PVIF Calculator

Behind every table, calculator, and piece of software, are the mathematical formulas needed to compute present value amounts, interest rates, the number of periods, and the future value amounts. We will, at the outset, show you several examples of how to use the present value formula in addition to using the PV tables. If you don’t have access to an electronic financial calculator or software, an easy way to calculate present value amounts is to use present value tables (PV tables).

A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day’s worth of interest, making the total accumulate to a value more than a dollar by tomorrow. By letting the borrower have access to the money, the lender has sacrificed the exchange value of this money, and is compensated for it in the form of interest. The initial amount of the borrowed funds (the present value) is less than the total amount of money paid to the lender.

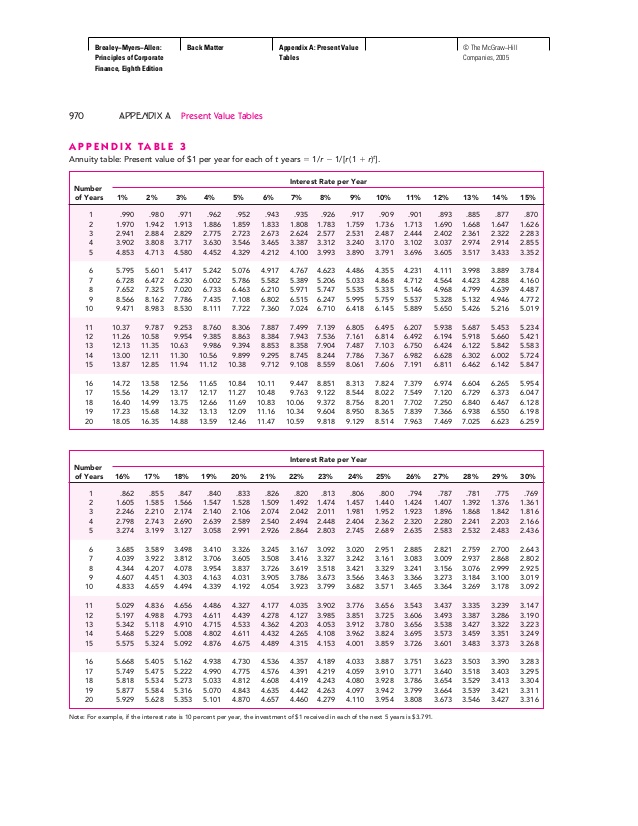

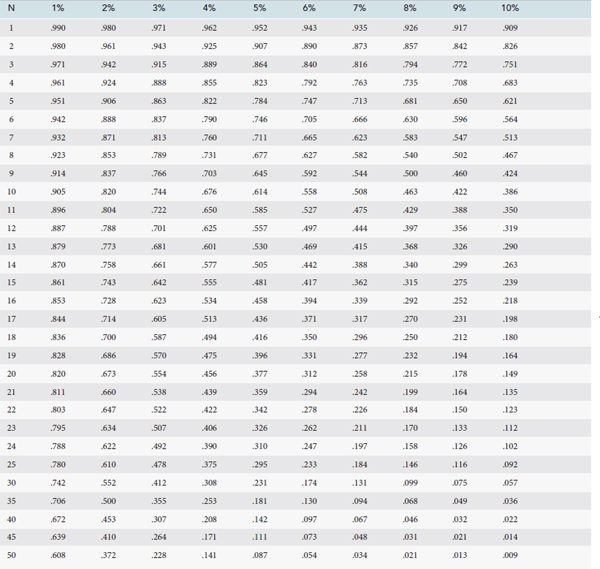

The table is used much the same way as the other time value of money tables. The present value interest factor is based on the key financial concept of the time value of money.

This table usually provides the present value factors for various time periods and discount rate combinations. While using the present value tables provides an easy way to determine the present value factor, there is one limitation to it. Interest is the additional amount of money gained between the beginning and the end of a time period.

The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent (this is the same data as the previous exercise). Determine the payback period for this investment using the format shown in Table 8.1 “Calculating the Payback Period for Jackson’s Quality Copies”.

Because the PV of 1 table had the factors rounded to three decimal places, the answer ($85.70) differs slightly from the amount calculated using the PV formula ($85.73). The present value of a sum of money to be received at a future date is determined by discounting the future value at the interest rate that the money could earn over the period. , of a stream of cash flows consists of discounting each cash flow to the present, using the present value factor and the appropriate number of compounding periods, and combining these values. The operation of evaluating a present sum of money some time in the future is called a capitalization (how much will 100 today be worth in five years?). The reverse operation—evaluating the present value of a future amount of money—is called discounting (how much will 100 received in five years be worth today?).

Interest represents the time value of money, and can be thought of as rent that is required of a borrower in order to use money from a lender. For example, when an individual takes out a bank loan, the individual is charged interest.

