Return on equity

However, one financial ratio by itself does not provide enough information about the company. When considering debt, looking at the company’s cash flow is also important.

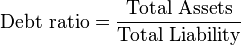

These figures looked at along with the debt ratio, give a better insight into the company’s ability to pay its debts. The debt ratio for a given company reveals whether or not it has loans and, if so, how its credit financing compares to its assets. It is calculated by dividing total liabilities by total assets, with higher debt ratios indicating higher degrees of debt financing.

Is this company in a better financial situation than one with a debt ratio of 40%? Debt ratio is a ratio that indicates the proportion of a company’s debt to its total assets. The debt ratio gives users a quick measure of the amount of debt that the company has on its balance sheets compared to its assets. The higher the ratio, the greater the risk associated with the firm’s operation. A low debt ratio indicates conservative financing with an opportunity to borrow in the future at no significant risk.

Each industry has different debt to equity ratio benchmarks, as some industries tend to use more debt financing than others. A debt ratio of .5 means that there are half as many liabilities than there is equity. In other words, the assets of the company are funded 2-to-1 by investors to creditors. This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar.

If the debt to equity ratio is 100%, it means that total liability is equal to total equity, thus, when you compute the debt to asset ratio, the answer will be 50%. However, if the answer for the debt to equity ratio is more than 100%, it means that total liability is higher than the company’s capital or total equity. Debt Ratio is a financial ratio that indicates the percentage of a company’s assets that are provided via debt. It is the ratio of total debt (long-term liabilities) and total assets (the sum of current assets, fixed assets, and other assets such as ‘goodwill’). A lower debt to equity ratio usually implies a more financially stable business.

What is a good long term debt ratio?

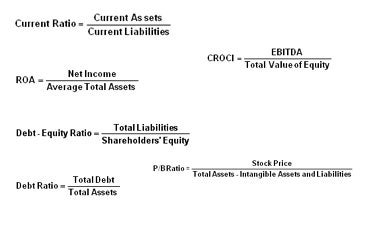

What is the definition of LT Debt / Equity %? The ratio is calculated by taking the company’s long-term debt and dividing it by the book value of common equity. The greater a company’s leverage, the higher the ratio.

This number can be found at the bottom of the balance sheet, and it’s basically the difference that you can find between liabilities and assets. Simply put, this is the amount of money that remains for the stockholders once all the debt has been paid. The ratio is calculated by taking the company’s long-term debt and dividing it by the book value of common equity.

Financial Strength Ratios

To find the debt ratio for a company, simply divide the total debt by the total assets. The debt ratio is a financial ratio that measures the extent of a company’s leverage. The debt ratio is defined as the ratio of total debt to total assets, expressed as a decimal or percentage. It can be interpreted as the proportion of a company’s assets that are financed by debt. The debt-to-equity ratio is a financial leverage ratio, which is frequently calculated and analyzed, that compares a company’s total liabilities to its shareholder equity.

What do You Know From Finding the Long-term Debt Ratio?

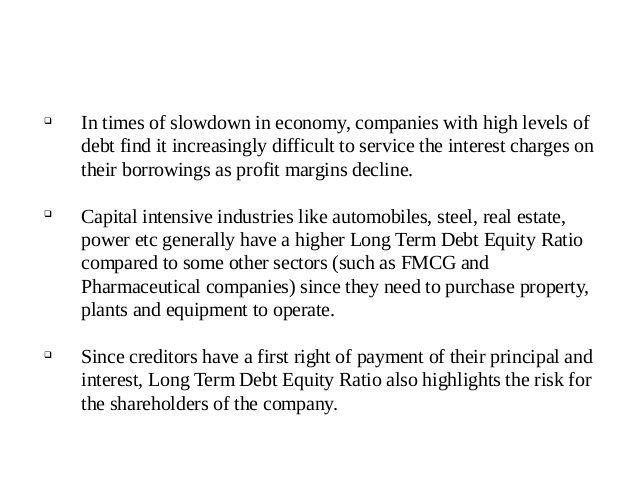

Therefore, analysts, investors and creditors need to see subsequent figures to assess a company’s progress toward reducing debt. In addition, the type of industry in which the company does business affects how debt is used, as debt ratios vary from industry to industry and by specific sectors. For example, the average debt ratio for natural gas utility companies is above 50 percent, while heavy construction companies average 30 percent or less in assets financed through debt. Thus, to determine an optimal debt ratio for a particular company, it is important to set the benchmark by keeping the comparisons among competitors.

Understanding the debt to equity ratio in this way is important to allow the management of a company to understand how to finance the operations of the business firm. For starters, ROCE is a useful measurement for comparing the relative profitability of companies.

