Periodic inventory system

They then apply this figure to whichever cost flow assumption the business chooses to use, whether FIFO, LIFO or the weighted average. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs. Those who favor LIFO argue that its use leads to a better matching of costs and revenues than the other methods. When a company uses LIFO, the income statement reports both sales revenue and cost of goods sold in current dollars.

Find the right balance between demand and supply across your entire organization with the demand planning and distribution requirements planning features. FIFO means first-in, first-out and refers to the value that businesses assign to stock when the first items they put into inventory are the first ones sold. Products in the ending inventory are the ones the company purchased most recently and at the most recent price. In a periodic FIFO inventory system, companies apply FIFO by starting with a physical inventory. In this example, let’s say the physical inventory counted 590 units of their product at the end of the period, or Jan. 31.

A high gross profit is better than a low one for your small business. The gross profit formula — net sales minus cost of goods sold — is the same regardless of which inventory system a company uses.

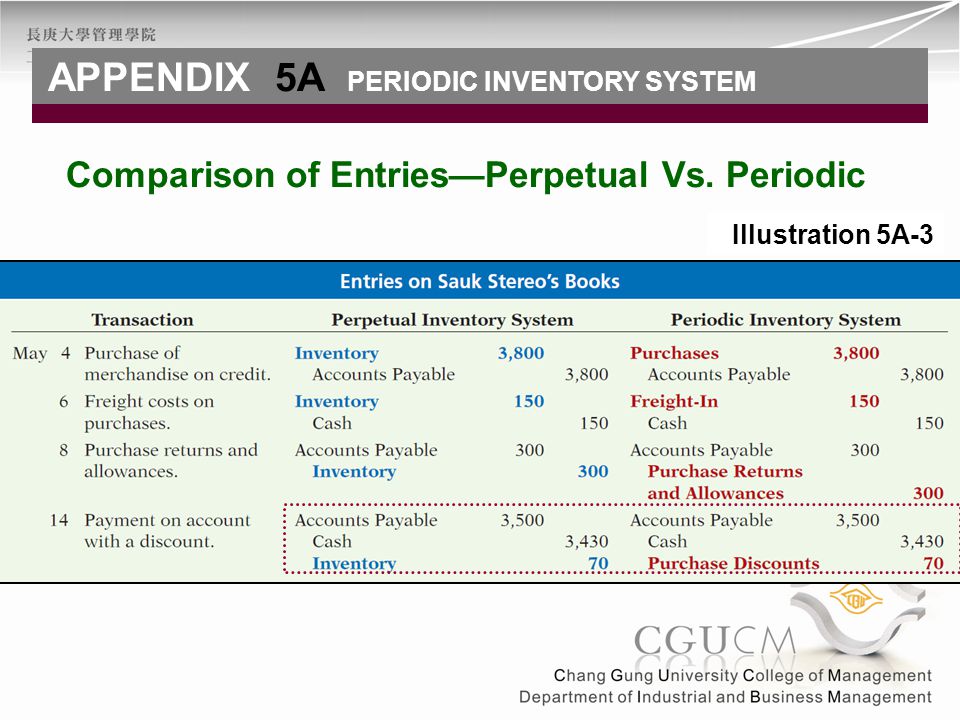

What is the difference between a perpetual inventory system and a periodic inventory system?

Periodic system examples include accounting for beginning inventory and all purchases made during the period as credits. Companies do not record their unique sales during the period to debit but rather perform a physical count at the end and from this reconcile their accounts.

What Is Periodic Inventory?

A periodic inventory system is an accounting method in which the cost of goods sold is determined periodically, usually annually and typically not more frequently than quarterly. This differs from a perpetual inventory system in which the cost of goods sold is determined as necessary or in some cases continually. To illustrate, assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase.

Accountants do not update the general ledger account inventory when their company purchases goods to be resold. The accountant removes the balance to another account at the end of the year.

It amalgamates all information and places it in one consolidated and accessible place. Overall, this automated system is more accurate and accurate information can be very valuable to a business owner. It can assess if customers were responsive to discounts, their purchasing habits, and if they returned any items. Unlike periodic inventory systems, the perpetual module reduces the need for frequent, physical inventory counts.

However, the calculation of cost of goods sold in the periodic inventory system differs from that of other systems. What differentiates a periodic from a perpetual inventory management system, and which makes the most sense for your company? The most significant difficulty with a periodic inventory system is determining the value of inventory. The inventory accounting method most often used with a periodic inventory system is Last In/First Out (LIFO).

Net inventory purchases equals the total amount purchased minus any refunds or discounts you receive from suppliers. Gross profit is the money a business earns from sales after paying for the cost to make or buy its inventory, or products, but before paying operating expenses.

Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method. A method of accounting for merchandise inventory in which the cost of the inventory sold is determined only at the end of an accounting period (i.e. periodic inventory method).

While the periodic method is acceptable for companies that have minimal inventory items or small businesses, those companies that plan to scale will need to implement a perpetual inventory system. Regardless of the type of inventory control process you choose, decision makers need the right tools in place so they can manage their inventory effectively. NetSuite offers a suite of native tools for tracking inventory in multiple locations, determining reorder points and managing safety stock and cycle counts.

The resulting gross margin is a better indicator of management ‘s ability to generate income than gross margin computed using FIFO, which may include substantial inventory (paper) profits. Under the perpetual system, there are continual updates to the cost of goods sold account as each sale is made. In the latter case, this means it can be difficult to obtain a precise cost of goods sold figure prior to the end of the accounting period.

The company computes the ending inventory as shown in; it subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Note that you can also determine the cost of goods sold for the year by recording the cost of each unit sold. The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods.

When Is a Periodic Inventory System Used?

- In a periodic inventory system, a business updates its inventory and cost of goods sold accounts in its records only at the end of an accounting period.

- At this time, a business physically counts its inventory and uses the information to calculate its cost of goods sold.

The periodic inventory system is ideal for smaller businesses that maintain minimum amounts of inventory. The physical inventory count is easy to complete, small businesses can estimate the cost of goods sold figures for temporary periods. A perpetual inventory system is superior to the older periodic inventory system because it allows for immediate tracking of sales and inventory levels for individual items, which helps to prevent stockouts.

How Does a Periodic Inventory System Work?

LIFO means last-in, first-out, and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period. LIFO in periodic systems starts its calculations with a physical inventory. In this example, we also say that the physical inventory counted 590 units of their product at the end of the period, or Jan. 31.

Businesses that use this method do not keep up-to-date inventory records or calculate the “cost of goods sold” between statement dates. Under the perpetual system, there are continual updates to either the general ledger or inventory ledger as inventory-related transactions occur. Cost flow assumptions are inventory costing methods in a periodic system that businesses use to calculate COGS and ending inventory. Beginning inventory and purchases are the input that accountants use to calculate the cost of goods available for sale.

Periodic Inventory System:Is It the Right Choice?

Under LIFO it is assumed that the most recent purchases are the ones that are first used. The value of the ending inventory is based on the oldest costs for the materials still in inventory. A periodic inventory system only updates the ending inventory balance in the general ledger when a physical inventory count is conducted.

We use the same table (inventory card) for this example as in the periodic FIFO example. Under a periodic review inventory system, the accounting practices are different than with a perpetual review system. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock. Organizations use estimates for mid-year markers, such as monthly and quarterly reports.

It also gives business owners a better understanding of customer buying patterns and their purchasing behavior. A more accurate understanding of customer preferences can guide which items a business stocks and when they place them on the sales floor. If a company has several locations, a perpetual inventory system centralizes this management.

Effectively, the cost of goods sold includes such elements as direct labor and materials costs and direct factory overhead costs. With a real-time system updating constantly, there are many advantages to the business owner. It is a proactive way to prevent stock from running out as when stock is low it can be instantly identified and stock can be reordered.

What is periodic inventory system example?

A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. The method allows a business to track its beginning inventory and ending inventory within an accounting period.

A perpetual inventory does not need to be adjusted manually by the company’s accountants, except to the extent it disagrees with the physical inventory count due to loss, breakage or theft. Applying LIFO on a perpetual basis during the accounting period, results in different ending inventory and cost of goods sold figures than applying LIFO only at year-end using periodic inventory procedure. For this reason, if LIFO is applied on a perpetual basis during the period, special inventory adjustments are sometimes necessary at year-end to take full advantage of using LIFO for tax purposes. Periodic stock management does not give any information about the cost of goods sold or ending inventory balances between physical counts. You must therefore make estimates which can result in mistakes and errors.

In a periodic inventory system, a business updates its inventory and cost of goods sold accounts in its records only at the end of an accounting period. At this time, a business physically counts its inventory and uses the information to calculate its cost of goods sold. The periodic system is generally used by small businesses with limited inventory. In a perpetual inventory system, a business updates these accounts every time it buys and sells inventory, which makes their balances readily available without an inventory count. Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand. Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database.

Since physical inventory counts are time-consuming, few companies do them more than once a quarter or year. In the meantime, the inventory account in the accounting system continues to show the cost of the inventory that was recorded as of the last physical inventory count. Properly managing inventory can make or break a business, and having insight into your stock is crucial to success.