Reconciliation

Some of the possible charges include ATM transaction charges, check-printing fees, overdrafts, bank interest, etc. The charges have already been recorded by the bank, but the company does not know about them until the bank statement has been received. Human error remains a potential possibility and therefore there is always a requirement to keep it under check. Recording of an incorrect amount, omitting an amount out of the bank statement or recording a duplicate transaction.

To better explain account reconciliation, it is one of the most common yet important actions taken for managerial accounting. It is also important to reconcile balance sheet accounts at the end of a period (month, quarter, or year-end) as part of the closing process. Differences caused by the timing of transactions, such as outstanding checks, are identified as reconciling items. When your company receives the bank statement, you should print a report listing all of the checks written and deposits made during the month. A company will probably have accounting software that can provide reports.If you’re reconciling your personal bank account, you should review your check register and your deposit slips.

What is the purpose of cash reconciliation?

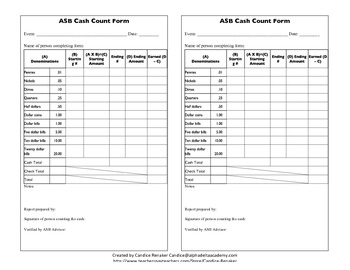

A cash reconciliation is the process of verifying the amount of cash in a cash register as of the close of business. The verification can also take place whenever a different clerk takes over a cash register.

Whether it’s checks, ATM transactions, or other charges, subtract these items from the bank statement balance. Note charges on your bank statement that you haven’t captured in your internal records. Reconciling accounts and comparing transactions also helps your accountant produce reliable, accurate, and high-quality financial statements. When an account is reconciled, the statement’s transactions should match the account holder’s records.

It is only when you reconcile your bank accounts on a regular basis that you can notify the bank of these errors and get them corrected right away. Once you finish all of your reconciliation work, your (cash account balance) plus or minus all (reconciling items) should equal the (balance per the bank statement). If that formula does not equal, review your work until you account for all of the reconciling items correctly.

This type of account reconciliation involves reviewing all balance sheet accounts to make sure that transactions were appropriately booked into the correct general ledger account. It may be necessary to adjust journal entries if they were booked incorrectly. This type of account reconciliation makes it possible to determine whether money is being fraudulently withdrawn. In double-entry accounting—which is commonly used by companies—every financial transaction is posted in two accounts, the income statement and the balance sheet.

Thus, fraud detection is a key reason for completing a bank reconciliation. When there is an ongoing search for fraudulent transactions, it may be necessary to reconcile a bank account on a daily basis, in order to obtain early warning of a problem. A bank reconciliation is used to compare your records to those of your bank, to see if there are any differences between these two sets of records for your cash transactions. The ending balance of your version of the cash records is known as the book balance, while the bank’s version is called the bank balance. It is extremely common for there to be differences between the two balances, which you should track down and adjust in your own records.

A business should compare the cash account’s general ledger to the bank statement activity. You may come across a transaction that you cannot fully explain. If you’re unclear about a business or personal bank transaction, contact your bank. Check that all outgoing funds have been reflected in both your internal records and your bank account.

If you’re not using accounting software, your financial transactions will appear on your paper check register, credit card statements, and bank statements. If you’re using accounting softwareto print batches of checks each time the company pays bills, your transactions will be recorded on your software’s account register. Check for any errors made by the bank’s processing department. If you’re reconciling a business cash account, your accounting is posted to general ledger.

Credit Card Reconciliation:

This saves your company from payingoverdraft fees, keeps transactions error-free, and helps catch improper spending and issues such as embezzlement before they get out of control. When a business receives an invoice, it credits the amount of the invoice to accounts payable (on the balance sheet) and debits an expense (on the income statement) for the same amount. When the company pays the bill, it debits accounts payable and credits the cash account.

One account will receive a debit, and the other account will receive a credit. For example, when a business makes a sale, it debits either cash or accounts receivable (on the balance sheet) and credits sales revenue (on the income statement). It is possible to have certain transactions that have been recorded as paid in the internal cash register but that do not appear as paid in the bank statement. The transactions should be deducted from the bank statement balance.

These definitions are different from how the accounting profession uses these terms. If there is no undocumented reconciling item, print the bank reconciliation and store it. Companies must reconcile their accounts to prevent balance sheet errors, check for fraud, and avoid auditors’ negative opinions. Companies generally perform balance sheet reconciliations each month, after the books are closed for the prior month.

- To better explain account reconciliation, it is one of the most common yet important actions taken for managerial accounting.

A company should print the cash reports, and also review the check register and deposit slips. A bank reconciliation is a critical tool for managing your cash balance.

Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement.

An example of such a transaction is checks issued but that have yet to be cleared by the bank. The first step is to compare transactions in the internal register and the bank account to see if the payment and deposit transactions match in both records.

With every transaction in the general ledger, the left (debit) and right (credit) side of the journal entry should agree, reconciling to zero. Conversely, identify any charges appearing in the bank statement but that have not been captured in the internal cash register.

After an investigation, the credit card is found to have been compromised by a criminal who was able to obtain the company’s information and charge the individual’s credit card. The individual is reimbursed for the incorrect charges, the card is canceled, and the fraudulent activity stopped. Reconciliation is a fundamental accounting process that ensures the actual money spent or earned matches the money leaving or entering an account at the end of a fiscal period. Reconciliation is typically done at regular intervals, such as monthly or quarterly, as part of normal accounting procedures. It is also useful to complete a bank reconciliation to see if any customer checks have bounced, or if any checks you issued were altered or even stolen and cashed without your knowledge.

If necessary, you can find the balance yourself by starting with the previous month’s ending balance, then adding and subtracting based on the activity listed on the printout. Once you have the final balance for that time period, you will then compare items from your personal or business register as in a standard bank reconciliation. You need to deduct all bank charges from your cash account. One type of bank charge is a monthly service charge.

For a checking account, it is important to factor in pending deposits or outstanding checks. To prepare a bank reconciliation, gather your bank statement and a list of all of your recent transactions. If you find an error on the bank’s part, contact them as soon as possible to let them know about the discrepancy. The general ledger is the master set of accounts that aggregates all transactions recorded for a business.

Cash reconciliation

The result could be an overdrawn bank account, bounced checks, and overdraft fees. In some cases, the bank may even elect to shut down your bank account. You can view your bank activity online, or ask a bank clerk for a printout of activity during the time period you are reconciling. The printout usually includes the bank account’s balance as of the date you are reconciling.

Account Reconciliation Services: What it means, the types and advantages!

Identify any transactions in the bank statement that are not backed up by any evidence. Because the individual is fastidious about keeping receipts, they call the credit card to dispute the amounts.

The reconciliation process is a common activity just prior to the arrival of the auditors for the annual audit, to ensure that the accounting records are in pristine condition. If the bank statement indicates that a “not sufficient funds” check bounced during the month, that means that the check amount was not deposited to your account. You will have to deduct the check amount from your cash account records. If the bank charges you a fee for depositing a bad check, you will also need to deduct that amount. You will also be charged if you overdraw your account.

You may also be charged if you overdraw your account balance. Most of these charges are posted to your bank statement, but may not be posted to your cash account at month-end. You also need to adjust your cash records for interest earned on your bank account balance.