Rate Of Return Calculator

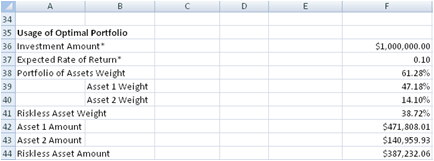

The expected return for an investment portfolio is the weighted average of the expected return of each of its components. Components are weighted by the percentage of the portfolio’s total value that each accounts for. Examining the weighted average of portfolio assets can also help investors assess the diversification of their investment portfolio.

Basics of Probability Distribution

Based on the expected return formula an investor can decide whether to invest in an asset based on the given probable returns. Rate of Return – An asset’s rate of return measures how much money you, as an investor, would have made or lost had you invested in this asset over a specific period of time.

What Is Expected Return?

So the cash flow that you receive, this is DIV1 plus P1, then you subtract P sub 0, this is what you’ve invested, and then you divide that by P sub 0. So basically, if this stock does not pay a dividend, then your only expected cash inflow is, if P1 is greater than P sub 0, you decide to sell and then you get some money. If you’re forced to sell for whatever reason and there’s no dividend, P1 is smaller than P sub 0, then you’ll lose money. If, for example you opt not to sell at all at this point, but you receive all of the dividend, then this is your total yield.

And also you can, right after receipt of this dividend, you can sell the stock at the price P1. So what is your expected return on this kind of investment? Well, it’s pretty clear, your expected return is equal to.

Imagine that an investor is considering buying Microsoft stock. She starts by researching the risk-free rate and finds that the one year U.S. Next, she learns that the stock trades on the Nasdaq, which investors believe will generate annual returns of 12 percent. Finally, she estimates that Microsoft’s stock has a beta of 1.2, meaning that on average, when the Nasdaq gains 1 percent, Microsoft’s stock gains 1.2 percent.

In other words, it is a percentage by which the value of investments is expected to exceed its initial value after a specific period of time. The expected rate of return can be calculated either as a weighted average of all possible outcomes or using historical data of investment performance. Now we are shifting focus and are moving toward stocks. Well, clearly the stock market is huge and it’s extremely important to come up with certain evaluation approaches for stocks.

But for now, we just study stocks with respect to their cash flows. Now, in order to proceed, let’s start with the most simplistic example. Imagine the one period project, so you bought a share of stock at P sub 0 here, at point one.

And the total of 13%, which is a very nice return but clearly this is just an example. Now, what we did so far seems to have nothing to do with PV. We just introduced the most simplistic approaches to expected returns and we analyzed stock cash flows.

It is computed as the expected return divided by the amount invested. It is important to understand the concept of a portfolio’s expected return as it is used by investors to anticipate the profit or loss on an investment.

Real World Example of Expected Return

Hence the expected return calculation is based on historical data and hence may not be reliable in forecasting future returns. It can be looked at as a measure of various probabilities and the likelihood of getting a positive return on one’s investment and the value of that return.

How Investment Risk Is Quantified

- Investors sometimes speak of a required rate of return, which is the minimum expected rate of return for a particular investment decision to make sense.

- An investor might decide that, given a particular investment’s riskiness and other factors, a minimum required rate of return is 5 percent, 10 percent or something higher.

The expected return doesn’t just apply to a single security or asset. It can also be expanded to analyze a portfolio containing many investments. If the expected return for each investment is known, the portfolio’s overall expected return is a weighted average of the expected returns of its components. This Stock Investment Calculator will calculate the expected rate of return given a stock’s current dividend, the current price per share, and the expected growth rate.

But it doesn’t require a lot of mental advancement to move from this formula to the one that will look very much like the PV formula for the stocks. And from that, we will proceed and come very close to the general stock price and formula. Calculating expected return is not limited to calculations for a single investment.

But expected rate of return is an inherently uncertain figure. As an investor you calculate it by assuming that the asset’s growth and yield in the past will continue unabated into the future. If your stock returned dividends in the past year, it will continue to pay those dividends in future years.

Expected Return Template

Investors sometimes speak of a required rate of return, which is the minimum expected rate of return for a particular investment decision to make sense. This can be based upon the relative rate of return of other, safer investments. An investor might decide that, given a particular investment’s riskiness and other factors, a minimum required rate of return is 5 percent, 10 percent or something higher. Using those expected rates and other information such as relative risk and liquidity of investments, investors can make decisions about where to put their money.

Now, the right to vote is very important, but we ignore it for now. Because we will talk about that in the fourth course of this specialization when we talk about [INAUDIBLE].

For example, say you assume a $1,000 investment in a stock over a one-year period after which you sold it. Between dividends and the sale of the stock you would have made $150. The rate of return on this stock would have been 0.15 percent. A portfolio is a grouping of several investments, so its expected percentage return is a weighted average of all expected rate of returns of its components according to their proportion.

Since ERR is based on assumptions that rarely hold true, most investors use ERR to compare the potential returns of one stock investment with another. After all, the growth rate figure used in the ERR formula does account for the actual historical growth of a company’s earnings per share. The expected return can be looked in the short term as a random variable which can take different values based on some distinct probabilities. This random variable has values within a certain range and can only take values within that particular range.

If it grew 10 percent in the past year, it will grow by at least another 10 percent this year. The expected rate of return is a percentage return expected to be earned by an investor during a set period of time, for example, year, quarter, or month.

Plugging the information into the CAPM formula tells the investor that she should expected an annual return of 13.9 percent. The expected rate of return is the amount you expect to lose or gain on an investment over a time period, and this lacks certainty due to market changes, interest rates and other factors. In contrast, the rate of return is how much you actually end up gaining or losing on that investment.

Well, we can get a very simple example for it if P sub 0 is $100 and P1 is $105. And then if dividend at 0.1 is expected to be $8 per share, then clearly we can rewrite this formula and see that that expected return will consist of two parts. Dividend yield will be 8%, Plus capital gain will be 5%.

Also, an investor can use the expected return formula for ranking the asset and eventually make the investment as per the ranking and include them in the portfolio. In short, the higher the expected return, the better is the asset. As was mentioned above, the expected rate of return of a portfolio is the weighted average of the expected percentage return on each security according to their weight. The concept of expected return is part of the overall process of evaluating a potential investment.

If our portfolio of investments has diversified away as much risk as is possible given the costs of diversifying, our portfolio will be attractive to investors. If our bowl does not diversify away enough risk, it will not lie on the Security Market Line for those who we are trying to recruit into buying our portfolio. For a portfolio, you will calculate expected return based on the expected rates of return of each individual asset.

The rate of return expected on an asset or a portfolio. The expected rate of return on a single asset is equal to the sum of each possible rate of return multiplied by the respective probability of earning on each return.

We know that these are public securities, that they are traded, that they are risky. And one thing with respect to what we’ve been learning about NPV is that cash flows offered to stock holders are not certain at all. You know that, basically, stockholders, Have two fundamental rights, one is the right to vote and the other is the right to claim, Dividends. But that means that investors they make their choice about which we talked about in the first week. And they just decide to keep this cash in the company because they believe that for them it’s better to reinvest than to pocket this money and then to look for some other ways of investing.