LLC Allocations vs Distributions

The withdrawal account is also closed to the capital account in the closing process. A current account records the flow of goods and services in and out of a country, including tangible goods, service fees, tourism receipts, and money sent directly to other countries either as aid or sent to families.

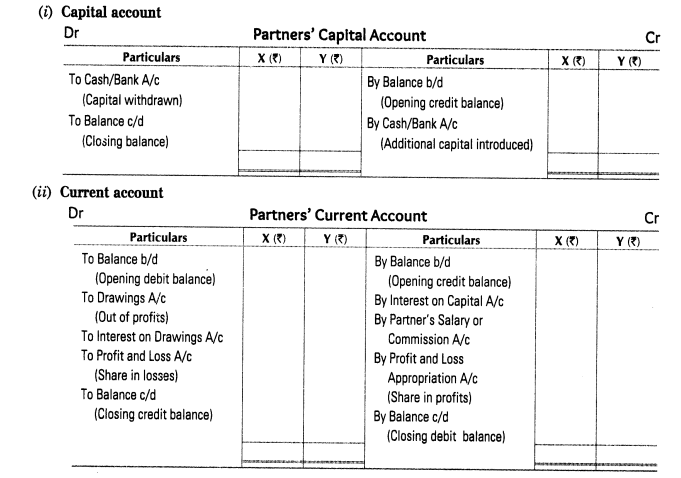

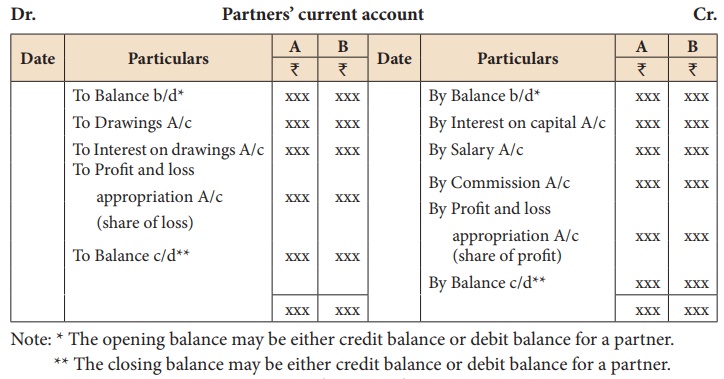

Debtors amounted to Rs 60,000, Trade Creditors to Rs 48,000 whilst expense creditors were Rs 4,000 and payments in advance were Rs 820. Depreciation was to be written off the Freehold Property at 21/2%, off Furniture at 10% and off Scooter at 25%. Prepare Trading and Profit and Loss Account for the year ended 31st March, 2012 together with a balance sheet as on 31st March, 2012 Also show X’s Loan Account and capital accounts of partners as well as their current accounts. A capital account can keep track of each member’s investment in the company.

In economics, the capital account is the part of the balance of payments that records net changes in a country’s financial assets and liabilities. In economic terms, the current account deals with the receipt and payment in cash as well as non-capital items, while the capital account reflects sources and utilization of capital. The sum of the current account and capital account reflected in the balance of payments will always be zero. Any surplus or deficit in the current account is matched and canceled out by an equal surplus or deficit in the capital account.

The Relationship and Differences Between a Partner’s Outside Basis and Capital Account

Some partnership agreements refer to salaries or salary allowances for partners and interest on investments. These are not expenses of the business, they are part of the formula for splitting net income. Many partners use the components of the formula for splitting net income or loss to determine how much they will withdraw in cash from the business during the year, in anticipation of their share of net income.

The equity section of a partnership’s balance sheet has a separate set of entries for every partner. In a typical setup, each partner has a “capital account” and a “current account.” The capital account is money the partner has put into the business. For example, if a partner contributed $50,000 at startup and another $20,000 along the way, then his capital account would be $70,000. The current account is the partner’s accumulated share of the company’s profits.

When they do so, it’s a drawing, and it comes out of the current account. The partnership agreement should include how the net income or loss will be allocated to the partners. If the agreement is silent, the net income or loss is allocated equally to all partners. As partners are the owners of the business, they do not receive a salary but each has the right to withdraw assets up to the level of his/her capital account balance.

The distribution is passed on each owner’s percentage of ownership in their capital account. A country’s balance of payments is a summarized record of that country’s international transactions with the rest of the world.

This is usually in parallel with a current account deficit—an inflow of money means the return on an investment is a debit on the current account. Thus, the economy is using world savings to meet its local investment and consumption demands. The partner by partner basis is generally easier to use over the long-term because it allows the partnership to more easily account for special allocations, partnership liquidation, and partner ownership changes.

A financial account measures the increases or decreases in international ownership assets that a country is associated with, while the capital account measures the capital expenditures and overall income of a country. Sole proprietorships, partnerships, and LLCs don’t pay business taxes; the taxes are passed through to the owners. The owners pay tax on the profits of the business that are distributed to them (called a distributive share).