Total liabilities divided by total assets or the debt/asset ratio shows the proportion of a company’s assets which are financed through debt. If the ratio is less than 0.5, most of the company’s assets are financed through equity. If the ratio is greater than 0.5, most of the company’s assets are financed through debt. The higher the ratio, the greater risk will be associated with the firm’s operation. In addition, high debt to assets ratio may indicate low borrowing capacity of a firm, which in turn will lower the firm’s financial flexibility.

Debt to equity ratio (also termed as debt equity ratio) is a long term solvency ratio that indicates the soundness of long-term financial policies of a company. It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders. As the debt to equity ratio expresses the relationship between external equity (liabilities) and internal equity (stockholder’s equity), it is also known as “external-internal equity ratio”. A lower debt-to-asset ratio suggests a stronger financial structure, just as a higher debt-to-asset ratio suggests higher risk. Generally, a ratio of 0.4 – 40 percent – or lower is considered a good debt ratio.

- If the ratio is less than 0.5, most of the company’s assets are financed through equity.

- Total liabilities divided by total assets or the debt/asset ratio shows the proportion of a company’s assets which are financed through debt.

Debt Ratios in Bear vs. Bull Markets

But ROCE is also an efficiency measure of sorts — it doesn’t just gauge profitability as profit margin ratios do. ROCE measures profitability after factoring in the amount of capital used. This metric has become very popular in the oil and gas sector as a way of evaluating a company’s profitability. It can also be used with other methods, such as return on equity (ROE).

The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders). The long-term debt to equity ratio shows how much of a business’ assets are financed by long-term financial obligations, such as loans. To calculate long-term debt to equity ratio, divide long-term debt by shareholders’ equity.

Long Term Debt to Equity %

A debt-to-asset ratio is a financial ratio used to assess a company’s leverage – specifically, how much debt the business is carrying to finance its assets. Sometimes referred to simply as a debt ratio, it is calculated by dividing a company’s total debt by its total assets. Average ratios vary by business type and whether a ratio is “good” or not depends on the context in which it is analyzed. The debt to equity ratio is a measure of a company’s financial leverage, and it represents the amount of debt and equity being used to finance a company’s assets. It’s calculated by dividing a firm’s total liabilities by total shareholders’ equity.

Debt ratios can be used to describe the financial health of individuals, businesses, or governments. investors and lenders calculate the debt ratio for a company from its major financial statements, as they do with other accounting ratios. While the total debt to total assets ratio includes all debts, the long-term debt to assets ratio only takes into account long-term debts. Both ratios, however, encompass all of a business’s assets, including tangible assets such as equipment and inventory and intangible assets such as accounts receivables. Because the total debt to assets ratio includes more of a company’s liabilities, this number is almost always higher than a company’s long-term debt to assets ratio.

Companies that are heavily capital intensive may have higher debt to equity ratios while service firms will have lower ratios. Debt and equity compose a company’s capital structure or how it finances its operations. The debt to equity ratio can be used as a measure of the risk that a business cannot repay its financial obligations.

Like all financial ratios, a company’s debt ratio should be compared with their industry average or other competing firms. The debt-to-equity ratio can help investors identify highly leveraged companies that may pose risks, during rough patches. Investors can compare a company’s debt-to-equity ratio against industry averages and other similar companies to gain a general indication of a company’s equity-liability relationship. In fact, debt can catalyze the expansion of a company’s operations and ultimately generate additional income for both the business and its shareholders. When a business finances its assets and operations mainly through debt, creditors may deem the business a credit risk and investors shy away.

It should not be used for companies that have a large cash reserve that remains unused. Certain sectors are more prone to large levels of indebtedness than others, however.

A high debt to equity ratio indicates a business uses debt to finance its growth. Companies that invest large amounts of money in assets and operations (capital intensive companies) often have a higher debt to equity ratio. For lenders and investors, a high ratio means a riskier investment because the business might not be able to produce enough money to repay its debts. Debt ratios vary widely across industries, with capital-intensive businesses such as utilities and pipelines having much higher debt ratios than other industries such as the technology sector. For example, if a company has total assets of $100 million and total debt of $30 million, its debt ratio is 30% or 0.30.

Companies with a higher debt to equity ratio are considered more risky to creditors and investors than companies with a lower ratio. Since debt financing also requires debt servicing or regular interest payments, debt can be a far more expensive form of financing than equity financing. Companies leveraging large amounts of debt might not be able to make the payments.

The optimal debt ratio is determined by the same proportion of liabilities and equity as a debt-to-equity ratio. This depicts that the company’s liabilities is only 40% compared to the company’s stockholders. This indicates that the company is taking little debt and thus has low risk.

A ratio above 0.6 is generally considered to be a poor ratio, since there’s a risk that the business will not generate enough cash flow to service its debt. You may struggle to borrow money if your ratio percentage starts creeping towards 60 percent. When figuring the ratio, add short-term and long-term debt obligations together. For example, the debt ratio for a business with $10,000,000 in assets and $2,000,000 in liabilities would be 0.2. This means that 20 percent of the company’s assets are financed through debt.