Rules of Trial Balance

In closing the books, companies make separate entries to close revenues and expenses to Income Summary, Income Summary to Retained Earnings, and Dividends to Retained Earnings. A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet.

Deferred expenses are expenses that have been paid in advance and will be expensed out at a later date. Sometimes a bill is processed during the accounting period, but the amount represents the expense for one or more future accounting periods. For example, the bill for the insurance on the company’s vehicles might be $6,000 and covers the six-month period of January 1 through June 30.

Adjusting Entries: A Simple Introduction

The assumption is that all income from the company in one year is held onto for future use. Any funds that are not held onto incur an expense that reduces net income (NI).

In order for a company’s financial statements to include these transactions, accrual-type adjusting entries are needed. If a company’s revenues were greater than its expenses, the closing entry entails debiting income summary and crediting retained earnings. In the event of a loss for the period, the income summary account needs to be credited and retained earnings are reduced through a debit. A company needs to book adjusting entries when it has prepayments, accruals or estimates in its accounting records.

When a company receives cash but hasn’t earned it yet, it’s considered a prepayment. The company will book an adjusting entry to recognize the revenue after it has completed the job. The opposite situation is an accrual; a company has incurred expenses but hasn’t paid money for them yet. GAAP requires accountants to record some estimates, such as bad debt expense. Accountants estimate the expense so they can record it in the period they receive the corresponding revenue.

The reversing entry removes the liability established on December 31 and also puts a credit balance in the Repairs Expense account on January 2. When the vendor’s invoice is processed in January, it can be debited to Repairs Expenses (as would normally happen). If the vendor’s invoice is $6,000 the balance in the account Repairs Expenses will show a $0 balance after the invoice is entered.

Prior to issuing its December financial statements, Servco must determine how much of the $4,000 has been earned as of December 31. The reason is that only the amount that has been earned can be included in December’s revenues. The amount that is not earned as of December 31 must be reported as a liability on the December 31 balance sheet.

A trial balance is the first place to start during your closing process to identify closing entries and accuracy concerns. You need to know what to include in your trial balance to ensure that your reports are complete. No matter what the type of account adjustment is that needs to be made, the main purpose of the adjustment is to ensure that account balances are correct for the end of the period reporting. The same balances that end a period are also the ones that open the next period. So, errors in account balances can and do cause information on the financial statements to be incorrect.

Account adjustments, also known as adjusting entries, are entries that are made in the general journal at the end of an accounting period to bring account balances up-to-date. Unlike entries made to the general journal that are a result of business transactions, account adjustments are a result of internal events. Internal events are those events that have occurred in the business that don’t involve an exchange of goods or services with another entity.

You create adjusting journal entries at the end of an accounting period to balance your debits and credits. They ensure your books are accurate so you can create financial statements. An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared.

The main purpose of adjusting entries is to update the accounts to conform with the accrual concept. At the end of the accounting period, some income and expenses may have not been recorded, taken up or updated; hence, there is a need to update the accounts. Accrued revenues are money earned in one accounting period but not received until another. Accrued expenses are expenses that are incurred in one accounting period but not paid until another. Deferred revenues are money that a business has been paid in advance for a service that will be provided later.

Account adjustments are entries made in the general journal at the end of an accounting period to bring account balances up-to-date. They are the result of internal events, which are events that occur within a business that don’t involve an exchange of goods or services with another entity. There are four types of accounts that will need to be adjusted. They are accrued revenues, accrued expenses, deferred revenues and deferred expenses. Closing the books occurs at the end of an accounting period.The process is to journalize and post closing entries and then rule and balance all accounts.

- Account adjustments are entries made in the general journal at the end of an accounting period to bring account balances up-to-date.

