Net Profit Margin Definition & Example

Accounting Terms

How do you calculate net profit margin?

Net profit margin is the percentage of revenue remaining after all operating expenses, interest, taxes and preferred stock dividends (but not common stock dividends) have been deducted from a company’s total revenue.

Suppose the Acme Widget Company has $2 million in sales for an accounting period. If the cost of goods sold equals $1,100,000, subtracting this amount leaves a gross profit of $900,000. The gross profit margin is calculated as $900,000 divided by $2 million, with the result multiplied by 100 to express it as a percentage. Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS).

How to calculate gross profit

It’s used to calculate the gross profit margin and is the initial profit figure listed on a company’s income statement. The net profit margin, also known as net margin, indicates how much net income a company makes with total sales achieved. A higher net profit margin means that a company is more efficient at converting sales into actual profit. Net profit margin analysis is not the same as gross profit margin. With net profit margin ratio all costs are included to find the final benefit of the income of a business.

Suppose Acme Widget Company has net costs in this category of $100,000. Subtracting out from the operating profit of $400,000 leaves you with $300,000 in pretax profit. Again, divide by total sales of $2 million to calculate the pretax profit margin of 15%.

How Does Net Profit Margin Work?

Gross profit is your business’s revenue minus the cost of goods sold. Your cost of goods sold (COGS) is how much money you spend directly making your products. But, your business’s other expenses are not included in your COGS. Gross profit is your company’s profit before subtracting expenses. Net profit margin is the percentage of profit generated from revenue after accounting for all expenses, costs, and cash flow items.

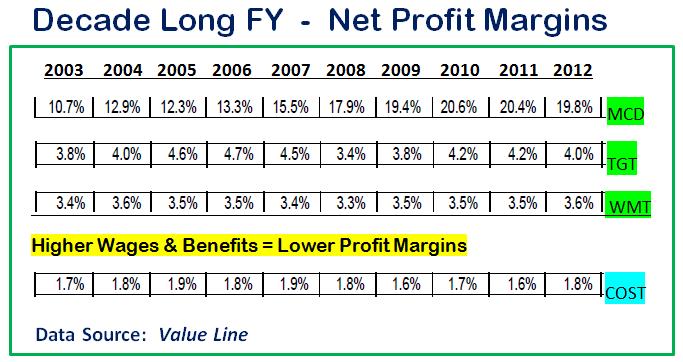

What is the objective of financial reporting?

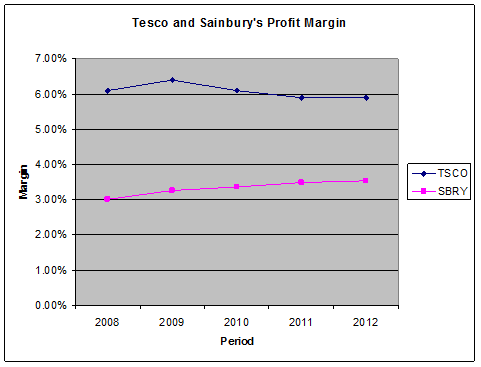

Ideally, investors want to see a track record of expanding margins meaning that net profit margin is rising over time. Net profit margin is the percentage by which a company’s total sales or revenue exceeds or is less than the sum of its expenses. It is wise to compare the margins of companies within the same industry and over multiple periods to get a sense of any trends. It’s computed by subtracting financing expenses from operating profit. Miscellaneous items, such as interest earned on investments, legal judgments and other amounts not related to the firm’s primary operations, are also added or subtracted.

This is after factoring in your cost of goods sold, operating costs and taxes. To calculate your net profit margin, divide your net income by your total sales revenue. The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue. The gross margin result is typically multiplied by 100 to show the figure as a percentage. The COGS is the amount it costs a company to produce the goods or services that it sells.

- In retail, direct costs are usually referred to as the cost of goods sold.

- Gross profit is the first profitability figure that appears on an income statement.

