to indicate owner’s equity may be listed as one or more accounts. Regardless of the account names, equity is the portion of the business the owner actually owns, including retained earnings. For example, if Company A earns 25 cents a share in 2002 and $1.35 a share in 2012, then per-share earnings rose by $1.10.