The initial investment to purchase the building is $420,000, and an additional $50,000 in working capital is required. Since this store will be operating for many years, the working capital will not be returned in the near future. Tower expects to remodel the store at the end of 3 years at a cost of $100,000. Annual net cash receipts from daily operations (cash receipts minus cash payments) are expected to be as follows.

This is because money can be put in a bank account or any other (safe) investment that will return interest in the future. In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. Time value can be described with the simplified phrase, “A dollar today is worth more than a dollar tomorrow”. Here, ‘worth more’ means that its value is greater.

For example, interest that is compounded annually is credited once a year, and the compounding period is one year. Interest that is compounded quarterly is credited four times a year, and the compounding period is three months. A compounding period can be any length of time, but some common periods are annually, semiannually, quarterly, monthly, daily, and even continuously.

If offered a choice between $100 today or $100 in one year, and there is a positive real interest rate throughout the year, ceteris paribus, a rational person will choose $100 today. This is described by economists as time preference. Time preference can be measured by auctioning off a risk free security—like a US Treasury bill. If a $100 note with a zero coupon, payable in one year, sells for $80 now, then $80 is the present value of the note that will be worth $100 a year from now.

Present value calculations, and similarly future value calculations, are used to value loans, mortgages, annuities, sinking funds, perpetuities, bonds, and more. These calculations are used to make comparisons between cash flows that don’t occur at simultaneous times, since time dates must be consistent in order to make comparisons between values. The project with the highest present value, i.e. that is most valuable today, should be chosen. A present value table or a PV table lists different periods in the first row and different discount rates in the first column. So, the table provides present value coefficients for a given discount rate and time.

Periods can be presented in weeks, months or years and discount rates normally go from 0 to 20% with intervals of 0.25% or 0.50% between them. The present value of an annuity is the current value of future payments from that annuity, given a specified rate of return or discount rate. Wood Products Company would like to purchase a computerized wood lathe for $100,000.

- The present value interest factor (PVIF) is a formula used to estimate the current worth of a sum of money that is to be received at some future date.

- The concepts of present value and present value factors play an important role in investment valuation and capital budgeting.

PV tables cannot provide the same level of accuracy as financial calculators or computer software because the factors used in the tables are rounded off to fewer decimal places. In addition, they usually contain a limited number of choices for interest rates and time periods. Despite this, present value tables remain popular in academic settings because they are easy to incorporate into a textbook. Because of their widespread use, we will use present value tables for solving our examples. The first column (n) refers to the number of recurring identical payments (or periods) in an annuity.

A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value. The interest rate selected in the table can be based on the current amount the investor is obtaining from other investments, the corporate cost of capital, or some other measure. The discount rate or the interest rate, on the other hand, refers to the interest rate or the rate of return that an investment can earn in a particular time period.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The present value interest factor (PVIF) is a formula used to estimate the current worth of a sum of money that is to be received at some future date. PVIFs are often presented in the form of a table with values for different time periods and interest rate combinations. The concepts of present value and present value factors play an important role in investment valuation and capital budgeting.

Present Value Formula, Tables, and Calculators

Alternatively, when an individual deposits money into a bank, the money earns interest. In this case, the bank is the borrower of the funds and is responsible for crediting interest to the account holder. A compounding period is the length of time that must transpire before interest is credited, or added to the total.

The Present Value Factor is based on the concept of the time value of money, which states that a dollar received today is more valuable than a dollar received in the future. The reason being the value of money appreciates over time provided the interest rates remain above zero. Therefore, when multiplying a future value by these factors, the future value is discounted down to the present value.

The present value interest factor of an annuity (PVIFA) is useful when deciding whether to take a lump-sum payment now or accept an annuity payment in future periods. Using estimated rates of return, you can compare the value of the annuity payments to the lump sum. Present value factor, also known as present value interest factor (PVIF) is a factor that is used to calculate the present value of money to be received at some future point in time. In other words, this factor helps us to determine whether cash received now is worth more, or less than when it is received later. Present value factor is often available in the form of a table for ease of reference.

Calculating the Present Value (PV) of a Single Amount

That is, a sum of money today is worth more than the same sum will be in the future, because money has the potential to grow in value over a given period of time. Provided money can earn interest, any amount of money is worth more the sooner it is received. Net Present Value, Internal Rate of Return, and Payback Period Analyses; Ethical Issues. Tower CD Stores would like to open a retail store in Houston.

In the table, the time can be in weeks, months or years. The discount rates are usually within 0% to 20% with an interval of 0.25% or 0.50% or 1%. What is the definition of present value table? A PV table lists different discount rates in the first column and different time periods in the first row. The purpose of the table is to provide present value coefficients for different time periods and discount rates.

Accounting Ratios

It is called so because it represents the rate at which the future value of money is ‘discounted’ to arrive at its present value. Present value impact factors are often used in analyzing annuities.