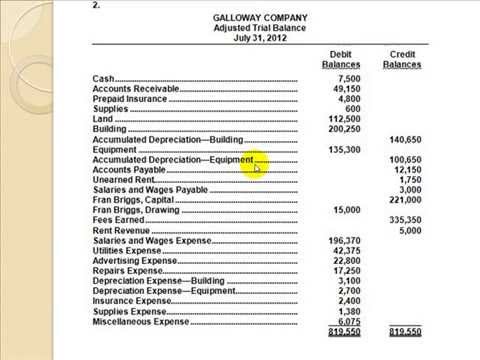

Adjusted Trial Balance

Some of these accounting adjustments are intended to be reversing entries – that is, they are to be reversed as of the beginning of the next accounting period. In particular, accrued revenue and expenses should be reversed. Otherwise, inattention by the accounting staff may leave these adjustments on the books in perpetuity, which may cause future financial statements to be incorrect. Reversing entries can be set to automatically reverse in a future period, thereby eliminating this risk.

Temporary accounts include revenue, expenses, and dividends and must be closed at the end of the accounting year. Reversing entries will be dated as of the first day of the accounting period immediately following the period of the accrual-type adjusting entries. In other words, for a company with accounting periods which are calendar months, an accrual-type adjusting entry dated December 31 will be reversed on January 2.

Permanent accounts, on the other hand, track activities that extend beyond the current accounting period. They are housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value, including what assets and liabilities it has. Below are examples of closing entries that zero the temporary accounts in the income statement and transfer the balances to the permanent retained earnings account. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. Let’s assume that Servco Company receives $4,000 on December 10 for services it will provide at a later date.

At the end of an accounting period, a company typically needs to post some adjusting journal entries to ensure their accounting records conform with generally accepted accounting principles. Adjusting entries allow accountants to match revenues and expenses to the period they were incurred. However, there are a few accounts that normally will not require adjusting journal entries. As part of the closing entry process, the net income (NI) earned by the company is moved into retained earnings on the balance sheet.

Companies make adjusting entries for deferrals to record the portion of the prepayment that represents the expense incurred or the revenue earned in the current accounting period. Income summary is a holding account used to aggregate all income accounts except for dividend expenses. Income summary is not reported on any financial statements because it is only used during the closing process, and at the end of the closing process the account balance is $0. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Permanent accounts are accounts that show the long-standing financial position of a company. These accounts carry forward their balances throughout multiple accounting periods. If adjusting entries are not prepared, some income, expense, asset, and liability accounts may not reflect their true values when reported in the financial statements. The post-closing trial balance is created after the closing process is complete. The post-closing balance includes only balance sheet accounts.

What is the difference between trial balance and adjusted trial balance?

The adjusted trial balance is an internal document that lists the general ledger account titles and their balances after any adjustments have been made. The adjusted trial balance is not a financial statement, but the adjusted account balances will be reported on the financial statements.

What is an adjusted trial balance?

One such expense that is determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. All temporary accounts must be reset to zero at the end of the accounting period. To do this, their balances are emptied into the income summary account. The income summary account then transfers the net balance of all the temporary accounts to retained earnings, which is a permanent account on the balance sheet.

Under the accrual method of accounting, a business is to report all of the revenues (and related receivables) that it has earned during an accounting period. A business may have earned fees from having provided services to clients, but the accounting records do not yet contain the revenues or the receivables. If that is the case, an accrual-type adjusting entry must be made in order for the financial statements to report the revenues and the related receivables. These categories are also referred to as accrual-type adjusting entries or simply accruals. Accrual-type adjusting entries are needed because some transactions had occurred but the company had not entered them into the accounts as of the end of the accounting period.

In a world where financial data is heavily relied upon, it is the job of the accounting professional to ensure that financial statement data is true and correct. Whenever an accounting period is about to close, we need to make sure that the balances in the accounts are correct. Because the ending balance in one period is the beginning balance in the next, one simple mistake will throw everything off. The account balances are where the information reported on financial statements comes from.

Under the accrual method of accounting, the financial statements of a business must report all of the expenses (and related payables) that it has incurred during an accounting period. For example, a business needs to report an expense that has occurred even if a supplier’s invoice has not yet been received. These three situations illustrate why adjusting entries need to be entered in the accounting software in order to have accurate financial statements.

You should not include income statement accounts such as the revenue and operating expense accounts. Other accounts such as tax accounts, interest and donations do not belong on a post-closing trial balance report. The general ledger is a central location for recording all of the financial activity for your business. Accurate ledger activity is essential to ensuring that the financial statements for each period are correct before filing statements with the Internal Revenue Service.