Pledging, Selling, Direct Write-Off Method

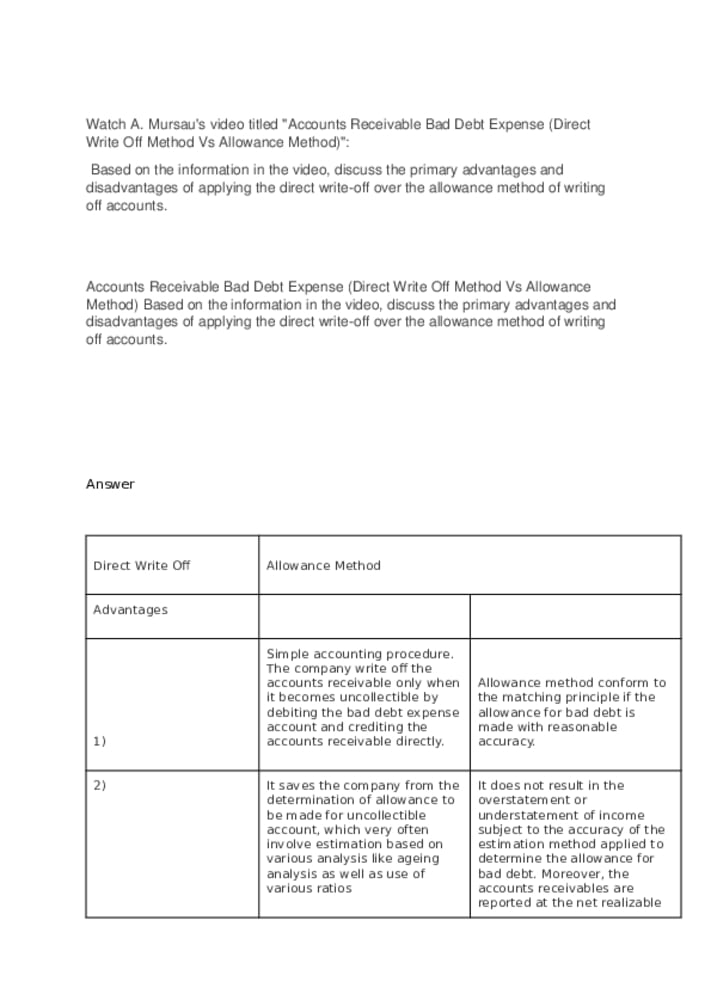

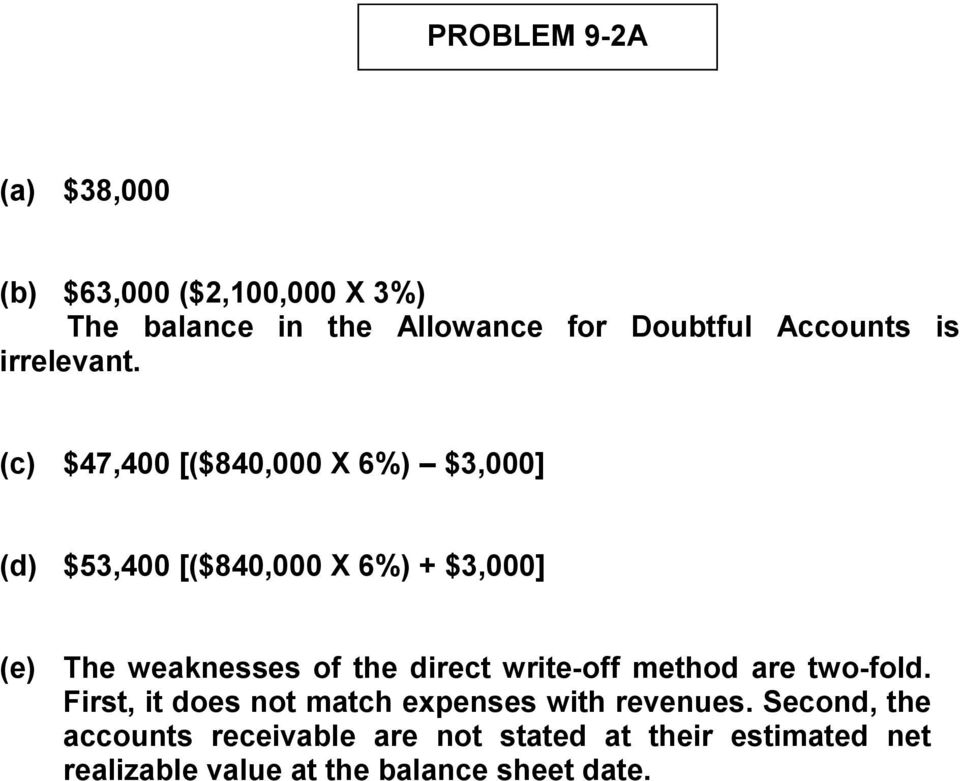

The Internal Revenue Service requires the direct write-off method, although it does not conform to generally accepted accounting principles (GAAP). When a business writes off an uncollectible account, it charges the amount as a bad debt expense on the income statement. The matching principle requires a business to record revenues and their related expenses in the same accounting period.

The direct write-off method takes place after the account receivable was recorded. You must credit the accounts receivable and debit the bad debts expense to write it off. The allowance method records an estimate of bad debt expense in the same accounting period as the sale. It often takes months for companies to identify specific uncollectible accounts. The allowance method follows the matching principle, which states revenues need to be matched with the expenses incurred in that same accounting period.

Later, when a specific account receivable is actually written off as uncollectible, the company debits Allowance for Doubtful Accounts and credits Accounts Receivable. Usually many months will pass between the time of the sale on credit and the time that the seller knows with certainty that a customer is not going to pay. This is why, for purposes of financial reporting (not tax reporting), companies should use the allowance method rather than the direct write-off method. The financial accounting term allowance method refers to an uncollectible accounts receivable process that records an estimate of bad debt expense in the same accounting period as the sale.

We record Bad Debt Expense for the amount we determine will not be paid. This method violates the GAAP matching principle of revenues and expenses recorded in the same period. Management uses the allowance for doubtful accounts method to estimate credit accounts that customers will not pay. Instead, management uses past financial information to estimate bad debt amounts. The first journal entries under the allowance method include a debit to bad debt expense and a credit to allowance for doubtful accounts.

The allowance method records bad debt expense by estimating uncollectible accounts at the end of the accounting period. -Footnote Generally accepted accounting principles (GAAP), however, require companies with a large amount of receivables to use the allowance method. As a result, most well-known companies such as General Electric, Pepsi, Intel, and FedEx use the allowance method.

