Relevant range

Sunk costs are irrelevant in your business decision-making process. People tend to focus an inappropriate amount of attention to sunk costs.

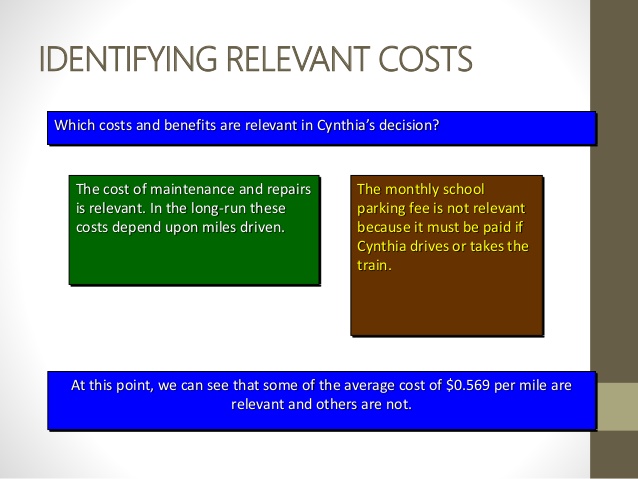

A relevant cost only relates to a particular management decision and which will alter in the future as a result of that decision. Other theorists described that relevant costs are future costs that will differ among alternatives. The main intent of relevant costing is to determine the objective cost of a business decision. An objective measure of the cost of a business decision is the degree of cash outflows that shall result from its execution. Relevant costing focuses on just that and overlooks other costs which do not influence the future cash flows.

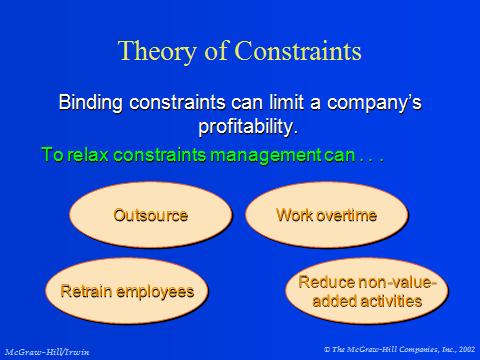

Continue Operating vs. Closing Business Units

All sunk costs are irrelevant (Allied Publishers, 1997). In management accounting, notion of relevant costing has great significance because these costs are pertinent with respect to a particular decision. A relevant cost for a particular decision is one that transforms if an alternative course of action is taken. Relevant costs are also termed as differential costs. Studies have demonstrated that relevant costs will make a difference in a decision.

Sunk costs are those costs that cannot be changed because they were from prior decisions. Typical examples are technology, machinery, tools, and vehicles. Fixed overhead costs are the costs needed to operate a business.

Hence the cost of material is relevant cost as long as the material not purchased because of deciding whether or not to purchase the material, one is to decide to sustain the cost or evade it. Therefore, all relevant costs are future costs.

What is relevant cost and irrelevant cost?

Relevant cost is a managerial accounting term that describes avoidable costs that are incurred only when making specific business decisions. The concept of relevant cost is used to eliminate unnecessary data that could complicate the decision-making process.

The fundamental principles of relevant costing are quite simple and managers can perhaps relate them to personal experiences involving financial decisions. To summarize relevant costs and irrelevant costs in accounting, we learned that determining these costs depends on the situation. Differential, avoidable, and opportunity costs are considered relevant costs. Sunk and fixed overhead costs are irrelevant. Using examples to demonstrate these costs show us that which costs are included in what places depend on what decision is made and the specific situation.

Relevant costing focuses on just that and ignores other costs which do not affect the future cash flows. Relevant costing is just a refined application of such basic principles to business decisions. The key to relevant costing is the ability to filter what is and isn’t relevant to a business decision. In the boat example, what about the $10,000 ($25,000 original sales price -$15,000 sold price) I just loss? Sunk costs are costs that have been incurred in the past, do not affect future costs and cannot be changed by any current or future actions.

Example of Relevant Cost

The concept of relevant cost is used to eliminate unnecessary data that could complicate the decision-making process. As an example, relevant cost is used to determine whether to sell or keep a business unit. The opposite of a relevant cost is a sunk cost, which has already been incurred regardless of the outcome of the current decision. A clear understanding of relevant costs will aid in your future decision making abilities.

Rent, insurance, and utilities are included here. SUMMARY • A relevant cost is a cost that differs in total between the alternatives in a decision. Relevant costing attempts to determine the objective cost of a business decision. An objective measure of the cost of a business decision is the extent of cash outflows that shall result from its implementation.

- Relevant costs are the costs which would change as a result of the decision under consideration, where as irrelevant costs are those which would remain unchanged by the decision.

- Therefore only relevant cost would be included in the investigative framework (Khan and Jain, 2008).

- Relevant information is the predicted future costs and incomes that will differ among the alternatives relevant information (Horngren, et al, 2006).

Normally, sunk costs and future costs (not changing with alternatives under consideration) are irrelevant costs. Relevant and irrelevant costs are mutually exclusive events. A cost item in one situation cannot be both relevant and irrelevant cost at the same time. Irrelevant costs are things like sunk costs, which include the cost of the lemon squeezer, and fixed overhead costs, which would be the costs of maintaining the lemonade stand.

Relevant & Irrelevant Costs for Decision-Making

In accounting, there are relevant and irrelevant costs. Relevant costs include differential, avoidable, and opportunity costs. Irrelevant costs include sunk and fixed overhead costs. In this lesson, we will learn about these and calculate them. Relevant cost is a managerial accounting term that describes avoidable costs that are incurred only when making specific business decisions.

A relevant cost is also defined as a cost whose amount will be affected by a decision being made. Management should believe only future costs and revenues that will differ under each alternative (Arora, 2008). Relevant costs are accepted future costs and relevant profits are expected future revenues that differ among the alternative course of action being considered (Hongren and Datar, 2008). In the arena of Management accounting, one feature of relevant cost is that they are future costs which have not been incurred.

Whether particular costs and profits are relevant for decision making depends on decision circumstance and the options available. The relevance of cost to decision alternative is determined by situation. It is established that historical cost is not relevant, only future cost is relevant.

Future decisions need to be based on future costs. Relevant costs are costs that will affect future expenses and revenue. Irrelevant costs have already been incurred and will have no bearing on future expenses or revenue. Here is an example of a recent purchase my family made that underscores the value of understanding relevant costs.

Two important characteristic features of relevant costs are ‘Occurrence in Future’ and ‘Different for Different Alternatives’. This does not mean that all costs which occur in future are not relevant cost. For a cost item to be relevant, both the conditions should be present. A future cost has also to be different in the different alternative to making it a relevant cost important for decision making. In other words, the costs which do not change with the alternative situation are irrelevant costs not considered by management.

Relevant costs are defined as the costs that arise in future and are different for different alternatives. An item of cost may be relevant for one situation and irrelevant for other.

Relevant information is the predicted future costs and incomes that will differ among the alternatives relevant information (Horngren, et al, 2006). Relevant costs are the costs which would change as a result of the decision under consideration, where as irrelevant costs are those which would remain unchanged by the decision. Therefore only relevant cost would be included in the investigative framework (Khan and Jain, 2008).

Why is relevant cost important?

Relevant costs are those costs that change with each decision you make. If you have two choices, and you choose A instead of B, relevant costs are those costs that will be different from those associated with choice B. These are costs that directly affect cash flow, the money coming in and going out of a business.

Relevant costs change as a result of a decision. If a cost is going to occur regardless of the decision being examined, it is not a relevant cost.