salaries expense definition and meaning

Hiring employees to meet labor demands is a special kind of business transaction that has its own monetary terms. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance. Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable.

Because they are paid amounts, you increase the expense account. Debit the wages, salaries, and company payroll taxes you paid. As a small business owner, you use payroll journal entries to record payroll expenses in your books.

If you contribute to your employees’ health care plans or make contributions to their retirement funds, then these payments are part of overall expenditures on your workforce or payroll expense. When calculating your payroll expense, don’t include amounts that you take out of employee paychecks, even if you remit these amounts to third parties such as health insurance providers. These amounts have already been included in your employees’ gross wages.

When you pay the employee, you no longer owe wages, so your liabilities decrease. A credit to the account of payroll payable increases the amount of payroll liability for the company. A credit to cash reduces the balance in the cash account.

50.00When it comes time to pay the payroll payable such as FICA and Federal Income Tax Payable, you would simply debit the payable accounts you are paying and credit cash. Gross earnings are recorded using expense accounts such as salary or wage expense. Net pay for your employees is recorded using liability accounts such as net payroll payable, wage payable, or accrued wages payable.

How do you Journalize payroll transactions?

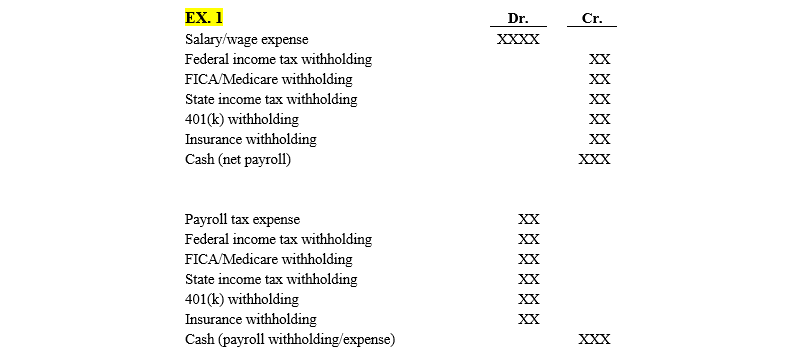

Payroll entries. The primary payroll journal entry is for the initial recordation of a payroll. This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the government by the company. Accrued wages.

This check may be paid through the corporate accounts payable bank account, rather than its payroll account, so you may need to make this entry through the accounts payable system. If you are recording it directly into the general ledger or the payroll journal, then use the same line items already noted for the primary payroll journal entry. It is quite common to have some amount of unpaid wages at the end of an accounting period, so you should accrue this expense (if it is material). When you record payroll, you will generally debit Gross Wage Expense, credit all of the liability accounts, and credit the cash account.

The accounts that you need to set up to track payroll will generally be an expense account or a liability account. An expense is a cost that you have as a result of doing business, like gross wages and health insurance.

Accrued payroll may be paid immediately at the period end or later, on the next payday. Companies use different journal entries to record accrued payroll, payroll payable and payroll cash payments. Business also accrue payroll expenses in the form of employee benefits.

If companies withhold any payroll taxes on behalf of employees, the cash payments are reduced by the amount of taxes to arrive at the net pay for employees. Companies then use another credit entry of payroll tax payable to offset the difference between the amount of total payroll and the amount of net pay. Accrued payroll is another term for accrued wages and salaries, which are labor costs that companies incur over time.

- Payroll taxes are the amounts that your business must pay to state and federal agencies based on gross payroll figures.

- Employers must make contributions to employees’ Social Security and Medicare funds in the combined amount of 7.65 percent of gross wages as of 2012.

This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the government by the company. As discussed in the previous section, a journal entry is best described as the recording of debits and credits. However, if you use a manual accounting system, then you will need to create journal entries.

Double Journal Entries

Initial recordings are the primary entries for payroll accounting. For these entries, record the gross wages your employees earn and all withholdings. Also, include employment taxes you owe to the government.

What is payroll accounting?

Only include the amounts that your business pays to supplement these withholdings. In accounting, recording business transactions follows the double journal entries recording system. Every business transaction is recorded in two opposite journal entries, a debit and a credit, representing respectively the money uses of the transaction and the money sources for the transaction.

If a company’s employees are paid weekly based on hours worked, the payroll processing is likely done during the first few days following the work week. As a small business owner, payroll is one of your biggest expenses.

Payroll taxes are the amounts that your business must pay to state and federal agencies based on gross payroll figures. Employers must make contributions to employees’ Social Security and Medicare funds in the combined amount of 7.65 percent of gross wages as of 2012. In addition, most states require employers to pay industrial insurance and unemployment insurance, and the federal government requires employers to pay an unemployment insurance tax as well.

Gross Wages will appear on your Profit and Loss report, and the liability and cash accounts will be included on your Balance Sheet report. Payroll accounting involves both expense and liabilities accounts such as FICA Taxes Payable, Federal and State Income Tax Payable, Health Insurance Premiums Payable, etc. On the income statement, payroll expenses are part of labor costs. They include employee salaries, employer payments for health insurance or similar benefits, payroll taxes paid by the employer, bonuses, commissions and similar expenses. The debits and credits must add up to the same amount for accurate payroll accounting entries.

Payroll journal entries fall under the payroll account and are a part of your small business general ledger. Expenses entered in the payroll account include gross wages, salaries, and other earnings as well as payroll taxes. The primary payroll journal entry is for the initial recordation of a payroll.

What Is the Offset Journal Entry for Accrued Payroll?

A credit to a liability account increases its credit balance. AccountDebitCreditGross WagesXFICA Tax Payable (Employee)XFederal Income Tax PayableXState Income Tax PayableXPayroll Payable (Net Wages)XThe expenses include gross wages, which are debited. The liabilities include FICA tax payable, federal income tax payable, state income tax payable, and payroll payable. The offset entry to the debit entry of accrued payroll is a credit entry of either cash payments or payroll-related liabilities.