Present and Future Value: Calculating the Time Value of Money

Future value of an ordinary annuity table

Multiply the number in that cell by the amount of money you get each period. Figuring the present value of any future amount of an annuity may also be performed using a financial calculator or software built for such a purpose. An annuity table is a variation of a present value table used by accountants. An annuity table is a tool for determining the present value of an annuity or other structured series of payments.

It’s figured by reducing the value of each payment based on a discount factor (typically the current interest rate on short-term U.S. Treasury debt) and the time until the payment occurs. An annuity account is meant to pay you money each month for either a fixed number of years or until you die, according to your contract with the insurance company. The largest insurance carriers are likely to make all payments on time, but annuities from smaller carriers carry some risk that the insurer will default on its payments. An ordinary annuity makes payments at the end of each time period, while an annuity due makes them at the beginning. The present value of an annuity is the current value of future payments from an annuity, given a specified rate of return, or discount rate.

How an Annuity Table Works

The payments due value is either a one (beginning of the month), or zero (end of the month). You could read (PV(1 + I)ⁿ) as, “the present value (PV) times (1 + I)ⁿ”, where l represents the interest rate and the superscript ⁿis the number of compounding periods. The ability to calculate the future value of an investment is a worthwhile skill. It allows you to make educated decisions about an investment or purchase regarding the return you may receive in the future. A fixed annuity’s present value is how much the future cash flows are worth in today’s dollars.

The future value of an annuity is the total value of annuity payments at a specific point in the future. This can help you figure out how much your future payments will be worth, assuming that the rate of return and the periodic payment does not change. The future value of an annuity calculation shows the total value of a collection of payments at a chosen date in the future, based on a given rate of return. This is different from the present value of an annuitycalculation, which gives you the current value of future annuity payments.

Annuity Table

While it is unlikely to be your sole source of cash during retirement, it can effectively supplement yourIRAor401(k). The future value of an annuity calculation shows what the payments from an annuity will be worth at a specified date in the future, based on a consistent rate of return.

How do you find the future value of an annuity table?

The annuity table contains a factor specific to the future value of a series of payments, when a certain interest earnings rate is assumed. When you multiply this factor by one of the payments, you arrive at the future value of the stream of payments.

Example Calculation for Future Value of Annuity

If you want to estimate your purchasing power over time, you consider how interest rates are increasing the value of money and how inflation is decreasing it. A lottery winner could use an annuity table to determine whether it made more financial sense to take his lottery winnings as a lump-sum payment today or as a series of payments over many years.

Calculate the future value interest factor of an annuity (FVIFA) and create a table of FVIFA values. Create a printable compound interest table for the future value of an ordinary annuity or future value of an annuity due for payments of $1. Since payments are made sooner with an annuity due than with an ordinary annuity, an annuity due typically has a higher present value than an ordinary annuity.

The interest rate can be based on the current amount you are obtaining through other investments, the corporate cost of capital, or some other measure. The future value of an annuity represents the total amount of money that will be accrued by making consistent investments over a set period, with compound interest.

What is the future value of an annuity?

While it is unlikely to be your sole source of cash during retirement, it can effectively supplement your IRA or 401(k). The future value of an annuity calculation shows what the payments from an annuity will be worth at a specified date in the future, based on a consistent rate of return.

Calculator Use

- An annuity tablerepresents a method for determining the future value of an annuity.

- When you multiply this factor by one of the payments, you arrive at the future value of the stream of payments.

- The annuity table contains a factor specific to the future value of a series of payments, when a certain interest earnings rate is assumed.

