Reduction of share capital

How Do Dividend Distributions Affect Additional Paid-In Capital?

In the latter case, the par value of the shares sold is recorded in the common stock account and any excess payments are recorded in the additional paid in capital account. It is customary for investors to concentrate their attention on the net amount of total equity, rather than this single element of equity.

Thus, the recordation of contributed capital is designed to fulfill a legal or accounting requirement, rather than providing additional useful information. Stockholders’ equity is related to additional paid-in capital vs. contributed capital. The key difference between the two is that the contributed capital is referred to as the total value of cash and assets that shareholders provided to a company in exchange for the company’s shares. The additional paid-in capital indicates the value of cash or assets that the shareholders provided in excess of the par value of the company’s shares.

TheFederal Reservecalls these transactions non-produced, nonfinancial assets. It is reported at the bottom of the company’s balance sheet, in the equity section. In a sole proprietorship, this section would be referred to as owner’s equity and in a corporation, shareholder’s equity. The current and capital accounts represent two halves of a nation’s balance of payments. Thecurrent accountrepresents a country’s net income over a period of time, while the capital account records the net change of assets and liabilities during a particular year.

Your company’s balance sheet displays the variables for the retained earnings to assets ratio. Total assets are the culmination of the left-hand side of the statement where current and long-term assets add together. Retained earnings and common stock typically make up the lower right-hand portion of the statement. The balance sheet follows the basic accounting formula that assets equal liabilities plus owners equity.

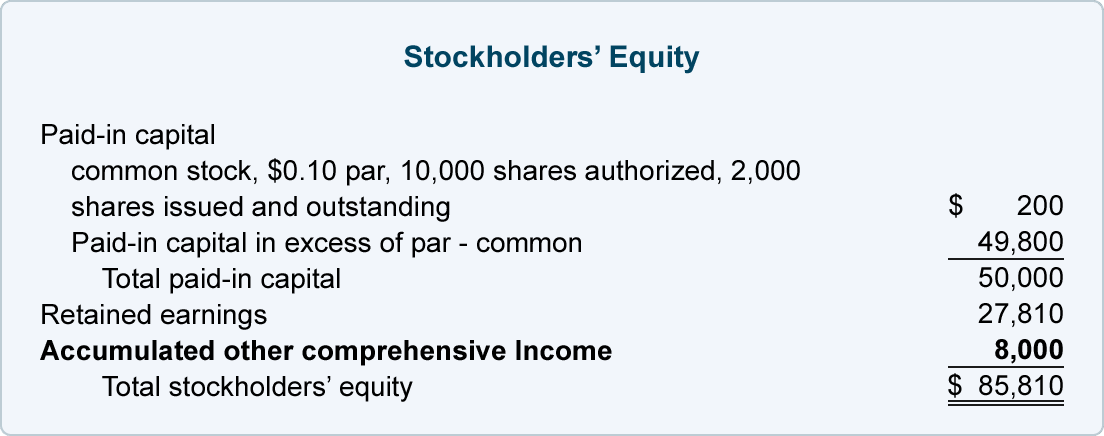

As a result, the company records $5,000 to the common stock account and $45,000 to the paid-in capital in excess of par. Both of these accounts added together equal the total amount stockholders were willing to pay for their shares. Contributed capital can be compared with additional paid-in capital, and the difference between the two values will equal the premium paid by investors over and above thepar valueof the company’s shares. The par value is merely an accounting value of each of the shares to be offered and is not equivalent to the market value that investors are willing to pay. Contributed capital, also known as paid-in capital, is the cash and other assets that shareholders have given a company in exchange for stock.

Stock prices in the secondary market don’t affect the amount of paid-in calculation in the balance sheet. Additional paid-in capital is the value of share capital above its par value. In other words, it indicates the difference between the actual price the investors paid for the company’s shares and the nominal value of the shares.

How do you calculate contributed capital?