When the company considers an account to be completely uncollectible, it makes a debit to allowance for doubtful accounts and a credit to accounts receivable. An advantage of using the direct write-off method is that it is simple. Companies only have to make two transactions for the amount of the customer’s bad debt. Another advantage is that companies can write off their bad debt on their annual tax returns. A disadvantage of the direct write-off method is the possibility of expense manipulation, because companies record expenses and revenue in different periods.

There are two methods companies use to account for uncollectible accounts receivable, the direct write-off method and the allowance method. Please note that using the bad debts direct write-off method is not permitted under GAAP (Generally Accepted Accounting Principle) and IFRS (International Financial Reporting Standards).

For example, if 2% of your sales were uncollectible, you could set aside 2% of your sales in your ADA account. Let’s say you have a total of $50,000 in accounts receivable ($50,000 X 2%). The direct write-off method allows more room for manipulation than other methods. Although a company is supposed to write off an account as soon as it determines the account to be uncollectible, it uses its judgment to decide when that moment arrives.

Because of this violation, GAAP allows a business to use the direct write-off method only for insignificant amounts. When a business extends credit to customers, some customers might be unable to pay on the spot. The direct write-off method is one way to account for these uncollectible receivables.

The allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. The allowance method represents the accrual basis of accounting and is the accepted method to record uncollectible accounts for financial accounting purposes. Under the allowance method, a company records an adjusting entry at the end of each accounting period for the amount of the losses it anticipates as the result of extending credit to its customers. The entry will involve the operating expense account Bad Debts Expense and the contra-asset account Allowance for Doubtful Accounts.

The direct write off method is simpler than the allowance method as it takes care of uncollectible accounts with a single journal entry. It’s certainly easier for small business owners with no accounting background. It also deals in actual losses instead of initial estimates, which can be less confusing.

Companies should exhaust all recovery attempts before writing off a bad debt. To write a debt off, companies debit the bad debt expense account and credit the accounts receivable account.

direct write-off method definition

Allowance for uncollectible accounts is also referred to as allowance for doubtful accounts, and may be expensed as bad debt expense or uncollectible accounts expense. Companies use the direct write-off method when they decide there is no chance of receiving the money that a customer owes.

