Reversing entries

Why are Reversal Entries Used?

This understates expenses until the invoice is posted. At the end of the month, if the invoice still has not been received, a new journal entry is made to accrue the expense again without impacting the current month’s profits.

What is a reversing journal entry?

Reversing entries, or reversing journal entries, are journal entries made at the beginning of an accounting period to reverse or cancel out adjusting journal entries made at the end of the previous accounting period. This is the last step in the accounting cycle.

Under the accrual accounting method, when a company incurs an expense, the transaction is recorded as an accounts payable liability on the balance sheet and as an expense on the income statement. As a result, if anyone looks at the balance in the accounts payable category, they will see the total amount the business owes all of its vendors and short-term lenders. When the expense is paid, the account payable liability account decreases and the asset used to pay for the liability also decreases. Under the accrual accounting method, an accrual occurs when a company’s good or service is delivered prior to receiving payment, or when a company receives a good or service prior to paying for it. For example, when a business sells something on predetermined credit terms, the funds from the sale is considered accrued revenue.

When you post the invoice in the new month, you typically debit expenses and credit accounts payable. If you do not reverse accruals until the end of the month following the accrual, your expenses are overstated for the entire month. To avoid this, many accountants prefer to reverse accruals at the beginning of the month.

It includes the assets your company owns, such as equipment, automobiles, cash and inventory, and the company’s liabilities, or money that you owe. Your balance sheet captures the information as of the date you choose to print the report. Balance sheet accounts do carry forward to the next accounting period, because they are perpetual accounts. In other words, your ending balance in your cash account as of December 31 will be your beginning cash balance as of January 1. If you have recently opened a small business, you might be unfamiliar with the proper accounting treatment for accrued expenses, especially at year-end.

Accruals accumulate until an adjusting entry is made. According to “Intermediate Accounting,” by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield, reversing accruals simplify the accrual by eliminating the prior month’s accrual. In the event of an accrual error, reversing accruals eliminate the need to make adjusting entries because the original entry is canceled at the beginning of the next accounting period. A small business that operates on accrual basis accounting matches up income and expenses into the period they are actually incurred, regardless of when money changes hands. This accounting method helps to improve the accuracy of a company’s reported net income.

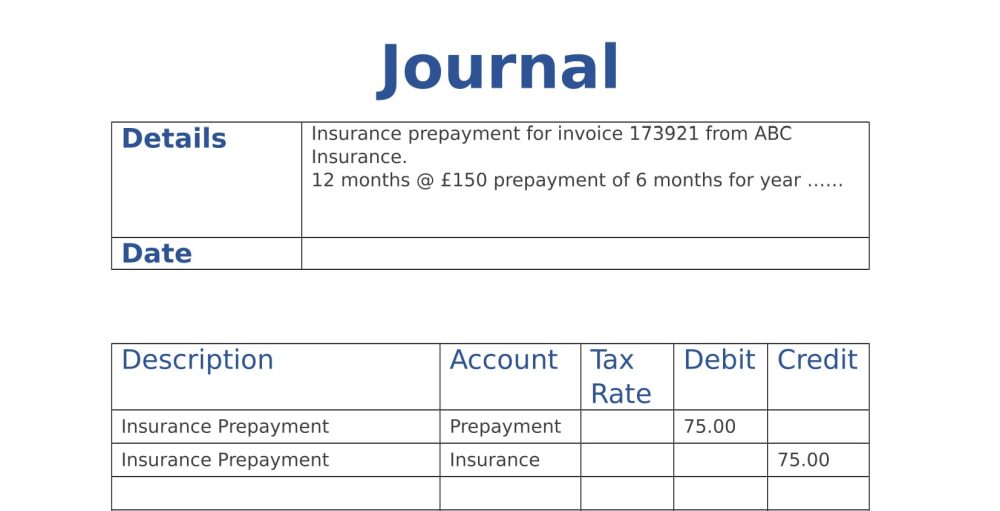

Accruals can be used to match revenue, expenses and prepaid items to the current accounting period. Accruals cannot be made for depreciation or bad debt expense.

When you reverse accruals, you’re canceling the prior month’s accruals. Accrual accounting matches revenue and expenses to the current accounting period so that everything is even. Accruals will continue to build up until a corresponding entry is made, which then balances out the amount. By reversing accruals, it means that if there is an accrual error, you don’t have to make adjusting entries because the original entry is canceled when the next accounting period starts.

They are the result of internal events, which are events that occur within a business that don’t involve an exchange of goods or services with another entity. There are four types of accounts that will need to be adjusted. They are accrued revenues, accrued expenses, deferred revenues and deferred expenses.

