Liquidity Ratio: Definition, Calculation & Analysis

Liquidity ratios show a company’s current assets in relation to current liabilities. The information used to calculate liquidity ratios comes from a company’s balance sheet. It uses a similar formula but does not include inventory in its calculation. The cash ratio determines the ability of a company to immediately pay for their current liabilities with liquid assets.

Higher-leverage ratios show a company is in a better position to meet its debt obligations than a lower ratio. This ratio reveals whether the firm can cover its short-term debts; it is an indication of a firm’s market liquidity and ability to meet creditor’s demands. For a healthy business, a current ratio will generally fall between 1.5 and 3. If the current ratio is too high, the company may be inefficiently using its current assets or its short-term financing facilities.

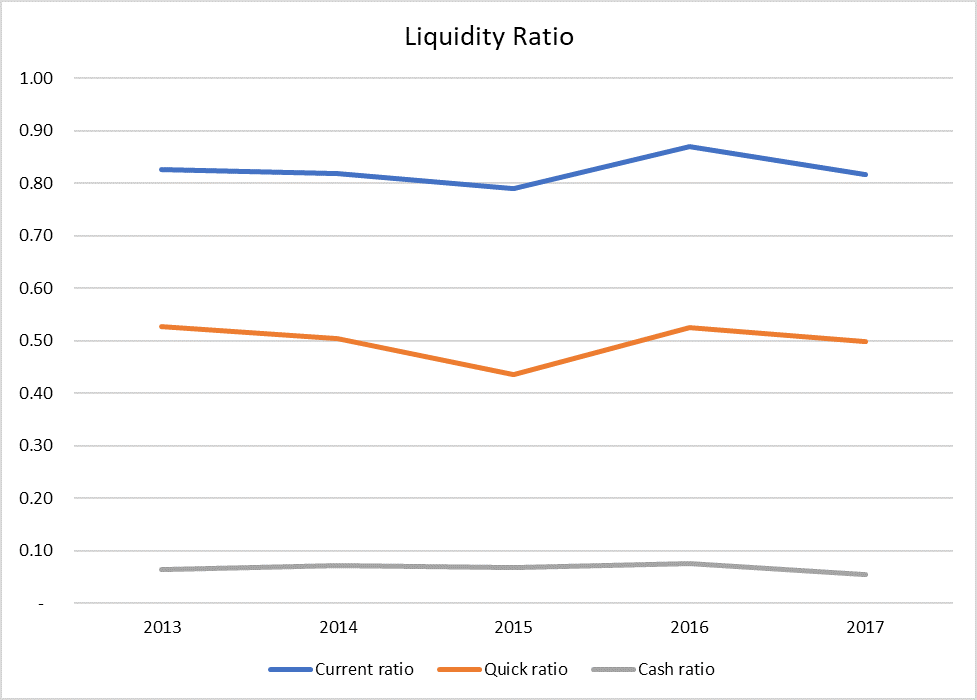

Liquidity ratios are an important class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital. Liquidity ratios measure a company’s ability to pay debt obligations and its margin of safety through the calculation of metrics including the current ratio, quick ratio, and operating cash flow ratio. Short-term liquidity is the ability of the company to meet its short-term financial commitments. Short-term liquidity ratios measure the relationship between current liabilities and current assets. Short-term financial commitments are current liabilities, which are typically trade creditors, bank overdrafts PAYE, VAT and any other amounts that must be paid within the next twelve months.

In the current ratio, current assets are used to assess a company’s ability to cover its current liabilities with all of its current assets. A high liquidity ratio indicates that a business is holding too much cash that could be utilized in other areas. A low liquidity ratio means a firm may struggle to pay short-term obligations.

Thecurrent ratiois a popular metric used across the industry to assess a company’s short-termliquidity with respect to its available assets and pending liabilities. In other words, it reflects a company’s ability to generate enough cash to pay off all its debts once they become due. It’s used globally as a way to measure the overallfinancial health of a company. Cash ratio(also calledcash asset ratio)isthe ratio of a company’s cash and cash equivalent assets to its total liabilities. Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current liabilities.

Most WantedFinancial Terms

Solvency refers to an enterprise’s capacity to meet its long-term financial commitments. Liquidity refers to an enterprise’s ability to pay short-term obligations; the term also refers to a company’s capability to sell assets quickly to raise cash. A solvent company is one that owns more than it owes; in other words, it has a positive net worth and a manageable debt load.

Current ratio is balance-sheet financial performance measure of company liquidity. Current ratio indicates a company’s ability to meet short-term debt obligations. The current ratio measures whether or not a firm has enough resources to pay its debts over the next 12 months. Current assets are liquid assets that can be converted to cash within one year such as cash, cash equivalent, accounts receivable, short-term deposits and marketable securities.