Instead, GAAP and IFRS require that companies use the allowance method to report credit losses. Under the direct write off method, when a small business determines an invoice is uncollectible they can debit the Bad Debts Expense account and credit Accounts Receivable immediately. This eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. For financial reporting purposes the allowance method is preferred since it means the loss (bad debts expense) is recognized closer to the time of the credit sales. This also means that the balance sheet will be reporting a lower, more realistic amount of its accounts receivable sooner.

- The allowance method records bad debt expense by estimating uncollectible accounts at the end of the accounting period.

- -The direct write-off method records bad debt expense only when an account is determined to be worthless.

Journal EntriesUnder the bad debts direct write-off method, one entry is required to record credit loss in the general journal. If it is known that a specific customer is not able to pay a specific amount, the accounts receivable should be reduced for that amount. It is recorded by debiting the Bad Debts Expense account and crediting Accounts Receivable. Use the percentage of bad debts you had in the previous accounting period and apply it to your estimate.

What is the difference between direct write off method and allowance method?

direct write-off method definition. A method for recognizing bad debts expense arising from credit sales. Under this method there is no allowance account. Rather, an account receivable is written-off directly to expense only after the account is determined to be uncollectible.

Businesses that sell their goods and services to customers on credit inevitability have to deal with bad debts. When they are not successful, they consider the accounts uncollectible.

Accounts Receivable Ratios

Therefore, companies should only use this method for small amounts that do not significantly impact financial records. Another disadvantage is that the balance sheet is not an accurate representation of the company’s accounts receivable. The sales method applies a flat percentage to the total dollar amount of sales for the period. For example, based on previous experience, a company may expect that 3% of net sales are not collectible. If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense.

Is the direct write off method GAAP?

Direct write-off method vs allowance method. Under the direct write-off method, a bad debt is charged to expense as soon as it is apparent that an invoice will not be paid. Under the allowance method, an estimate of the future amount of bad debt is charged to a reserve account as soon as a sale is made.

The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. Because customers do not always keep their promises to pay, companies must provide for these uncollectible accounts in their records. The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes.

The Disadvantages of Direct Write-off Method

This leeway allows an unethical company to inappropriately manage its profits. For instance, if a business wants to artificially raise its profits, it might overlook some past-due accounts until a later period so it can delay reporting the bad debt expense. Generally accepted accounting principles (GAAP) require that companies use the allowance method when preparing financial statements. As a result, companies must use the direct write-off method for income tax reporting. With the allowance method, you predict that you won’t receive payment for credit sales from all your customers.

Free Financial Statements Cheat Sheet

-The direct write-off method records bad debt expense only when an account is determined to be worthless. -The direct write-off method is often used by small companies and companies with few receivables.

Companies use a few different types of methods, usually based on their past experience with bad debt. Let’s say your business brought in $100,000 worth of sales in an accounting period. Based on past trends, you predict that 3% of your sales will be bad debts. You must record $3,000 as a debit in your bad debts expense account and a matching $3,000 as a credit in your allowance for doubtful accounts. The direct write-off method is an easier way of treating the bad debt expense since it only involves a single entry where bad debt expense is debited and accounts receivable is credited.

The allowance method is used to adjust accounts receivable appearing on the balance sheet. Allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. When customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

With this method, a business writes off an account only when it determines that a customer cannot pay. This differs from the allowance method, which requires a business to estimate its uncollectible accounts each period. The direct write-off method is simpler to use, but its drawbacks might make it inappropriate for some small businesses. Unfortunately, not all customers that make purchases on credit will pay companies the money owed.

Companies account for uncollectible accounts using two methods – the direct write-off method and the allowance method. The allowance method follows GAAP matching principle since we estimate uncollectible accounts at the end of the year. We can calculate this estimates based on Sales (income statement approach) for the year or based on Accounts Receivable balance at the time of the estimate (balance sheet approach). The direct write-off method is used only when we decide a customer will not pay. We do not record any estimates or use the Allowance for Doubtful Accounts under the direct write-off method.

As a result, you debit bad debts expense and credit allowance for doubtful accounts. When there is a bad debt, you will credit accounts receivable and debit allowance for doubtful accounts. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. Two primary methods exist for estimating the dollar amount of accounts receivables not expected to be collected. GAAP requires that businesses extending credit to customers use the allowance method, which means they estimate uncollectible accounts.