Manufacturing cost

The $226,000 figure also does not recognize that some costs incurred during the period are in the ending Raw Materials and Work in Process inventory accounts, as explained in part above. The insurance company’s liability is probably just $156,000, which is the amount of cost associated with the ending Finished Goods inventory as shown in part above. No distinction has been made between period expenses and product costs on the income statement filed by the company’s accountant.

A cost that is classified as a period cost will be recognized on the income statement as an expense in the current period. If some units are unsold at the end of the period, the costs of those unsold units are treated as assets. Therefore, by reclassifying period costs as product costs, the company is able to carry some costs forward in inventories that would have been treated as current expenses. 2-3A product cost is any cost involved in purchasing or manufacturing goods. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead.

What are examples of product costs?

Product cost refers to the costs incurred to create a product. These costs include direct labor, direct materials, consumable production supplies, and factory overhead. Product cost can also be considered the cost of the labor required to deliver a service to a customer.

No, the insurance company probably does not owe Solar Technology $226,000. The key question is how “cost” was defined in the insurance contract. The $226,000 figure is overstated since it includes elements of selling and administrative expenses as well as all of the product costs.

Product Costs Template

Since there were ending inventories, some of the product costs should appear on the balance sheet as assets rather than on the income statement as expenses. Direct labor costs are the same as those used in prime cost calculations.

Product Costs

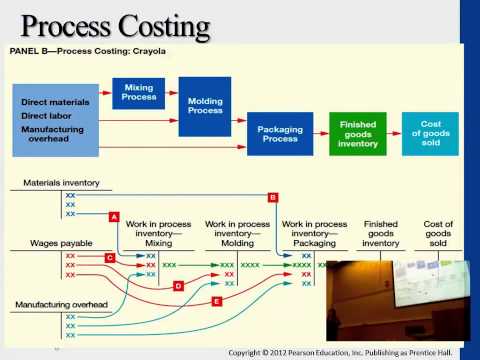

2-7Since product costs accompany units of product into inventory, they are sometimes called inventoriable costs. The flow is from direct materials, direct labor, and manufacturing overhead to Work in Process.

Product costs are then broken down into the elements of cost which are labor, materials and overhead. Understanding accounting cost classifications can help you make sure that you are accounting for production at your company in the correct manner.

Examples of other overhead costs are property taxes, rent and utilities. Add together each manufacturing overhead cost you incurred during the month to determine total manufacturing overhead costs. Production costs refer to the costs incurred by a business from manufacturing a product or providing a service. Production costs can include a variety of expenses, such as labor, raw materials, consumable manufacturing supplies, and general overhead.

Product costs in managerial accounting are those that are necessary to manufacture a product. Product costs equal the sum of your direct materials costs, direct labor costs and manufacturing overhead costs. Using the actual costing method, you can determine your small business’s overall product costs and product costs per unit based on the actual costs you incurred during a period. Knowing your product costs can help you price your products and budget your small business’s money.

Direct Materials Costs

As goods are completed, their cost is removed from Work in Process and transferred to Finished Goods. As goods are sold, their cost is removed from Finished Goods and transferred to Cost of Goods Sold.

A period cost is a cost that is taken directly to the income statement as an expense in the period in which it is incurred. Product cost refers to the costs incurred to create a product. These costs include direct labor,direct materials, consumable production supplies, and factory overhead. Product cost can also be considered the cost of the labor required to deliver a service to a customer.

Understanding the Costs in Product Costs

- 2-7Since product costs accompany units of product into inventory, they are sometimes called inventoriable costs.

- The flow is from direct materials, direct labor, and manufacturing overhead to Work in Process.

- As goods are completed, their cost is removed from Work in Process and transferred to Finished Goods.

This $1,000,000 cost includes $500,000 of administrative, insurance, and marketing expenses, which are generally fixed. If Company XYZ decides to produce 2,000,000 widgets next year, its total production costs may only rise to $1,500,000 ($0.75 per widget) because it can spread its fixed costs over more units.

For example, wages for materials handlers and line workers are usually considered to be direct labor costs. However, factory maintenance workers, plant supervisors and quality control engineers would be considered indirect labor. Management accounting techniques break costs into two major cost classifications, product costs, which relate to manufacturing, and period costs, which are all non-manufacturing costs.