Contributed capital is the total value of the stock that shareholders have bought directly from the issuing company. It includes the money from initial public offerings (IPOs), direct listings, direct public offerings, and secondary offerings—including issues of preferred stock.

What Is Contributed Capital?

The additional paid-in capital is recorded into a separate account under the equivalent name. On the other hand, the contributed capital usually does not include a separate account on the balance sheet, but it can be determined as the sum of the common stock and additional paid-in capital accounts. For example, a company issues 5,000 $1 par value shares to investors. The investors pay $10 a share, so the company raises $50,000 in equity capital.

The capital account, in international macroeconomics, is the part of the balance of payments which records all transactions made between entities in one country with entities in the rest of the world. These transactions consist of imports and exports of goods, services, capital, and as transfer payments such as foreign aid and remittances. The balance of payments is composed of a capital account and a current account—though a narrower definition breaks down the capital account into a financial account and a capital account.

- In a corporate balance sheet, the equity section is usually broken down into common stock, preferred stock, additional paid-in capital, retained earnings, and treasury stock accounts.

- All of the accounts have a natural credit balance, except for treasury stock that has a natural debit balance.

It measures financial transactions that affect a country’s future income, production, or savings. An example is a foreigner’s purchase of a U.S. copyright to a song, book, or film.

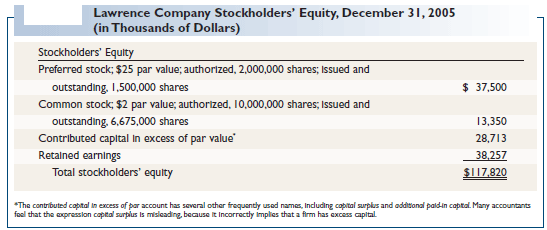

In a corporate balance sheet, the equity section is usually broken down into common stock, preferred stock, additional paid-in capital, retained earnings, and treasury stock accounts. All of the accounts have a natural credit balance, except for treasury stock that has a natural debit balance. Common and preferred stock are recorded at the par value of total shares owned by shareholders.

Contributed capital

Investors make capital contributions when a company issues equity shares based on a price that shareholders are willing to pay for them. The total amount of contributed capital or paid-in-capital represents their stake or ownership in the company. This means more capital is flowing into the country than going out, caused by an increase in foreign ownership of domestic assets. A country with a large trade surplus is exporting capital and running a capital account deficit, which means money is flowing out of the country in exchange for increased ownership in foreign assets. The first one is the stated capital which is reported in the balance sheet at the par (face) value and the other is APIC which amounts to the money received by the company above its par value.

The treasury stock account is a contra equity account that records a company’s share buybacks. Contributed capital is an element of the total amount of equity recorded by an organization. It can be a separate account within the stockholders’ equity section of the balance sheet, or it can be split between an additional paid-in capital account and a common stock account.

APIC calculation many times reflects the significant part of the shareholders’ equity before the retained earnings Start to accumulate and it is a safe layer in case the retained earnings is a deficit. For example, a company issues 1,000 $1 par value shares to investors. The investors pay $10,000 for these shares because of the company prospects and change to increase their investments. The company would record $1,000 to the common stock account and $9,000 to thepaid-in capital in excess of par. Contributed capital may also refer to a company’s balance sheet item listed under stockholders’ equity, often shown alongside the balance sheet entry for additional paid-in capital.

At the time of incorporation of company promoters and investors purchase the shares of the company. Firstly, the authorized share capital is fixed by the company beyond which the company cannot issue the shares in the market. The par value or the face value of each share is fixed by the company. So initially in the balance sheet, the issued and paid in capital is recorded at the par value. After the amount has been paid by the investor, a new journal entry will be passed by recording the increase in the paid-in capital of the company.

Example of Contributed Capital

Additional paid-in capital is the amount shareholder’s have paid into the company in excess of the par value of stock. Retained earnings is the cumulative earnings of the company overtime, minus dividends paid out to shareholders, that have been reinvested in the company’s ongoing business operations.