Margin Definition

Selling Price and Volume

For example, your heating and cooling bills are variable costs while your rent is a fixed cost. Calculating the contribution margin allows you to see how much revenue each product earns. Variable expenses and costs may remain stagnant if the company produces the same amount of units. “Product A’s” revenue decreases to $80,000 due to a temporary decline in market share.

This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. In general, the contribution margin tends to yield a higher percentage than the gross margin, since the contribution margin includes fewer costs. In fact, total company profits are the same, no matter which method is used, as long as the number of units sold has not changed. The contribution margin reflects a company’s profitability on each unit sold.

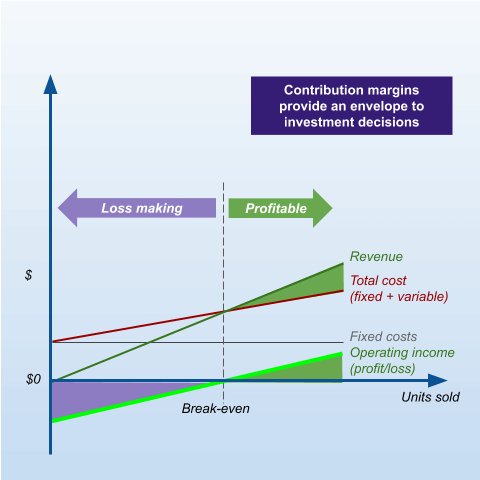

Knight points to a client of his that manufactures automation equipment to make airbag machines. For this client, factory costs, utility costs, equipment in production, and labor are all included in COGS, and all are fixed costs, not variable. Contribution margin is used by companies to simplify decisions regarding its operations. One application is using the contribution margin as a quick measure for break even analysis.

The Importance of a Contribution Margin

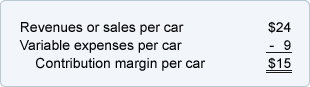

To calculate the contribution margin, variable expenses are subtracted from revenue for each unit, or for product sales in total. Variable expenses are those costs that increase or decrease with production or output. Contribution margin is a product’s price minus all associated variable costs, resulting in the incremental profit earned for each unit sold. The total contribution margin generated by an entity represents the total earnings available to pay for fixed expenses and to generate a profit. The contribution margin concept is useful for deciding whether to allow a lower price in special pricing situations.

As a reminder, fixed costs are business costs that remain the same, no matter how many of your product or services you produce — for example, rent and administrative salaries. Variable costs are those expenses that vary with the quantity of product you produce, such as direct materials or sales commissions. Some people assume variable costs are the same as COGS, but they’re not. (When you subtract COGS from revenue you get gross profit, which, of course, isn’t the same as contribution margin.) In fact, COGS includes both variable and fixed costs.

This decreases total net sales to $280,000 and “Product A’s” contribution margin to $220,000. The contribution margin ratio or percentage also decreases to approximately 79 percent. If variable costs also decrease – say to $50,000 – the contribution margin increases by $10,000.

Using the contribution margin in comparison

The gross profit margin measures the relationship between a company’s revenues and the cost of goods sold (COGS). Operating profit margin takes into account COGS and operating expenses and compares them with revenue, and net profit margin takes all these expenses, taxes and interest into account. To calculate the contribution margin for each of the products your business sells, you subtract the variable costs related to the specific product from the revenue it generates. Revenue is your gross income and variable costs are directly related to the product and are subject to change.

Contribution margin – What is a contribution margin?

Both ratios are useful management tools, but reveal different information. Gross profit is your income or sales less cost of goods sold (COGS), which are all fixed costs (above the line on your income statement). Contribution margin analyzes sales less variable costs, such as commissions, supplies and other back office expenses (costs listed below the line on the income statement).

- For example, a production line with positive contribution margin should be kept even if it causes negative total profit, when the contribution margin offsets part of the fixed cost.

- Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth.

How do you calculate the contribution margin?

Contribution margin is a product’s price minus all associated variable costs, resulting in the incremental profit earned for each unit sold. The total contribution margin generated by an entity represents the total earnings available to pay for fixed expenses and to generate a profit.

Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth. Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business. For example, a production line with positive contribution margin should be kept even if it causes negative total profit, when the contribution margin offsets part of the fixed cost. However, it should be dropped if contribution margin is negative because the company would suffer from every unit it produces.

When calculating an accurate contribution margin, defining your variable costs vs. your fixed costs is essential. However, it should be calculated as direct variable expenses to see gross profit and indirect variable expense to see contribution margin. You need both because if any expenses are in the wrong category on your income statement, then you will not be able to calculate an accurate contribution margin or ratio. To get its contribution margin, you would subtract $50,000 from the company’s total net sales of $300,000.

This is not as straightforward as it sounds, because it’s not always clear which costs fall into each category. Analyzing the contribution margin helps managers make several types of decisions, from whether to add or subtract a product line to how to price a product or service to how to structure sales commissions. Before making any major business decision, you should look at other profit measures as well. It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low.

Further, the concept can be used to decide which of several products to sell if they use a common bottleneck resource, so that the product with the highest contribution margin is given preference. When calculating your contribution margin, be careful to subtract only variable costs from your revenue or sales. These are items located below the line (i.e. below “gross profit”) on your company’s income statement.

The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

The break even point for a company is when its revenues equal its expenses, leaving the company with neither a net profit nor net loss. For example, suppose that a company does a quick calculation for the contribution margin and finds that it is $3 per product sold. If the company has $30,000 in fixed costs for the period, then the break-even would be to sell 10,000 units for that same period.

If the contribution margin at a particular price point is excessively low or negative, it would be unwise to continue selling a product at that price. It is also useful for determining the profits that will arise from various sales levels (see the example).

The term revenues is synonymous with sales, and expenses include fixed costs and variable costs. Fixed costs are expenses that typically do not change and are not heavily influenced by the quantity of products sold.

Contribution margin means a measurement of the profitability of a product. CM can be calculated for a product line using total revenues and total variable costs. It can also be calculated at the unit level by using unit sales price and unit variable cost. The metric is commonly used in cost-volume-profit analysis and break-even analysis.

To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs. To calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable.

Contribution margin may also be used to compare individual product lines and also be estimated to set sales goals. The contribution margin for this example would be the difference of $1,000,000 and $400,000, which is $600,000. A ‘per product’ margin can be found by dividing $600,000 by the number of units sold. To better understand contribution margin, consider that the net income of a company is its revenues minus expenses.

Any remaining revenue left after covering fixed costs is the profit generated. C. The company should encourage the sales force to sell the products that bring the highest amount of profit for every sales dollar sold, which is the highest contribution margin ratio. High variable costs and high prices do not neccessary bring high profit. Products associated with low fixed cost take less sales in units to cover the fixed cost. Accounting Margin – In business accounting, margin refers to the difference between revenue and expenses, where businesses typically track their gross profit margins, operating margins, and net profit margins.