It could even be that the process spills over into the next calendar year. As soon as the legal fees have been paid, you can reverse the accrual on the balance sheet. Provisions are similar to accruals and are allocated toward probable, however, not yet certain, future obligations. An accrual is where there is more certainty that an expense will be incurred.

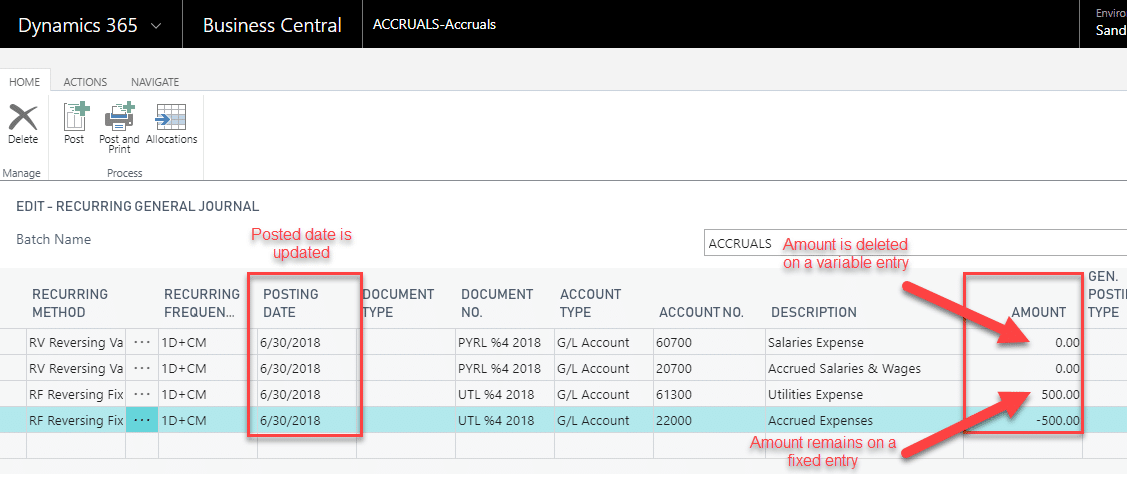

A business can implement an accrual process at any time because it does not affect the financial statements. A manual process would require entries to be made on the first day of the month. The majority of accounting software systems allow the accountant to “flag” the accrual as “reversing accrual” when it is posted. The system automatically reverses the entry on the first day of the next accounting period. Reversing accruals are optional and can be implemented at any time because they do not affect the financial statements.

The accruals must be added via adjusting journal entries so that the financial statements report these amounts. Both accrual and account payable are accounting entries that appear on a business’ income statements and balance sheets.

Accounting entries are made to either accrue expenses to the current period that have not yet been paid or defer them to the next period if they were paid early. Accrued expenses include all purchases for anything other than assets that have not been paid for by the end of the period. They should be reconciled to ensure that the entries are correct and complete. A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period. The reversing entry typically occurs at the beginning of an accounting period.

- When you reverse accruals, you’re canceling the prior month’s accruals.

Reversing entries simplify recordkeeping and reduce the number of mistakes in the monthly accounting process. They are recorded in response to accrued assets and accrued liabilities created by adjusting entries at the end of the reporting period. A company’s income statement shows the sales, expenses and profits for an accounting period. The balance sheet tracks assets, liabilities and owners’ equity.