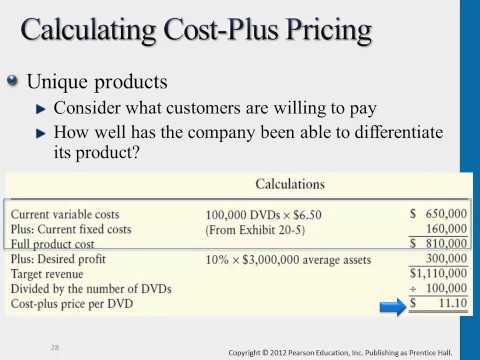

Add together your total direct materials costs, your total direct labor costs and your total manufacturing overhead costs that you incurred during the period to determine your total product costs. Divide your result by the number of products you manufactured during the period to determine your product cost per unit. Using the numbers from the previous examples, add together $15,000, $3,200 and $5,000 to get $23,200 in total product costs. The reported net operating income for the year will differ depending on how the salary cost is classified.

This includes all indirect labor and materials costs, as well as any other untraceable costs. Common overhead costs include depreciation on factory equipment, manufacturing rents, supplies costs, insurance costs and licensing fees. Indirect labor costs are any other wages and salaries related to production, but are not traceable back to units of product.

Both International and U.S. accounting standards require that certain abnormal costs, such as those associated with idle capacity, must be treated as expenses rather than part of inventory. Factory overhead also called manufacturing expenses or factory burden may be defined as the cost of indirect materials, indirect labour and indirect expenses. They are production supplies and other materials that cannot conveniently or economically be charged to a specific unit of output. Examples of such items are lubricants, cotton waste, hand tools, works stationery. This idea is also referred to as diminishing marginal cost.For example, let’s assume it costs Company XYZ $1,000,000 to produce 1,000,000 widgets per year ($1 per widget).

Because prime cost only considers direct costs, it does not capture the total cost of production. As a result, the prime cost calculation can be misleading if indirect costs are relatively large. These other expenses are considered manufacturing overhead expenses and are included in the calculation of the conversion cost.

Although Company XYZ’s total costs increase from $1,000,000 to $1,500,000, each widget becomes less expensive to produce and therefore more profitable. Operating costs are expenses associated with the maintenance and administration of a business on a day-to-day basis.

By analyzing its prime costs, a company can set prices that yield desired profits. By lowering its prime costs, a company can increase its profit or undercut its competitors’ prices. Overhead costs are related to production, but are not classified as direct labor or direct materials.

If the salary cost is classified as a selling expense all of it will appear on the income statement as a period cost. However, if the salary cost is classified as a manufacturing (product) cost, then it will be added to Work In Process Inventory along with other manufacturing costs for the period. To the extent that goods are still in process at the end of the period, part of the salary cost will remain with these goods in the Work in Process Inventory account. Only that portion of the salary cost that has been assigned to finished units will leave the Work In Process Inventory account and be transferred into the Finished Goods Inventory account. In like manner, to the extent that goods are unsold at the end of the period, part of the salary cost will remain with these goods in the Finished Goods Inventory account.

AccountingTools

The remainder of the salary costs will be on the balance sheet as part of inventories. Manufacturing overhead costs are those necessary to making a product, but that you cannot trace directly to a specific product. Examples include indirect materials, such as masking tape, and indirect labor costs, such as the costs to employ a maintenance worker.

In the latter case, product cost should include all costs related to a service, such as compensation, payroll taxes, and employee benefits. Additional costs may include freight paid to acquire the goods, customs duties, sales or use taxes not recoverable paid on materials used, and fees paid for acquisition. For financial reporting purposes such period costs as purchasing department, warehouse, and other operating expenses are usually not treated as part of inventory or cost of goods sold. For U.S. income tax purposes, some of these period costs must be capitalized as part of inventory. Costs of selling, packing, and shipping goods to customers are treated as operating expenses related to the sale.

Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. 2-5The schedule of cost of goods manufactured lists the manufacturing costs that have been incurred during the period. These costs are organized under the three major categories of direct materials, direct labor, and manufacturing overhead. The total costs incurred are adjusted for any change in the Work in Process inventory to determine the cost of goods manufactured (i.e. finished) during the period.

A prime cost is the total direct costs, which may be fixed or variable, of manufacturing an item for sale. Businesses use prime costs as a way of measuring the total cost of the production inputs needed to create a given output.

The conversion cost takes labor and overhead expenses into account, but not the cost of materials. Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. Such materials are called indirect materials and are accounted for as manufacturing overhead. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs.

Prime costs are a firm’s expenses directly related to the materials and labor used in production. It refers to a manufactured product’s costs, which are calculated to ensure the best profit margin for a company. The prime cost calculates the direct costs of raw materials and labor that are involved in the production of a good. Direct costs do not include indirect expenses, such as advertising and administrative costs.