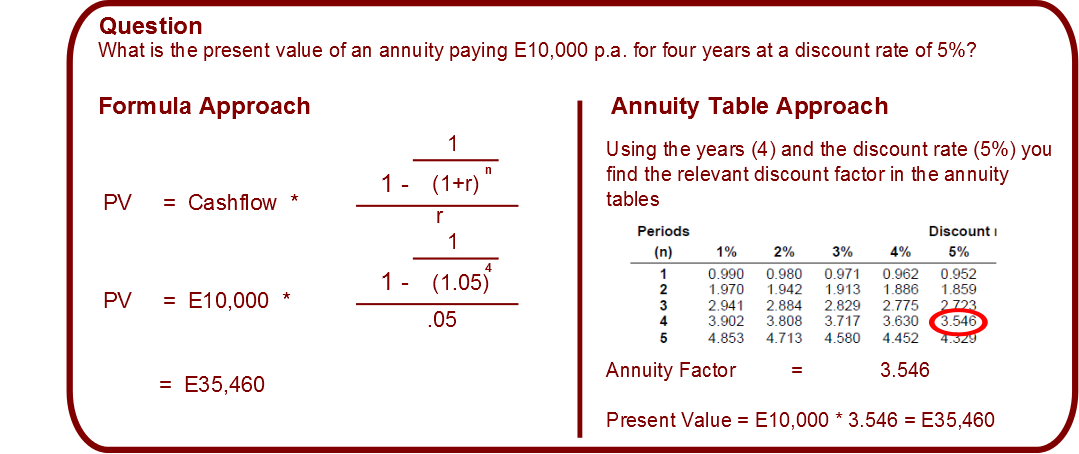

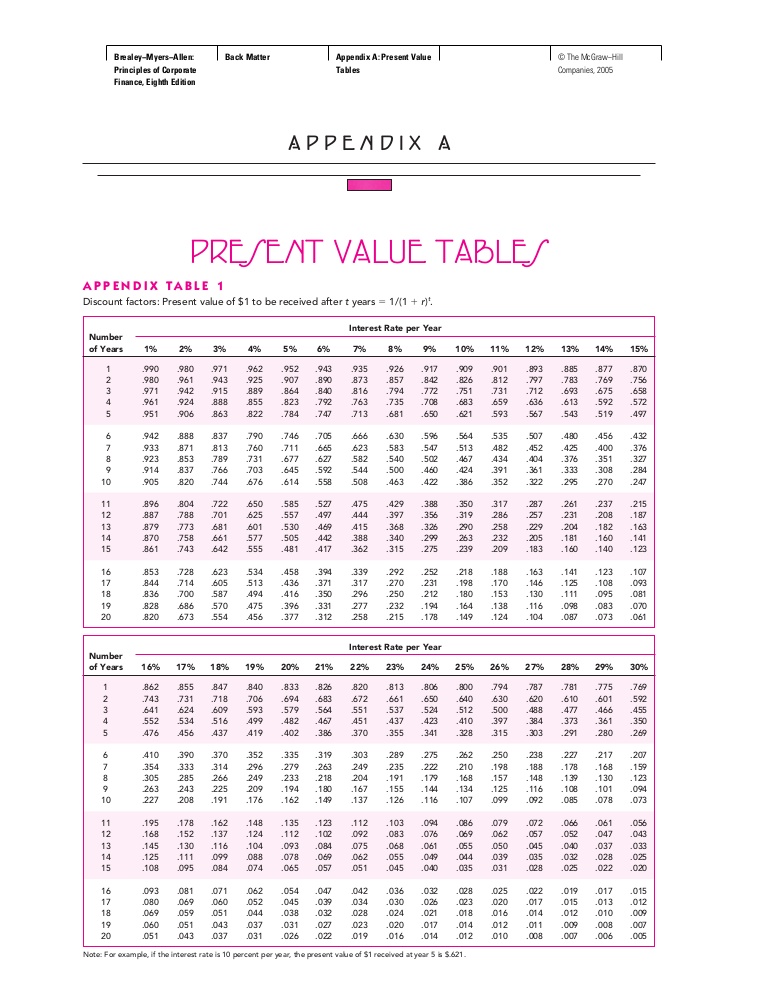

An annuity table provides a factor, based on time and a discount rate, by which an annuity payment can be multiplied to determine its present value. For example, an annuity table could be used to calculate the present value of an annuity that paid $10,000 a year for 15 years if the interest rate is expected to be 3%. An annuity table calculates the present value of an annuity using a formula that applies a discount rate to future payments.

You purchase the contract through either a lump sum payment or a series of payments, and then receive monthly payments in retirement. You might want to calculate the future value of an annuity, to see how much a series of investments will be worth as of a future date. You do this by using an interest rate to add interest income to the amount of the annuity.

