Price/Earnings to Growth and Dividend Yield

This ratio shows the relation between the book value of the company (total equity excluding the preference shares of the shareholders) and the outstanding shares in the market. When the market value exceeds the book value, the stock market is assigning a higher value to the company due to the potential of it and its assets’ earnings power. It indicates that investors believe the company has excellent future prospects for growth, expansion, and increased profits that will eventually raise the book value of the company. They may also believe the value of the company is higher than what the current book value calculation shows.

Using P/B Ratio to Evaluate Stock

While the PEGY ratio doesn’t tell the whole story of a stock’s potential for appreciation, it provides investors with a starting point in their stock analysis. The price/earnings to growth and dividend yield (PEGY ratio)—also known as the “dividend-adjusted PEG ratio”—was created by famed value investor Peter Lynch.

The price-to-earnings (P/E) ratio gives analysts a good fundamental indication of what investors are currently paying for a stock in relation to the company’s earnings. One weakness of the P/E ratio, however, is that its calculation does not take into account the future expected growth of a company.

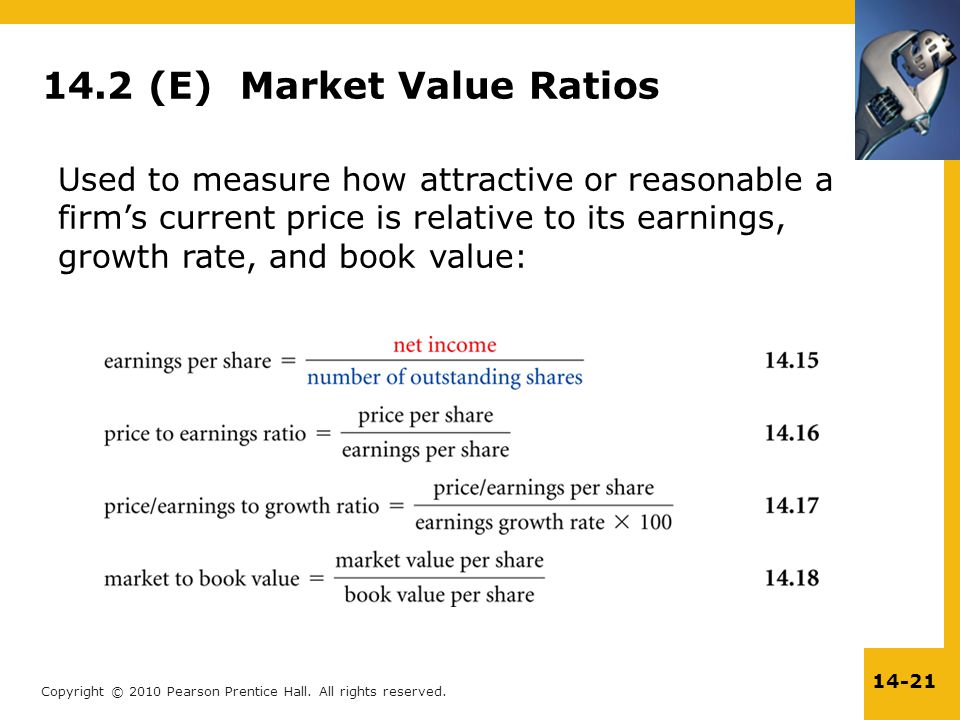

Although a wide variety of market value ratios are available, the most popular includeearnings per share,book value per share, and the price-earnings ratio. Others include the price/cash ratio,dividend yield ratio,market value per share, and themarket/book ratio. Each of these measures is used in a different way, but when combined, they offer a financial portrait of publicly traded companies.

What Is Considered a Good Price-To-Book Ratio?

When book value is divided by the number of outstanding shares, we get the book value per share (BVPS) which can be used to make a per-share comparison. Outstanding shares refer to a company’s stock currently held by all its shareholders, including share blocks held by institutional investors and restricted shares. Calculated as the total market value of the business, divided by the total number of shares outstanding. This reveals the value that the market currently assigns to each share of a company’s stock.

In effect, the book value represents how much a company would have left in assets if it went out of business today. Some analysts use the total shareholders’ equity figure on the balance sheet as the book value. The book-to-market ratio is used to find a company’s value by comparing its book value to its market value.

What is a good market value ratio?

Market value ratios are used to evaluate the current share price of a publicly-held company’s stock. These ratios are employed by current and potential investors to determine whether a company’s shares are over-priced or under-priced. The most common market value ratios are as follows: Book value per share.

