NPV: The Gold Standard of Financial Decision Making Tools

Interest on student loans (along with loan origination fees and any capitalized interest) is tax deductible, providing the borrower’s income is below a certain level. The Internal Revenue Service (IRS) states that an individual’s modified adjusted gross income (MAGI) must be less than $85,000 (or $170,000 if filing a joint return) for tax year 2019. Though personal loans are not tax deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year.

For donations to qualify, they must be given to an approved organization. Tax shield strategies are available for both business and individual tax returns. The classic example of a tax shield strategy for an individual is to acquire a home with a mortgage.

Also, the value of a levered firm or organization exceeds the value of an else equal unlevered firm or organization by the value of the interest tax shield. A tax shield on depreciation is the proper management of assets for saving the tax.

Tax-deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income. Personal credit card interest, auto loan interest and other types of personal consumer finance interest are not tax deductible.

Interest tax shields refer to the reduction in the tax liability due to the interest expenses. Interest expenses (via loan and mortgages) are tax deductible, meaning they lower the taxable income. Thus, interest expenses act as a ‘shield’ against the tax obligations. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

Tax Shields for Medical Expenses

Similarly, interest paid on credit card balances is also generally not tax deductible. The reason that he was able to earn additional income is because the cost of debt (i.e. 8% interest rate) is less than the return earned on the investment (i.e. 10%). The 2% difference makes income of $80 and another $100 is made by the return on equity capital. Total income becomes $180 which becomes taxable at 20%, leading to the net income of $144. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield.

Interest Tax Shield Example

However, you may be able to claim interest you’ve paid when you file your taxes if you take out a loan or accrue credit card charges to finance business expenses. While the government expects you to pay income tax, it also allows you to legally save on income tax. You don’t have to pay income tax if you earn less than Rs. 2.5 lakh in a year. Income more than that is taxed as per different slabs, with the tax rates going up with increase in income. No matter how much taxable income you earn, there are certain exemptions and deductions available to all individual and HUF taxpayers that can be used to pay less income tax.

The corporate tax rate has been reduced to a flat 21 percent, starting in 2018, and personal tax rates have also been reduced. Adoption Credit.For 2020, the credit for an adoption of a child with special needs is $14,300, and the maximum credit allowed for other adoptions is the amount of qualified adoption expenses up to $14,300. The available adoption credit begins to phase out for taxpayers with modified adjusted gross income (MAGI) in excess of $214,520; it’s completely phased out at $254,520 or more.

In order to qualify, the taxpayer must use itemized deductions on his tax return. The deductible amount may be as high as 60 percent of the taxpayer’s adjusted gross income, depending on the specific circumstances.

Adding Back a Tax Shield

For 2019 and 2020, an individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5 percent of adjusted gross income by filing Schedule A. Another big change is that the standard deduction on personal tax returns has been doubled, decreasing the value of some tax shields, like mortgage interest and charitable giving. Taxpayers won’t be able to take advantage of these tax shields until they reach a level of deductions over the standard amount. Read more about the Trump Tax Plan and how it affects deductions. The main change is the reduction in income tax rates, beginning with 2018 taxes.

Governments often create tax shield as a way to encourage certain behavior or investment in certain industries or programs. Interest expenses are, as opposed to dividends and capital gains, tax-deductible, therefore the tax shield is an important factor. These are the tax benefits derived from the creative structuring of a financial arrangement. The tax shield on interest is positive when earnings before interest and taxes i.e. The value of the interest tax shield is the present value i.e.

- Tax-deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

Higher the savings from the tax shield, the higher is the cash profit of the company. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. Itemizing deductions allows some taxpayers to reduce their taxable income, and so their taxes, by more than if they used the standard deduction.

Tax Shield

Types of interest that are tax deductible include mortgage interest, mortgage interest for investment properties, student loan interest, and more. The term “tax shield” references a particular deduction’s ability to shield portions of the taxpayer’s income from taxation. Tax shields vary from country to country, and their benefits depend on the taxpayer’s overall tax rate and cash flows for the given tax year. For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields.

If you are considering major surgery, for example, you might want to look at whether you want the tax shield in one year or another, to lower your taxable income. One of the best illustrations of this concept for an Individual is to acquire a home with a mortgage or loan. The interest expenses associated with the mortgage or loan is tax-deductible, which then offset against the taxable income of the person, resulting in a significant reduction in his or her tax liability. The ability to use a housing loan as a tax shield is a major benefit for middle-class people whose houses are major components of their net worth.

Mortgage interest, for example, is only deductible if the loan was taken out to fund the purchase of a primary residence. Income taxes affect a company’s cash flows and should therefore be taken into consideration when calculating the Net Present Value (NPV) of a project.

These deductions reduce a taxpayer’s taxable income for a given year or defer income taxes into future years. Tax shields lower the overall amount of taxes owed by an individual taxpayer or a business. A tax shield is a reduction in taxable income by taking allowable deductions.

With basic mathematical operation, you can determine that by increasing the deductions, you reduce your tax liability. The double declining method is a depreciation method wherein your depreciation expense is higher in the earlier life of an asset. In turn, your deductions from gross income higher at the early life of an asset hence lesser tax liability. However, certain criteria must be met to qualify for the above deductions.

Tax-efficient investment strategies are cornerstones of investing for high net-worth individuals and corporations, whose annual tax bills can be very high. For business owners, as you already know to arrive at the tax liability, you first have to determine the gross income. Then you deduct that with the allowable deductions then multiply it by the tax rate.

It also makes beneficiary to those who are interested in purchasing the house, by providing a specific tax benefit to the borrower. If you use a personal loan or credit card to finance business expenses in addition to personal expenditures, you may be able to claim the interest paid on those expenses on your taxes. You must be the person legally liable for the loan, and you must be able to itemize what portion of the interest paid is attributable to legitimate business expenses. If you borrow to buy a car for personal use or to cover other personal expenses, the interest you pay on that loan does not reduce your tax liability.

The interest expense associated with the mortgage is tax deductible, which is then offset against the taxable income of the person, resulting in a significant reduction in his or her tax liability. If expenditures on medical expenses are greater than the standard deduction, the excess expenses are tax deductible.

A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income. Student Loan Interest Deduction.For 2020, the maximum amount that you can deduct for interest paid on student loans remains $2,500.

For example, depreciation is a non-cash expense, but it serves as a tax deduction that reduces a company’s tax liability by its marginal tax rate. To account for taxes, you can first convert all cash flows to after-tax cash flows and then discount the after-tax cash flows to their present value. Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayer’s obligations.

How do you calculate tax shield?

The value of a tax shield is calculated as the amount of the taxable expense, multiplied by the tax rate. Thus, if the tax rate is 21% and the business has $1,000 of interest expense, the tax shield value of the interest expense is $210.

Tax Shield Definition

For example, because interest on debt is a tax-deductible expense, taking on debt creates a tax shield. Since a tax shield is a way to save cash flows, it increases the value of the business, and it is an important aspect of business valuation.

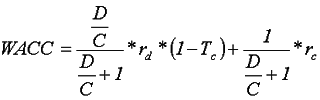

We can say that the interest tax shields are the tax benefits from the financial structure of a company. For instance, taking a loan rather than issuing equity increases tax shield as interest on loan is tax deductible while dividend paid on equity is not. So, in a way, interest tax shields motivate the companies to take on debt to finance projects rather than using equity. The adjusted present value is the net present value (NPV) of a project or company if financed solely by equity plus the present value (PV) of any financing benefits, which are the additional effects of debt. By taking into account financing benefits, APV includes tax shields such as those provided by deductible interest.