Materials Quantity Variance Question Accounting Need Help

Accounting All-in-One For Dummies

Review this figure carefully before moving on to the next section where these calculations are explained in detail. To compute the direct materials price variance, subtract the actual cost of direct materials ($297,000) from the actual quantity of direct materials at standard price ($310,500).

Analyzing an Unfavorable DM Quantity Variance

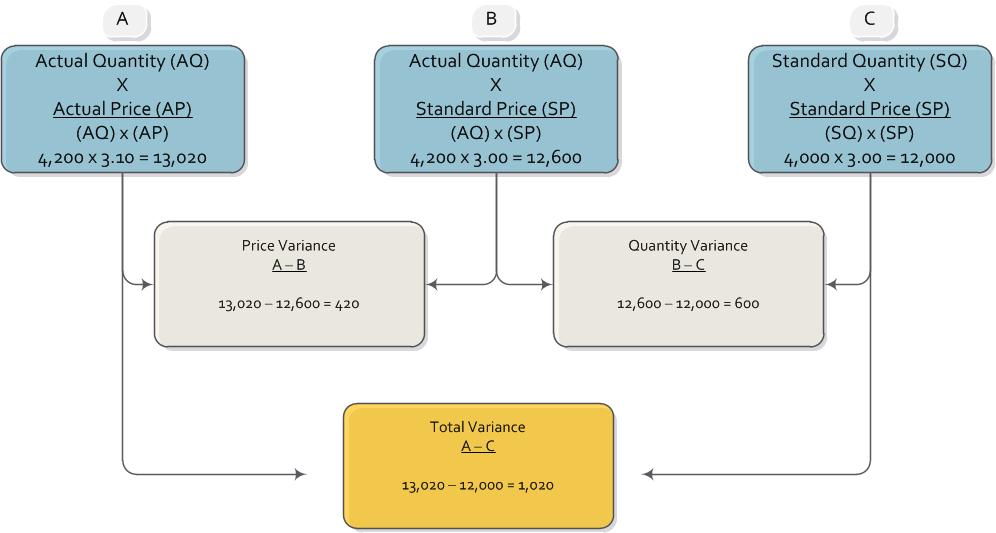

The difference between the actual quantity at standard price and the standard cost is the direct materials quantity variance. The total of both variances equals the total direct materials variance.

An if actual quantity of materials used is less than the standard quantity allowed, the variance is called favorable materials quantity variance. The total direct materials cost variance is also found by combining the direct materials price variance and the direct materials quantity variance. By showing the total materials variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. It is one of the two components (the other is direct material price variance) of direct material total variance.

The flexible budget is compared to actual costs, and the difference is shown in the form of two variances. The materials quantity variance focuses on the quantity of materials used in production. It is defined as the difference between the actual quantity of materials used in production and budgeted materials that should have been used in production based on the standards. Because the company uses 30,000 pounds of paper rather than the 28,000-pound standard, it loses an additional $20,700. The actual cost less the actual quantity at standard price equals the direct materials price variance.

Diagramming direct materials variances

The standard quantity which should have been used in production is transferred to work in process inventory at the standard price (4.00), giving a total debit entry of 4,000. The difference between the two postings is the variance of -800, which is posted to the direct materials variance account as a debit representing the unfavorable variance. Standard costs are used to establish the flexible budget for direct materials.

The normal wastage and inefficiencies are taken into account while setting direct materials price and quantity standards. Variances are calculated and reported at regular intervals to ensure the quick remedial actions against unfavorable situations. When actual quantity of materials used deviates from the standard quantity allowed to manufacture a certain number of units, materials quantity variance occurs. This is a variance of physical quantity but is also reported in dollars for proper financial measurement. To express this variance in dollars, both actual quantity used and standard quantity allowed are multiplied by standard price per unit of materials.

Read direct materials price and quantity standards article to understand how standard price and quantity of direct materials are set. Figure 8.3 shows the connection between the direct materials price variance and direct materials quantity variance to total direct materials cost variance. In this case, the actual price per unit of materials is $9.00, the standard price per unit of materials is $7.00, and the actual quantity used is 0.25 pounds. This is an unfavorable outcome because the actual price for materials was more than the standard price. As a result of this unfavorable outcome information, the company may consider using cheaper materials, changing suppliers, or increasing prices to cover costs.

