Piece rates and commission payments

Residual payments to an employee are a novel concept, as they reward a sales employee for selling a product or service to a customer who continues to buy from the employer over a period of time. The longer they remain a cash-generated client, the longer a sales employee can earn a residual payment based on sales to that client.

Others combine the two approaches, offering a base salary and a commission plan. With these types of jobs, your base salary may be minimal and your commission plan generous, or the base salary may be generous and the commission plan small. A draw essentially equates to advanced commission payments ahead of the sales you’ll make. Some employers may also pay cash bonuses — no matter what your compensation plan — if you meet or exceed your sales goals. Some commission-based sales professionals may opt for a draw against commission payment model.

Though your paycheck may fluctuate, commission-only jobs tend to pay higher commissions than jobs with a base salary. These types of jobs also typically provide more freedom; you have more control over your workday than an employee who’s being paid a set rate. While many employees are paid on an hourly or salaried basis, commissioned employees are paid based on the value of goods and services that they sell. Commission-based payment is common in certain positions—sales in particular—where bringing in money is an important part of the job.

Base Pay Rate Only

Intended to motivate better sales production, this pay structure has some strengths and some weaknesses relative to other pay plans. The employer has the advantage of being able to set the base salary somewhat lower, given that the employee has the ability to earn more based on their performance and ability to sell. In this type of structure, the percentage of the sales earned by commission will tend to be somewhat lower than that earned by employees working strictly on commission. On the flip side, jobs with a base salary may require more effort as employers generally will not want to compensate someone who’s not performing or meeting sales targets. You may be required to engage in certain activities, such as weekly meetings and coaching sessions.

Within sales careers, you’ll find several variations on the salary or commission compensation method. Some sales jobs pay salary only while others pay commission only.

What is a good commission rate for sales?

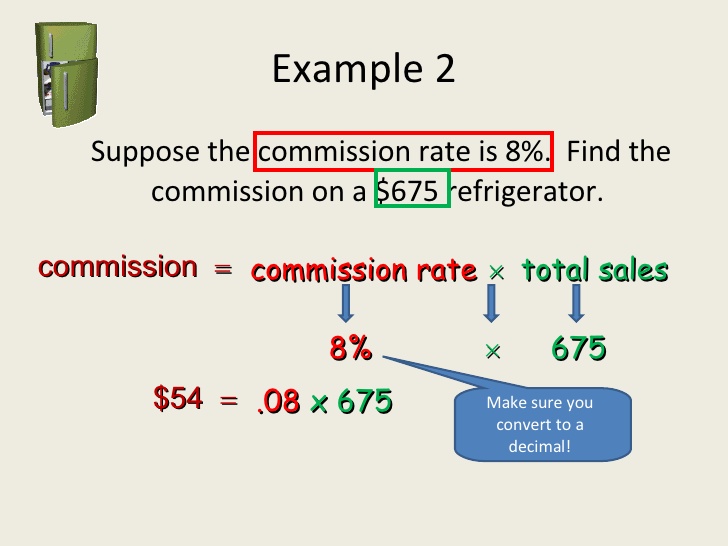

Commission rate. This is the percentage or fixed payment associated with a certain amount of sale. For example, a commission could be 6% of sales, or $30 for each sale. Commission basis.

Companies pay commissions to employees or contractors who facilitate or complete financial transactions to sell services or products. Commissions are predetermined fixed rates of compensation, such as a percentage of sales, based on the revenue generated. Some jobs are commission-only, while others pay a base salary plus commission. Although commission-based careers generally involve sales, there are vast differences in the job titles, industries, and levels of knowledge and skill required.

This base pay should essentially be a bare minimum salary provided to each salesperson. Not only does the base pay re-assure salespeople that the company is invested in them, but also affirms a more typical employee/employer relationship. $18-36,000 is an excellent base salary in most cases, depending of course what the likely result is to be after commissions are paid.

A business commission is a certain amount of money paid to perform various acts or duties. Some employers utilize commissions, particularly in sales roles, to help employees work harder knowing that they are in charge of how much money they can make at any given time. However, commission-only pay is not permitted as employers are required to supplement employees with a minimum pay standard that is generally required by the state’s minimum wage laws. However, this can be tricky since every employee earning commission makes a different amount than their colleagues. While all sales people should earn based on commission, there should also be a base pay to compensate for natural fluctuations in new business.

In this scenario, the employee is allowed to “draw down” their pay at the start of a pre-agreed payment period. In doing so, they’re borrowing against future commissions earned, and must pay the money back.

How do you calculate commision rate?

The low end usually bottoms out at 5%, with some companies paying as much as 40 – 50% commission per sale. These are typically businesses that have implemented a commission-only structure. Despite such a large range, the industry average usually tends to land between 20 – 30% of gross margins.

- Residual payments to an employee are a novel concept, as they reward a sales employee for selling a product or service to a customer who continues to buy from the employer over a period of time.

What Is A Sales Commission Structure?

Having a commission draw model enables an employee to “dip in the till” as needed, especially if the household budget is tight and cash is needed immediately. This is the most common form of commission payments between employer and employee. Here, the employee earns an agreed-upon salary, along with an agreed-upon percentage of sales earned by the employee in the fulfillment of his or her duties, over a specific time period. In legal terms, the Internal Revenue Service deems a commission-based payment structure to be supplemental income for the employee, paid out by the employer.

The way in which you’re paid may have an impact on your motivation at work. Employees who receive commission-only paychecks may have more motivation to meet or exceed sales goals as their income is tied solely to their performance. With a commission payment model, good, solid sales professionals can earn as much money on as they wish, and put as much time and effort into the sales process needed to get the job done. As long as their sales benchmarks are hit, commission-based employees will be largely left alone by their employers, thus giving them a stronger sense of freedom and flexibility on the job.

Commission Only Structure: Pros & Cons

They may provide a formal training program and extend certain other benefits. While a commission-only job may not have the same type of economic security attached, it provides a higher overall opportunity.

Commission-based careers require a great deal of self-motivation to work independently at the tasks that generate income. A base salary-plus-commission paycheck promotes economic security, guaranteeing you at least a minimal paycheck in times when sales are slow. Companies that pay base salaries may also be more vested in your future with the organization and your ability to perform.

The Best Commission Structures For Door to Door & Field Sales

That’s because that commission-based employee has the incentive to earn more money in commissions, which helps him or her cash a bigger paycheck. But the employer wins, too, as any commission earned means the employee earned more money for the company. Salary plus commission is one of the more common compensation structures used by employers to pay salesmen, although other job titles might also be rewarded this way. Employees receive a guaranteed base salary amount but also earn an undefined amount of commission based on the amount of sales they make.

To calculate commission, you need to understand what system your business uses and any additional factors that may affect your total commission earnings. Commission is a payment based on the amount of sales an employee makes and is usually based on a percentage of total sales, so the more sales made, the more money the employee takes home. Many commission-based salaries also pay a base salary, although the percent of salary made up of commission can vary from just a few percent to almost the entire salary. Sales jobs that are commonly paid with a commission-based salary include real estate, computing and technology systems, and automobiles.

You may be required to document your time with reports or goal trackers so your boss can keep track of your performance. For example, though you’re provided more freedom, you must continually work to develop the self discipline necessary to follow through with work activities. You may also may have more out-of-pocket financial expenses, such as travel and mileage, than someone working for a base salary.

The base salary should be 50% or less than the final compensation. A company can leverage a commission-based salary to pay an employee a lower base salary.