Margin vs Profit

AccountingTools

For instance, if a company sells lemonade, then the costs of lemons, water, and sugar are all a part of the cost of goods sold. Operating margin is calculated by dividing operating earnings by sales or revenue, Operating earnings are also known as earnings before interest and taxes or EBIT. This represents revenue less the cost of goods sold and less the general and administrative expenses of running the business.

Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth. A company’s gross manufacturing margin is calculated by subtracting the cost of goods sold from total sales or revenue. The result is then divided by the total sales or revenue to arrive at the gross margin.

The first thing the income statement does is calculate gross margin, or gross profit. You can do that by subtracting the direct cost of the goods or services the company sells.

Gross profit margin is almost always higher than the operating margin because there are fewer costs to subtract from gross income. Gross margin offers a more specific look at how well a company is managing the resources that directly contribute to the production of its salable goods and services. Operating margin is calculated with the same formula as gross margin, simply subtracting the additional costs from revenue before dividing by the revenue figure.

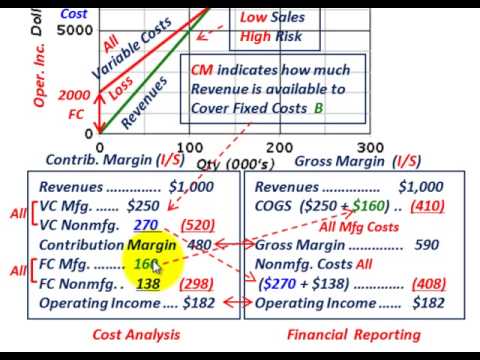

Gross profit margin analyzes the relationship between gross sales revenue and the direct costs of sales. Companies will have varying types of direct costs depending on their business. Companies that are involved in the production and manufacturing of goods will use the cost of goods sold measure while service companies may have a more generalized notation. When calculating your contribution margin, be careful to subtract only variable costs from your revenue or sales. These are items located below the line (i.e. below “gross profit”) on your company’s income statement.

Gross profit results from subtracting a company’s cost of goods from its gross revenue. Below gross profit on the income statement, you’ll find the firm’s operating expenses. These include items such as compensation-related expenses, sales, and marketing costs, and miscellaneous office expenses like utilities and office supplies. Operating profit is obtained by subtracting operating expenses from gross profit. The operating profit margin is then calculated by dividing the operating profit by total revenue.

Gross margin, also called gross profit margin, represents the percentage of total revenue a company has left over above costs directly related to production and distribution. The percentage figure is calculated by subtracting those costs from the total revenue figure and then dividing that sum by the total revenue figure. For gross margin, the higher the percentage, the more is retained on each dollar of sales by the company. On the other hand, if a company’s gross margin is falling, it may look to find ways to cut labor costs, lower costs on acquiring materials or even increase prices.

Operating expenses include items such as wages, marketing costs, facility costs, vehicle costs, depreciation, and amortization of equipment. Analyzing a company’s historical operating margins can be a good way to tell if recent earnings growth in the business is likely to last.

Gross Profit Margin

Operating profit shows a company’s ability to manage its indirect costs. Therefore, this section of the income statement shows how a company is investing in areas it expects will help to improve its brand and business growth through several channels. A company may have a high gross profit margin but a relatively low operating profit margin if its indirect expenses for things like marketing, or capital investment allocations are high.

The Difference Between Gross Profit Margin and Net Profit Margin

Gross margin and operating margin are two fundamental profit metrics used by investors, creditors, and analysts to evaluate a company’s current financial condition and prospects for future profitability. The two margins differ in regard to the specific costs and expenses included in their calculations and the different purposes they serve in providing a company with information for analysis. Operating margin captures how much a company makes or loses from its primary business per dollar of sales. You’ll recall from our earlier discussion of the income statement that gross profit is simply the difference between a company’s sales of goods or services and how much it must pay to provide those goods or services.

Gross margin is simply the amount of each dollar of sales that a company keeps in the form of gross profit, and it is usually stated in percentage terms. The higher the gross margin, the more of a premium a company charges for its goods or services. Keep in mind that companies in different industries may have vastly different gross margins.

Operating margin indicates what proportion of a company’s revenue (income) remains after variable production costs are paid, such as workers’ wages and raw materials. If your company makes a product that costs $10 to produce and it sells for $15, the operating margin is $5. The difference between operating margin and gross manufacturing margin is that the operating margin presents a picture of how much your business makes on every dollar of sale before tax and interest.

- Also known as gross profit, gross income doesn’t include expenses such as salaries, income taxes and office supplies.

- Gross profit is used to figure out a company’s gross margin, which measures how efficiently your company is producing and distributing its products.

In other words, the profit the business earns from its core business operations. Market and business factors may affect each of the three margins differently. Systematically if direct sales expenses increase across the market, then a company will have a lower gross profit margin that reflects higher costs of sales. The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue.