- The actual quantity (1,200 sheets) of plastic is removed from the raw materials inventory at the standard price (4.00) giving a credit entry of 4,800 posted to the account.

- In the standard costing system, material costs are posted at the standard price.

In this case, the actual quantity of materials used is 0.20 pounds, the standard price per unit of materials is $7.00, and the standard quantity used is 0.25 pounds. This is a favorable outcome because the actual quantity of materials used was less than the standard quantity expected at the actual production output level. As a result of this favorable outcome information, the company may consider continuing operations as they exist, or could change future budget projections to reflect higher profit margins, among other things. Recall from Figure 10.1 “Standard Costs at Jerry’s Ice Cream” that the direct materials standard price for Jerry’s is $1 per pound, and the standard quantity of direct materials is 2 pounds per unit. Figure 10.4 “Direct Materials Variance Analysis for Jerry’s Ice Cream” shows how to calculate the materials price and quantity variances given the actual results and standards information.

To calculate a direct materials efficiency variance, the formula is (actual quantity used × standard price) (standard quantity allowed × standard price). Materials quantity variance is computed by comparing the actual quantity of materials used with the standard quantity of material allowed, both priced at standard cost. If actual quantity used is more than the standard quantity allowed to produce a particular number of units, the variance is calledunfavorable materials quantity variance.

This difference comes to a $13,500 favorable variance, meaning that the company saves $13,500 by buying direct materials for $9.90 rather than the original standard price of $10.35. If the actual quantity used is greater than the standard quantity, the variance is unfavorable. This means that the company has used excessive materials in producing its output. The result, shown as a monetary amount, permits management to adjust production or purchases as needed to conform to the standards the business wishes to meet.

Direct Material Variances

In the standard costing system, material costs are posted at the standard price. The actual quantity (1,200 sheets) of plastic is removed from the raw materials inventory at the standard price (4.00) giving a credit entry of 4,800 posted to the account.

In this case, the actual quantity of materials used is 0.50 pounds, the standard price per unit of materials is $7.00, and the standard quantity used is 0.25 pounds. This is an unfavorable outcome because the actual quantity of materials used was more than the standard quantity expected at the actual production output level. As a result of this unfavorable outcome information, the company may consider retraining workers to reduce waste or change their production process to decrease materials needs per box.

Difference between actual direct materials cost and the flexible budget. It is made up of the direct materials price variance and the direct materials quantity variances. If the actual quantity of materials used is less than the standard quantity used at the actual production output level, the variance will be a favorable variance. A favorable outcome means you used fewer materials than anticipated, to make the actual number of production units.

Direct Materials Quantity Variance

Under a standard costing system, production and inventories are reported at the standard cost—including the standard quantity of direct materials that should have been used to make the products. If the manufacturer actually uses more direct materials than the standard quantity of materials for the products actually manufactured, the company will have an unfavorable direct materials usage variance. If the quantity of direct materials actually used is less than the standard quantity for the products produced, the company will have a favorable usage variance. The amount of a favorable and unfavorable variance is recorded in a general ledger account Direct Materials Usage Variance. (Alternative account titles include Direct Materials Quantity Variance or Direct Materials Efficiency Variance.) Let’s demonstrate this variance with the following information.

The variance is calculated using the direct materials quantity variance formula, which takes the difference between the standard quantity and the actual quantity, and multiplies this by the standard price per unit of material. These thin margins are the reason auto suppliers examine direct materials variances so carefully. Any unexpected increase in steel prices will likely cause significant unfavorable materials price variances, which will lead to lower profits. Auto part suppliers that rely on steel will continue to scrutinize materials price variances and materials quantity variances to control costs, particularly in a period of rising steel prices. Angro Limited – a single product company – uses a perfect standard costing system.

The direct materials quantity variance is one of the main standard costing variances, and results from the difference between the standard quantity and the actual quantity of material used by a business during production. The variance is sometimes referred to as the direct materials usage variance or the direct materials efficiency variance.