Your income statement shows your revenue, followed by your cost of goods sold, and your gross profit. The next section shows your operating, interest, and tax expenses. The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue. Investors can assess if a company’s management is generating enough profit from its sales and whether operating costs and overhead costs are being contained. For example, a company can have growing revenue, but if its operating costs are increasing at a faster rate than revenue, its net profit margin will shrink.

Profit margin is a percentage measurement of profit that expresses the amount a company earns per dollar of sales. If a company makes more money per sale, it has a higher profit margin. Gross profit margin and net profit margin, on the other hand, are two separate profitability ratios used to assess a company’s financial stability and overall health. Gross profit margin does not help you measure your business’s overall profitability.

Profit margin is a ratio analysis method used by accountants and financial analysts to gauge the profitability of a business by comparing to previous records or other businesses within the same industry. The figures used are taken from an income statement and primarily involve sales as basis of computation. Profit margin shows how much profit is earned from every dollar worth of sales. Dividing net profit or net loss by sales will result in a net profit margin.

Net profit margin is one of the most important indicators of a company’s financial health. By tracking increases and decreases in its net profit margin, a company can assess whether current practices are working and forecast profits based on revenues. Because companies express net profit margin as a percentage rather than a dollar amount, it is possible to compare the profitability of two or more businesses regardless of size.

What is net income?

The gross profit margin reflects how successful a company’s executive management team is in generating revenue, considering the costs involved in producing their products and services. In short, the higher the number, the more efficient management is in generating profit for every dollar of cost involved.

Interest payable, on the other hand, refers to the amount or percentage of money the company owes to different parties specified for settlement at a certain period. Net profit margin is the ratio of net income relative to revenues, calculated by simply dividing profits by sales. This is a quick way to determine what percentage of your sale price that your company keeps after accounting for the costs that went into the sale. Also called the net profit margin, this profitability metric is the most comprehensive evaluative ratio used in corporate finance. Record both gross and net profit on your small business income statement.

What is a good net profit margin?

To calculate your net profit margin, divide your net income by your total sales revenue. The result is your net profit margin. You can multiply this number by 100 to get a percentage.

To know how profitable your company is, you must look at net profit margin. Most of the time, net profit margin is what people talk about to determine profitability. Overhead refers to the ongoing administrative cost when it comes to operating the business. Cost of goods sold refers to the direct expenses or costs needed to produce the product or goods.

Gross profit is the first profitability figure that appears on an income statement. It equals sales less the direct costs required to acquire products for sale. In retail, direct costs are usually referred to as the cost of goods sold.

Similar terms used to describe net profit margins include net margin, net profit, net profit ratio, net profit margin percentage, and more. To calculate net profit margin and provide net profit margin ratio analysis requires skills ranging from those of a small business owner to an experienced CFO. As a result, this depends on the size and complexity of the company. This guide will cover formulas and examples, and even provide an Excel template you can use to calculate the numbers on your own. Your net profit margin shows what percentage of your sales is actual profit.

Generally, a net profit margin in excess of 10% is considered excellent, though it depends on the industry and the structure of the business. You can calculate profit margin using either gross profit (revenue minus cost of goods sold), for gross profit margin, or net profit (revenue minus all expenses), for net profit margin. One of the most essential aspects of launching and operating a business is selling enough goods or services to pay for the company’s costs. If a company can’t earn enough to cover its costs, it loses money, which may eventually force owners to shut the company down.

Gross profit margin is the gross profit divided by total revenue and is the percentage of income retained as profit after accounting for the cost of goods. Gross profit marginis the proportion of money left over from revenues after accounting for the cost of goods sold (COGS). COGS are raw materials and expenses associated directly with the creation of the company’s primary product, not including overhead costs such as rent, utilities, freight, or payroll. Gross profit is the direct profit left over after deducting the cost of goods sold, or “cost of sales”, from sales revenue.