Process Costing

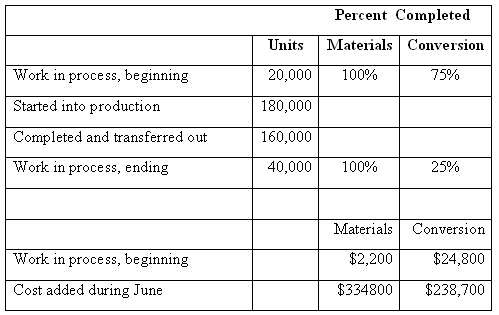

Work-in-process represents the incomplete equivalent units from the previous month. Only 100 percent complete equivalent units will be assigned full process cost.

A job costing system is used by companies that produce unique products or jobs. Process costing systems track costs by processing department, whereas job costing systems track costs by job. They produce all of the components of a single product (e.g. coffee tables) in one batch.

Costs are likely to be accumulated at the department level, and no lower within the organization. With the standardization of products, managers track performance, productivity, and costs over time.

Direct allocation costing applies a specific amount of raw materials, production labor and manufacturing overhead to goods or services. Process costing may allow non-production costs to be included in the total process cost. Including non-production costs will arbitrarily increase each item’s cost; this also increases the consumer product price. Management accountants may also leave out production costs and create under-costed products.

If a process costing system does not mesh well with a company’s cost accounting systems, there are two other systems available that may be a better fit. The job costing system is designed to accumulate costs for either individual units or for small production batches.

AccountingTools

Process costing relies on a very distinct flow of units through the company’s production system. Homogenous goods usually flow through several various production processes. Each process has a specific amount of costs associated with producing products.

What is an example of process costing?

A process costing system accumulates costs when a large number of identical units are being produced. A process costing system accumulates costs and assigns them at the end of an accounting period. At a very simplified level, the process is: Direct materials.

The costs of all labor worked on that specific item of furniture would be recorded on a time sheet and then compiled on a cost sheet for that job. Similarly, any wood or other parts used in the construction of the furniture would be charged to the production job linked to that piece of furniture. A hybrid cost accounting system is one that includes parts of job costing and process costing.

The FIFO (first-in, first-out) method of inventory costing assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods. This method assumes the first goods purchased are the first goods sold. In some companies, the first units in (bought) must be the first units out (sold) to avoid large losses from spoilage.

Under-costed products usually result in lower business profits because goods are actually more expensive than actually reported. Job costing involves the detailed accumulation of production costs attributable to specific units or groups of units. For example, the construction of a custom-designed piece of furniture would be accounted for with a job costing system.

Low value indicates that each individual unit of output is not worth much. If the output products are of low value, then it may be beneficial to use process costing. If it’s difficult or infeasible to trace production costs directly to individual units of output, then it may be beneficial to use the process costing method. In accounting, process costing is a method of assigning production costs to units of output.

The cost flow and journal entries in process costing system

The process costing method is in contrast to other costing methods, such as product costing, job costing, or operation costing systems. Using the process costing method is optimal under certain conditions. Homogeneous indicates that the units of output are relatively indistinguishable from one another. If the output products are homogeneous, then it may be beneficial to use process costing.

- Production cost errors often represent a significant disadvantage for cost accounting systems.

- Process costing can create cost errors in the production system.

Process costing can create cost errors in the production system. Production cost errors often represent a significant disadvantage for cost accounting systems. Process costing does not use direct allocation to apply business costs to individual goods.

Costs can include direct materials, production labor and manufacturing overhead. These items represent the direct costs related to the specific production of goods. Manufacturers may have different types of processes they use when producing goods. In the wine industry, production processes can include harvesting, crushing and pressing grapes, fermentation, aging, bottling, labeling and shipping.

Process costing summary

They would then produce the components of another product (e.g. dining room sets) in a new batch. (Some university food service companies prepare meals this way.) Companies such as these use job costing methods to accumulate the cost of each batch. Process costing involves the accumulation of costs for lengthy production runs involving products that are indistinguishable from each other.

The basic cost calculation is work-in-process plus costs incurred for the month divided by total equivalent units. Companies often break down production costs into direct material costs and conversion costs. Conversion costs include the direct labor and manufacturing overhead for each production process.

Labor costs

Such items as fresh dairy products, fruits, and vegetables should be sold on a FIFO basis. In these cases, an assumed first-in, first-out flow corresponds with the actual physical flow of goods. Process costing is an easier system to use when costing homogenous products compared to other cost allocation methods. Business owners allocate business costs according to the number of processes each good travels through in the production system. Each process applies direct materials, labor and manufacturing overhead to the production cost total.

Accounting for Managers

Cost accounting helps managers determine the costs of running a business by recording the costs of materials, processes, and projects. Analyzing trends on costs of production and overhead along with revenue helps management make informed decisions on how to improve, scale, or grow effectively. Cost accounting utilizes either job costing, process costing, or a hybrid of both. In this article, we will discuss the differences between job costing and process costing as well as advantages or disadvantages of each. A process costing system is used by companies that produce similar or identical units of product in batches employing a consistent process.

Management accountants take the total number of goods leaving the process and divide the total process cost by this number. Manufacturing companies follows the process costing and the production process is carried on in two or more centers continuously. It is a basic method of allocating total costs to a unit of product in process wise. This system accumulates costs by time period and associates them with the output produced during the same period.

In process costing systems, production costs are not traced to individual units of output. Then assign the costs to units of output as they move through the departments. The process costing method is typically used for processes that produce large quantities of homogeneous products. Computing individual unit costs in process costing is a fairly basic process compared to other cost accounting methods.

When a business creates or manages products in batches and charges based on the batch as well as costs labor as an individual unit, hybrid costing can help. Prefabrication contractors are an example of those who benefit from hybrid costing. Each unit prefabricated for a project, or batch, is cost based on the batch. While the workers are usually cost based on the hours worked on an individual unit level. This can ensure that the overall rice is still low enough to remain competitive while covering all operational, material and labor costs.