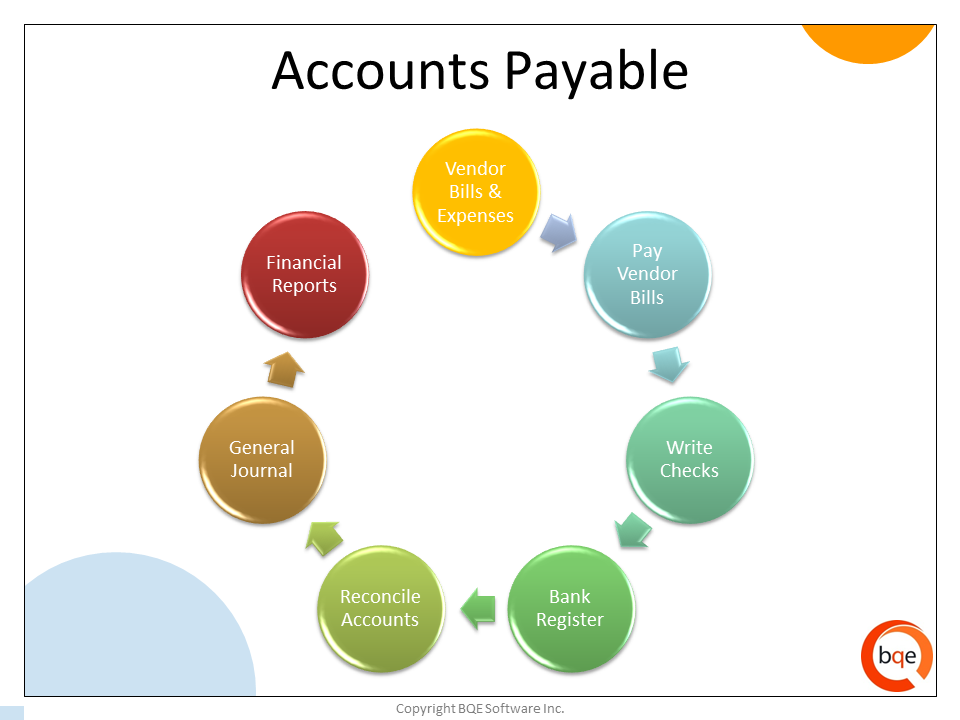

Process of accounts payable

Accounts payable process includes not only non-payments to contractors but also debts for taxes, fees, and other payments to the budget and extra-budgetary funds. In addition, accounts payable includes amounts of unpaid salaries. While processing, you may use the accounts payable process flow chart. You need a good accountant, so after the next check, the size of your accounts payable does not suddenly increase by the amount of accrued fines or penalties before the state.

Purchase order

A purchase order, abbreviated PO, is an official document that confirms the buyer’s desire to order specific products or services and pay for their purchase in the future.

Each purchase order document has its tracking number that allows one to monitor both sides of the delivery and payment. The information on the document form for accounts payable process in sap confirms the sale of goods or services on a permanent basis until the specified date or volume of deliveries.

Receiving report

The receiving report is used to account for the receipt of various goods, both inside the organization and from outside. The form of such report includes mandatory details such as:

- name of the company-seller;

- name of the product or material;

- the unit value;

- number and amount of goods;

- a person responsible for the transfer.

This data becomes the basis for displaying the arrival of goods and services in accounting. At the same time, it is from the receiving report that the quantitative and cost indicators of the receipt operation are transferred to the accounting during accounts payable process automation.

Vendor invoice

A vendor invoice is a document that is used for registering the sale (issue) of inventory items to a third-party organization in the accounts payable process.

The vendor invoice is made in two copies. The first copy remains in the organization that delivers inventory items and is the basis for their write-off. The second copy is transferred to a third-party organization and is the basis for posting these values.

Three-way match

A three-way match is a method of comparison. The accountant should compare information in three important documents: purchase order, receiving report, and vendor invoice. Afterward, the documents are perforated or sealed to prevent a repeated payment.

Vouchers

Voucher is used in order to document completeness while speaking about the process of approval. Voucher is valid when other documents are attached to it, as a vendor’s invoice, receiving a report, or purchase order. Paid vouchers are stored in a separate file. Sometimes a special machine is used in order to perforate the word “Paid” on the document to distinguish it from other vouchers.

Vendor invoices without purchase orders and receiving reports

Some vendor invoices don’t contain receiving reports and purchase orders. Thus, it is impossible to process them with the three-way match method. Such invoices in the accounts payable process are usually applied when natural resources are consumed, for example, electric energy, gas, or water.

Statements from vendors

In statements from vendors, one can see all invoices and unallocated payments that have not been paid yet. They are indicated at the end of a certain period of time. If invoices have been paid only partially, you can see there a paid sum and a sum that should be paid. Now, you know an answer to “What is account payable process?”.