The higher the gross margin, the better as this is an indicator that your company is making more profit on each dollar of sales. For example, if your company had total sales of $1 million during a given year and the costs incurred to produce the goods sold was $300,000, the gross manufacturing margin or gross profit margin would be 70 percent.

What Is Operating Margin?

Gross profit margin shows the percentage of revenue after subtracting the cost of goods sold involved in production. The cost of goods sold is the amount it costs a company to produce the goods or services that it sells. Gross margin shows how well a company generates revenue from the direct costs like direct labor and direct materials involved in producing their products and services.

So, let us say if management wants to see how much of the cost of goods sold is eating up the total revenue from sales then the gross margin can very well serve the purpose. Also, if the management wants to have a look at the overall operations of the business then operating margin is the right choice. And if the management wants to analyze the overall health of the business performed during the period then the net profit margin may prove to be the best key performance indicator.

Also known as gross profit, gross income doesn’t include expenses such as salaries, income taxes and office supplies. Gross profit is used to figure out a company’s gross margin, which measures how efficiently your company is producing and distributing its products. It’s a good way to get a big-picture account of how well your company is using its resources, and how it measures up to other, similar companies in your industry. A high gross margin means you’re competing effectively in your industry, while a low gross margin could be a sign that you need to revisit your business model because your costs of production are outpacing sales. Operating income, on the other hand, represents your company’s actual profit, after you subtract all of your operating expenses and depreciation (the decrease in value of your company’s assets over time).

Like any measure of profitability, operating margin is just one factor to look at when evaluating the profitability of a company, and when comparing two or more companies in the same industry. Gross profit margin, net income and others in combination with operating margin will help shed light on the company’s full value as a business and a potential investment.

Operating profitis located further down the income statement and is derived from its predecessor, gross profit. Operating profit or operating income takes gross profit and subtracts all overhead, administrative, and operational expenses. Operating expenses include rent, utilities, payroll, employee benefits, and insurance premiums. Operating profit includes all operating costs except interest on debt and the company’s taxes.

Both ratios are useful management tools, but reveal different information. Gross profit is your income or sales less cost of goods sold (COGS), which are all fixed costs (above the line on your income statement). Contribution margin analyzes sales less variable costs, such as commissions, supplies and other back office expenses (costs listed below the line on the income statement).

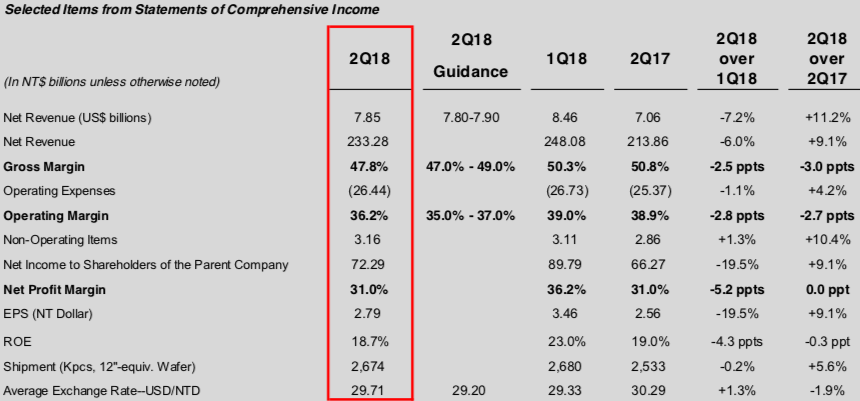

As an example of how these margins are calculated, a business has $100,000 of sales, a cost of goods sold of $40,000, and operating expenses of $50,000. Based on this information, its gross margin is 60% and its operating margin is 10%. When calculating an accurate contribution margin, defining your variable costs vs. your fixed costs is essential.

Gross profit margin is calculated by takingtotal revenueand subtracting thecost of goods sold. You can multiply the result by 100 since gross margin is typically shown as a percentage. Gross profit margin and operating profit margin are two metrics used to measure a company’s profitability. The difference between them is that gross profit margin only figures in the direct costsinvolved in production, while operating profit margin includes operating expenses likeoverhead. Both metrics are important in assessing the financial health of a company.

Gross manufacturing margin, also called gross profit margin or the gross margin, represents the total amount of income your company keeps after paying the direct costs related to the manufacturing of products sold. It is critical for a company to have a generous operating margin to pay its fixed costs, such as the interest payments on debt.

The formula is $1,000,000 – $300,000 divided by $1,000,000 to arrive at 0.70 or 70 percent. The higher a company’s gross manufacturing margin, the more cash flow it has for expansion.

JC Penney earned only $3 million in operating income after earning $2.67 billion in revenue. Although gross profit margin appeared healthy at 38%, after taking out expenses and SG&A, operating profit margin tells a different story. The disparity between the numbers shows the importance of using multiple financial metrics in analyzing the profitability of a company. Operating profit margin is calculated by taking operating income and dividing it by total revenue. Like gross profit margin, operating profit margin can be expressed as a percentage by multiplying the result by 100 as shown below.