The PEG ratio represents a fuller—and hopefully—more accurate valuation measure than the standard P/E ratio. The book value is a company’s equity (not including preferred stock) divided by the shares outstanding in the market. For example, if a company’s total assets equal $15 million and its total liabilities equal $5 million, the total equity would be $10 million. If the company has $2 million in preferred stock, deduct that to get $8 million, the amount available to common shareholders. If there are 1 million outstanding shares, the book value per share would be $8, or $8 million divided by 1 million.

Specifically, it compares the company’s stock price to its book value per share (BVPS). The market capitalization (company’s value) is its share price multiplied by the number of outstanding shares.

Book Value Vs. Market Value: What’s the Difference?

For example, if a company has a book value per share of $8 and the stock currently is valued at $10 per share, the M/B ratio would be calculated by dividing $10 (stock price) by $8 (book value per share). In other words, the market value of a share of stock is 25% greater than its book value. Investors check both the price and dividend earnings from a share so, this ratio helps in measuring the amount of dividend distributed in a year against the number of shares outstanding.

In short, the P/E shows what the market is willing to pay today for a stock based on its past or future earnings. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.

- Although a wide variety of market value ratios are available, the most popular includeearnings per share,book value per share, and the price-earnings ratio.

The book value is the total assets – total liabilities and can be found in a company’s balance sheet. In other words, if a company liquidated all of its assets and paid off all its debt, the value remaining would be the company’s book value.

Calculated as the total dividends paid per year, divided by the market price of the stock. This is the return on investment to investors if they were to buy the shares at the current market price.

In addition, market value ratios give management an idea of what a firm’s investors think of its performance and future prospects. The P/B ratio compares a company’s market capitalization, or market value, to its book value.

To calculate earnings per share, divide the company’s net income by the number of outstanding shares (the stock currently held by all shareholders). For example, if a company has $10 million in net income and 4 million outstanding shares, the earnings per share would be $10 million divided by 4 million, which amounts to $2.50.

Investors not only use the P/E ratio to determine a stock’s market value but also in determining future earnings growth. For example, if earnings are expected to rise, investors might expect the company to increase its dividends as a result. The P/E ratio helps investors determine the market value of a stock as compared to the company’s earnings.

The market value of a publicly-traded company is determined by calculating its market capitalization, which is simply the total number of shares outstanding multiplied by the current share price. The market value is the price that investors are willing to pay to acquire or sell the stock in the secondary markets. Since it is determined by supply and demand in the market, it does not always represent the actual value of a firm. The book value of a firm is its historical cost or accounting value calculated from the company’s balance sheet. Book value can be calculated by subtracting total liabilities, preferred shares, and intangible assets from the total assets of a company.

This measurement does not reflect the market price of a company’s shares in any way, but can be used by investors to derive the price they think the shares are worth. While a company’s stock price reflects the value that investors are currently placing on that investment, a stock’s P/E ratio indicates how much investors are willing to pay for every dollar of earnings.

This gives an insight into the company’s earning and investors can decide whether they want to invest in the shares which pay a certain level of dividend against the current price of the share in the market. This ratio is again one of the most important market value ratios to analyze and decide whether the price per share of the company is at its market price or not.

A company’s book value is calculated by looking at the company’s historical cost, or accounting value. A firm’s market value is determined by its share price in the stock market and the number of shares it has outstanding, which is its market capitalization. The PEG ratio builds upon the P/E ratio by factoring growth into the equation. Factoring in future growth adds an important element to stock valuation since equity investments represent a financial interest in a company’s future earnings. Earnings per share measure a company’s net income per share of outstanding stock, indicating a company’s profitability to investors.

In theory, a PEG ratio value of 1 represents a perfect correlation between the company’s market value and its projected earnings growth. With the market/book ratio, analysts can compare a company’s market value to its book value. The ratio can be calculated by dividing the market value per share by the book value per share.

The high multiple indicates that investors expect higher growth from the company compared to the overall market. Any P/E ratio needs to be considered against the backdrop of the P/E for the company’s industry. Calculated as the reported earnings of the business, divided by the total number of shares outstanding (there are several variations on this calculation).

However, companies that grow faster than average typically have higher P/Es, such as technology companies. A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future. For example, a company with a current P/E of 25, above the S&P average, trades at 25 times earnings.

The market price of a given stock is needed to calculate its P/E ratio, but in many ways, the P/E ratio offers better insight into the stock’s growth potential. The P/E ratio measures the relationship between a company’s stock price and its earnings per share of stock issued. The P/E ratio is calculated by dividing a company’s current stock price by its earnings per share (EPS). If you don’t know the EPS, you can calculate it by subtracting a company’s preferred dividends paid from its net income, and then dividing the result by the number of shares outstanding. The price/earnings to growth ratio, or PEG ratio, is a stock valuation measure that investors and analysts can use to get a broad assessment of a company’s performance and evaluate investment risk.