An annuity is a financial investment that generates regular payments for a set time period. In modern times, an annuity is most often purchased through an insurance company or a financial services company. We will use easy to follow examples and calculate the present and future value of both sums of money and annuities. Ordinary annuities are seen in retirement accounts, where you receive a fixed or variable payment every month from an insurance company, based on the value built up in the annuity account. In a fixed annuity account, your monthly payment is based on a fixed interest rate applied to the account balance at the start of payments.

The calculation of both present and future value assumes a regular annuity with a fixed growth rate. Many online calculators determine both the present and future value of an annuity, given its interest rate, payment amount, and duration.

An annuity tablerepresents a method for determining the future value of an annuity. The annuity table contains a factor specific to the future value of a series of payments, when a certain interest earnings rate is assumed. When you multiply this factor by one of the payments, you arrive at the future value of the stream of payments. You can calculate the future value of money in an investment or interest bearing account.

This number can be used to make financial planning easier because you’ll know more accurately how much your annuity payments will be worth in the future. This, in turn, enables you to make more informed decisions about your financial life.

An annuity is good way to supplement your retirement savings to ensure your golden years are as smooth as possible. By locking in a fixed monthly income in exchange for an upfront payment, you can make sure that you’ll be able to handle all of your bills and expenses when you are no longer working. Either way, the fees and charges on annuities will conspire to diminish your retirement income. Simple interest is the principal amount multiplied by the interest rate and the number of accounting periods in a loan or investment.

The present value of annuity formula relies on the concept of time value of money, in that one dollar present day is worth more than that same dollar at a future date. Annuities can help you plan for your retirement by providing a guaranteed source of income for you and your family when you reach your golden years. They aren’t the simplest of investments, though, and sometimes it can be difficult to know exactly how much your annuity is worth. An annuity table can help with that by allowing you to easily calculate the present value of your annuity.

First, find out the interest rate, the number of periods and whether the account earns simple or compound interest. Then, you can plug those values into a formula to calculate the future value of the money. Knowing the future value of your annuity can be useful when planning for your retirement or any other aspect of your financial life. Once you know how much money your annuity payments may be worth, assuming you invest and have a certain rate of return, you can make plans based on your expected income.

Variable annuity account payments are based on the investment performance of your account. An annuity table typically has the number of payments on the y-axis and the discount rate on the x-axis. Find both of them for your annuity on the table, and then find the cell where they intersect.

More commonly, annuities are a type of investment used to provide individuals with a steady income in retirement. The discount rate refers to an interest rate or an assumed rate of return on other investments. The smallest discount rate used in these calculations is the risk-free rate of return. Treasury bonds are generally considered to be the closest thing to a risk-free investment, so their return is often used for this purpose. The present value of annuity formula determines the value of a series of future periodic payments at a given time.

This information allows you to make informed decisions about what steps to take to plan for your retirement. If you need assistance with annuities or retirement planning more generally, find a financial advisor to work with using SmartAsset’s free financial advisor matching service. According to the concept of the time value of money, receiving a lump sum payment in the present is worth more than receiving the same sum in the future. As such, having $10,000 today is better than being given $1,000 per year for the next 10 years because the sum could be invested over that decade. At the end of the 10-year period, the $10,000 lump sum would be worth more than the sum of the annual payments, even if invested at the same interest rate.

Compound interest is calculated in the principal amount plus any accrued interest from previous periods. The rate of return on an investment or deposit account is the amount of interest you are paid divided by the amount of dollars in the account or investment. The value of $100 is different today than it was five years ago or will be five years from now. When you invest money or deposit it into an interest-bearing account, the value will increase or decrease depending on the rate of return. Even though $100 may be enough to purchase an item today, it may not be enough to purchase that same item in the future.

Before we cover what the future value of an annuity is, let’s first define annuity. An annuity is basically a financial contract that a person signs with an insurance company.

On the other hand, when interest rates fall, the value of an ordinary annuity goes up. This is due to the concept known as the time value of money, which states that money available today is worth more than the same amount in the future because it has the potential to generate a return and grow. Evaluate the worth of an amount of money today after a given period of time. The change in the value of money over time is calculated using information about interest rates and inflation. If you want to evaluate the future value of an investment, you multiply the principal by the given interest rate.