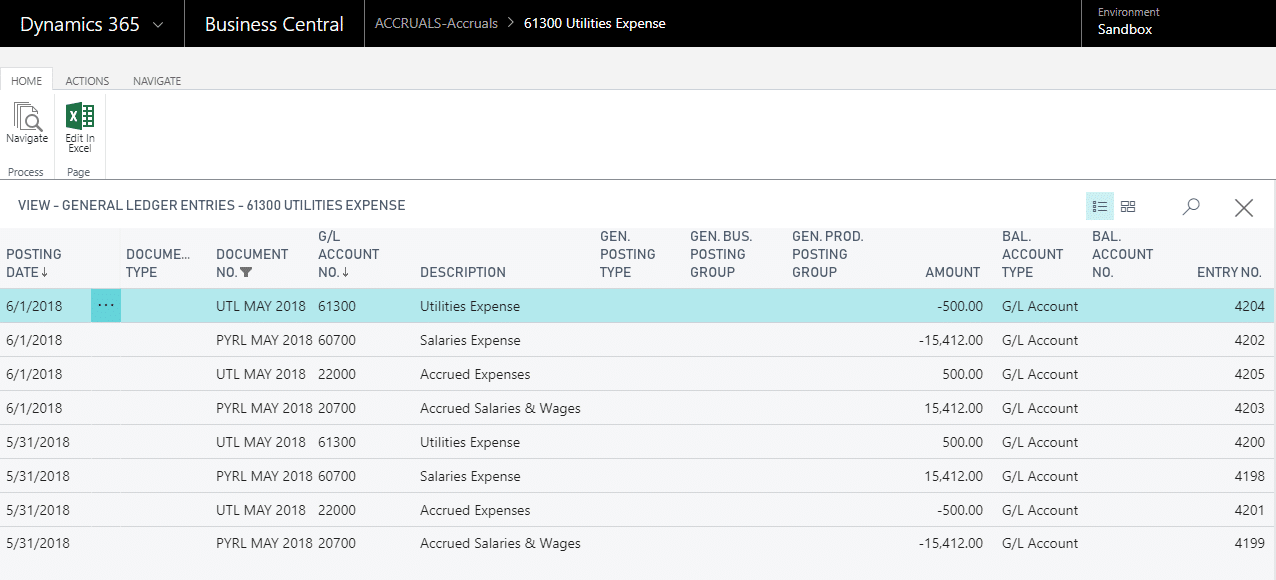

Accounting with the reversing entry:

The temp agency will bill the retailer on January 6 and the retailer is required to pay the invoice by January 10. Assuming the retailer’s accounting year ends on December 31, the retailer will make an accrual adjusting entry on December 31 for the estimated amount. If the estimated amount is $18,000 the retailer will debit Temp Service Expense for $18,000 and will credit Accrued Expenses Payable for $18,000. The most important part of reconciling the accrued expenses balance is to ensure that the amounts recorded are correct and complete. Print off the account listing for accrued expenses and identify the accruals that make up the balance.

Despite this, reversing accruals are optional or can be used at any time since they don’t make a difference to the financial statement. They can be used to match revenues, expenses, and prepaid items to the current accounting period—but cannot be made for reversing depreciation or debt. Financial statements are usually prepared in accordance with generally accepted accounting principles (GAAP). Accrual accounting states revenues and expenses should be recognized when they are incurred, and not when cash changes hands. Reversing entries are an optional feature of accrual accounting.

Either way is acceptable, because the misstatement is temporary; but most accountants prefer to reverse at the beginning of the month. Income statements show the revenue and expenses for a given accounting period. The difference between the two categories is your profit or loss for that period. Income statements display only the activity for the selected period; the ending balance from the previous accounting period does not carry forward to the next. A balance sheet, however, represents your net worth.

Unlike balance sheet accounts, income statement accounts are temporary. At the end of an accounting period, closing journal entries transfer the income statement account balances to the retained earnings account on the balance sheet. The journal entries to close revenue accounts are to debit the revenue account and credit income summary, which is also a temporary account used for the closing process. The journal entries to close expense accounts are to credit the expense account and debit income summary. The final journal entries are to debit income summary and credit retained earnings for a profit, and credit income summary and debit retained earnings for a loss.

Therefore, reversing accruals cannot be used for reversing depreciation or bad debt expenses. Accrued revenues are money earned in one accounting period but not received until another. Accrued expenses are expenses that are incurred in one accounting period but not paid until another.

In most cases, you will receive the corresponding invoice in the following month. Match the accounting entry to the invoice, ensuring that the amount is correct and that the expense was actually incurred before the date of the reconciliation. If the invoice includes expenses from multiple months, recalculate the amount that belongs in the periods before the reconciliation date. Make adjusting journal entries to correct any accrual errors.

An account payable is a liability to a creditor that denotes when a company owes money for goods or services. Reversing accruals cancel the prior month’s accruals. Accrual-based accounting matches revenue and expenses to the current accounting period.

Because the company actually incurred 12 months’ worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the last month’s expense. The adjusting entry will be dated December 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet. To illustrate reversing entries, let’s assume that a retailer uses a temporary employment agency service to provide workers from December 15 to December 29.

In the double-entry system of accounting, each financial transaction has at least one debit and one credit entry. Debits and credits are the key tools for adjusting company accounts. Closing entries are part of the accounting cycle, which starts with a financial transaction and ends with the preparation of financial statements. Account adjustments are entries made in the general journal at the end of an accounting period to bring account balances up-to-date.

How do reversing entries simplify recordkeeping?

Definition: A reversing entry is an optional journal entry that is recorded at the beginning of an accounting period to undo the prior period’s adjusting entries. In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the prior accounting period.

Deferred revenues are money that a business has been paid in advance for a service that will be provided later. Deferred expenses are expenses that have been paid in advance and will be expensed out at a later date. When you reverse an accrual, you debit accrued expenses and credit the expense account to which you recorded the accrual.

What are Reversing Entries?

Accruals are expenses or revenues incurred in a period for which no invoice was sent or no money changed hands. If for example, you’re in an ongoing court case, you can assume that legal fees will need to be paid in the near future and not straightaway so you have to factor that into your calculations.