The person makes a capital contribution to the business when they join, investing in the business. Partner share of profits and losses is determined by the partnership agreement or LLC operating agreement, based on their capital share. Except for the number of partners’ equity accounts, accounting for a partnership is the same as accounting for a sole proprietor.

Partnership capital account

Each partner has a separate capital account for investments and his/her share of net income or loss, and a separate withdrawal account. A withdrawal account is used to track the amount taken from the business for personal use. The net income or loss is added to the capital accounts in the closing process.

When the company closes its books for a year, it determines how much profit it made that year. It then distributes that profit to the partners’ current accounts based on their share of ownership. So if three partners had 45 percent, 35 percent and 20 percent ownership, and the company turned a $50,000 profit, then the partners’ current accounts would be credited $22,500, $17,500 and $10,000, respectively. Each partner’s current account is reduced by any “drawings” the partner has made from the company. Owners are entitled to take some of the company’s profits for personal use.

- For example, if a partner contributed $50,000 at startup and another $20,000 along the way, then his capital account would be $70,000.

- In a typical setup, each partner has a “capital account” and a “current account.” The capital account is money the partner has put into the business.

- The equity section of a partnership’s balance sheet has a separate set of entries for every partner.

Together, these three accounts tell a story about the state of an economy, its economic outlook, and its strategies for achieving its desired goals. The current and capital accounts represent two halves of a nation’s balance of payments. The current account represents a country’s net income over a period of time, while the capital account records the net change of assets and liabilities during a particular year. Partners in a partnership and members of a limited liability company (LLC) have capital accounts.

So, if member A contributes $25,000 worth of raw material inventory and member B contributes $25,000 in cash, both accounts need to be increased by $25,000. If the business distributes cash to its members, the capital account needs to be decreased by the amount of the distribution. If members A and B receive a $15,000 distribution, their capital accounts decrease by $15,000 each.

Assume members A and B agree to share equally in the business’s income and losses, and the LLC suffers a $50,000 loss in the first year but generates $100,000 in income the second year. Both A and B’s capital accounts would increase over that two year period by $25,000, or minus $25,000 for year one and plus $50,000 for year two. A Limited Liability Company capital account is a way to keep track of an individual member’s investment in the business.

A partnership can maintain a single partnership capital account for all partners, with a supporting schedule that breaks down the capital account for each partner. Add the value of any additional contributions the members made to the LLC after the initial investment. Using the same guidelines that established the initial balance, the capital accounts must be increased by the value of the property or cash the members contribute.

How is partner’s capital account calculated?

The partnership capital account is an equity account in the accounting records of a partnership. It contains the following types of transactions: Initial and subsequent contributions by partners to the partnership, in the form of either cash or the market value of other types of assets. Distributions to the partners.

Individual members in the LLC have capital accounts, and each person should have a full understanding of the account basics. A person’s ownership is formed on the basis of the amount he or she contributes at the beginning.

How do I zero out partner capital accounts in a final year?

If the partnership uses the accrual basis of accounting, the partners pay federal income taxes on their share of net income, regardless of how much cash they actually withdraw from the partnership during the year. The balance of payments (BOP) is the record of any payment or receipt between one nation and its nationals with any other country. The current account, the capital account, and the financial account make up a country’s BOP.

Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms. A member’s capital account balance is affected by additional contributions of money or property by the member and by distributions to the member that are made during the LLC’s existence.

These transactions are categorized into the current account, the capital account, and the financial account. When an economy, however, has positive capital and financial accounts (a net financial inflow), the country’s debits are more than its credits due to an increase in liabilities to other economies or a reduction of claims in other countries.

If the business was sold, or the member wanted to sell her share of the business back to the LLC, the capital account is a measure of what she receives in return. The account represents a combination of the member’s initial investment, additional contributions she made to the business, her share of the LLC’s profits and losses, and any cash or property distributions she received from the business. Tax accounting is more concerned with the taxation of owner’s basis in the capital account.

The capital account is a way to measure what individuals receive if the company is sold. The easiest way for a business to stay organized is to maintain capital accounts for individual members. Sometimes, you can renegotiate the operating agreement terms to make changes to how much ownership a member has in the LLC as well as the amount of allocations that members are due. A lot of business owners like LLCs because these types of businesses offer limited liability for the owners.

Adjustments to book value of partnership property do not affect a partner’s outside basis. Section 704(d) of the Code prohibits partners from claiming deductions in excess of the basis of his partnership interest. A capital account deficit typically represents the amount of cash that the partner would be obligated to contribute to the partnership upon liquidation. Adjust the account for the member’s share of the annual gains or losses of the business. The LLC’s operating agreement will normally dictate how the profits or losses will be divided amongst the members each year.