But financial leverage appears to be at comfortable levels, with debt at only 25 percent of equity and only 13 percent of assets financed by debt. Overall, Solvents Co. is in a dangerous liquidity situation, but it has a comfortable debt position. Based on its current ratio, it has $3 of current assets for every dollar of current liabilities. Its quick ratio points to adequate liquidity even after excluding inventories, with $2 in assets that can be converted rapidly to cash for every dollar of current liabilities. However, financial leverage based on its solvency ratios appears quite high.

Financial Ratios

In contrast to liquidity ratios, solvency ratios measure a company’s ability to meet its total financial obligations. Solvency relates to a company’s overall ability to pay debt obligations and continue business operations, while liquidity focuses more on current financial accounts. A company must have more total assets than total liabilities to be solvent and more current assets than current liabilities to be liquid. Although solvency does not relate directly to liquidity, liquidity ratios present a preliminary expectation regarding a company’s solvency.

A low liquidity measure would indicate either that the company is having financial problems, or that the company is poorly managed; hence, a fairly high liquidity ratio is good. However, it shouldn’t be too high, because excess funds incur an opportunity cost and can probably be invested for a higher return. Primary measures of liquidity are net working capital and the current ratio, quick ratio, and the cash ratio. By contrast, solvency ratios measure the ability of a company to continue as a going concern, by measuring the ratio of its long-term assets over long-term liabilities.

Liquidity ratios: What is it?

- Liquidity ratios show a company’s current assets in relation to current liabilities.

- The information used to calculate liquidity ratios comes from a company’s balance sheet.

Potential creditors use this ratio as a measure of a company’s liquidity and how easily it can service debt and cover short-term liabilities. The concept of cash cycle is also important for better understanding of liquidity ratios. A company’s cash is usually tied up in the finished goods, the raw materials, and trade debtors. It is not until the inventory is sold, sales invoices raised, and the debtors’ make payments that the company receives cash. The cash tied up in the cash cycle is known as working capital, and liquidity ratios try to measure the balance between current assets and current liabilities.

What are examples of liquidity ratios?

Liquidity ratios are the ratios that measure the ability of a company to meet its short term debt obligations. The liquidity ratios are a result of dividing cash and other liquid assets by the short term borrowings and current liabilities.

The company’s current ratio of 0.4 indicates an inadequate degree of liquidity with only 40 cents of current assets available to cover every $1 of current liabilities. The quick ratio suggests an even more dire liquidity position, with only 20 cents of liquid assets for every $1 of current liabilities.

The current liabilities refer to the business’ financial obligations that are payable within a year. The current ratio, also known as the working capital ratio, measures the business’ ability to pay off its short-term debt obligations with its current assets. The best example of such a far-reaching liquidity catastrophe in recent memory is the global credit crunch of 2007–09. Commercial paper—short-term debt that is issued by large companies to finance current assets and pay off current liabilities—played a central role in this financial crisis. Solvency and liquidity are both terms that refer to an enterprise’s state of financial health, but with some notable differences.

What is the liquidity ratio formula?

Liquidity ratios are the ratios that measure the ability of a company to meet its short term debt obligations. They show the number of times the short term debt obligations are covered by the cash and liquid assets. If the value is greater than 1, it means the short term obligations are fully covered.

In accounting, the term liquidity is defined as the ability of a company to meet its financial obligations as they come due. The liquidity ratio, then, is a computation that is used to measure a company’s ability to pay its short-term debts.

To summarize, Liquids Inc. has a comfortable liquidity position, but it has a dangerously high degree of leverage. The current ratio measures a company’s ability to pay off its current liabilities (payable within one year) with its current assets such as cash, accounts receivable, and inventories. There are several key ratios analysts use to analyze liquidity, often called solvency ratios.

There are three common calculations that fall under the category of liquidity ratios. These three ratios are often grouped together by financial analysts when attempting to accurately measure the liquidity of a company. The quick ratio is ameasure of a company’s ability to meet its short-term obligations using its most liquid assets (near cash or quick assets).

On the other hand, a company with adequate liquidity may have enough cash available to pay its bills, but it may be heading for financial disaster down the road. Leverage ratios focus more on long-term debt, while liquidity ratios deal with short-term debt.

Working Capital Ratio

Current assets are stocks and work-in-progress, debtors and cash that would normally be re-circulated to pay current liabilities. The quick ratiob measure of a company’s ability to meet its short-term obligations using its most liquid assets (near cash or quick assets). Quick assets include those current assets that presumably can be quickly converted to cash at close to their book values. Quick ratio is viewed as a sign of a company’s financial strength or weakness; it gives information about a company’s short term liquidity. The ratio tells creditors how much of the company’s short term debt can be met by selling all the company’s liquid assets at very short notice.

Cash Ratio

Debt exceeds equity by more than three times, while two-thirds of assets have been financed by debt. Note as well that close to half of non-current assets consist of intangible assets (such as goodwill and patents).