Liabilities Meaning & Examples in Accounting

Asset created by an accounting entry (and included under assets in the balance sheet) that has no tangible existence or realizable value but represents actual cash expenditure. The purpose of creating a fictitious asset is to account for expenses (such as those incurred in starting a business) that cannot be placed under any normal account heading.

Accountants must look past the form and focus on the substance of the transaction. Commercial paper is also a short-term debt instrument issued by a company. The debt is unsecured and is typically used to finance short-term or current liabilities such as accounts payables or to buy inventory. In short, a company needs to generate enough revenue and cash in the short-term to cover its current liabilities.

Balance Sheet Classification

Property (such as office space or buildings) and equipment are common long-term assets. Common asset categories include cash and cash equivalents; accounts receivable; inventory; prepaid expenses; and property and equipment. Although physical assets commonly come to mind when one thinks of assets, not all assets are tangible. In financial accounting, an asset is any resource owned by the business.

Your thinking shouldn’t stop at Social Security and your IRA, but it also shouldn’t start with your primary residence. Nonperforming assets are listed on the balance sheet of a bank or other financial institution. After a prolonged period of non-payment, the lender will force the borrower to liquidate any assets that were pledged as part of the debt agreement.

Non-current liabilities, also known as long-term liabilities, are debts or obligations that are due in over a year’s time. Long-term liabilities are an important part of a company’s long-term financing.

Free Accounting Courses

Fictitious assets are written off as soon as possible against the firm’s earnings. Assets are presented on the balance sheet in order of their liquidity.

Current liabilities of a company consist of short-term financial obligations that are due typically within one year. Current liabilities could also be based on a company’s operating cycle, which is the time it takes to buy inventory and convert it to cash from sales.

For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000. The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Examples of current liabilities include accounts payables, short-term debt, accrued expenses, and dividends payable.

Carrying nonperforming assets, also referred to as nonperforming loans, on the balance sheet places significant burden on the lender. The nonpayment of interest or principal reduces the lender’s cash flow, which can disrupt budgets and decrease earnings. Loan loss provisions, which are set aside to cover potential losses, reduce the capital available to provide subsequent loans to other borrowers. Once the actual losses from defaulted loans are determined, they are written off against earnings.

Types of assets

The remaining principal amount should be reported as a long-term liability. The interest on the loan that pertains to the future is not recorded on the balance sheet; only unpaid interest up to the date of the balance sheet is reported as a liability.

- Current liabilities are listed on the balance sheet under the liabilities section and are paid from the revenue generated from the operating activities of a company.

- Current liabilities of a company consist of short-term financial obligations that are due typically within one year.

- Current liabilities could also be based on a company’s operating cycle, which is the time it takes to buy inventory and convert it to cash from sales.

Companies take on long-term debt to acquire immediate capital to fund the purchase of capital assets or invest in new capital projects. Other noncurrent assets include the cash surrender value of life insurance. A bond sinking fund established for the future repayment of debt is classified as a noncurrent asset. Some deferred income taxes, goodwill, trademarks, and unamortized bond issue costs are noncurrent assets as well.

If no assets were pledged, the lender mightwrite-offthe asset as abad debtand then sell it at a discount to acollection agency. Also referred to as PPE (property, plant, and equipment), these are purchased for continued and long-term use in earning profit in a business. They are written off against profits over their anticipated life by charging depreciation expenses (with exception of land assets).

This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets.

Properties of an Asset

Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets.

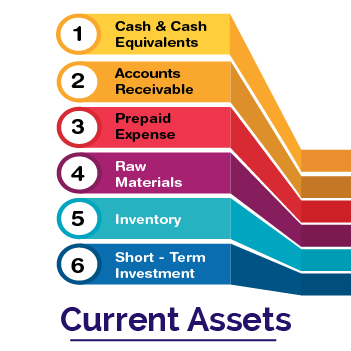

It covers money and other valuables belonging to an individual or to a business. Current assets typically include categories such as cash, marketable securities, short-term investments, accounts receivable , prepaid expenses, and inventory. Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment.

Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset. Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetary value of the assets owned by that firm.

Current liabilities are listed on the balance sheet under the liabilities section and are paid from the revenue generated from the operating activities of a company. Accrued expenses are listed in the current liabilities section of the balance sheet because they represent short-term financial obligations. Companies typically will use their short-term assets or current assets such as cash to pay them.

Short-term debts can include short-term bank loans used to boost the company’s capital. Overdraft credit lines for bank accounts and other short-term advances from a financial institution might be recorded as separate line items, but are short-term debts. The current portion of long-term debt due within the next year is also listed as a current liability.

We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting.

What is assets and how many types of assets?

Types of assets. The two main types of assets are current assets and non-current assets. These classifications are used to aggregate assets into different blocks on the balance sheet, so that one can discern the relative liquidity of the assets of an organization.

Classification of Assets: Physical Existence

Accumulated depreciation is shown in the face of the balance sheet or in the notes. Long-term assets are investments in a company that will benefit the company for many years. Long-term assets can include fixed assets such as a company’s property, plant, and equipment, but can also include other assets such as long-term investments or patents. Short-term debt, also called current liabilities, is a firm’s financial obligations that are expected to be paid off within a year. Current liabilities are a company’s debts or obligations that are due to be paid to creditors within one year.

Your fixed home ownership expenses include mortgage payments, maintenance, taxes, insurance, and utilities, among others. If you live in your home, you will be paying those expenses out of pocket, and the longer you live there, the more money you will spend. If you have tenants in your home covering all fixed expenses plus generating you income each month, your home then becomes an asset. For retirement purposes, an asset is something that generates cash flow.

As a result, many financial ratios use current liabilities in their calculations to determine how well or how long a company is paying them down. Current liabilities are listed on the balance sheet and are paid from the revenue generated from the operating activities of a company. One thing that purchasing a home does not do is generate retirement income.

Current assets, which are expected to be consumed or converted to cash within one year, are listed at the top. Cash, short-term investments and inventory are examples of current assets. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased.

Carrying a significant amount of NPAs on the balance sheet over a period of time is an indicator to regulators that the financial health of the bank is at risk. Long-term assets, or fixed assets, are expected to be consumed or converted to cash after one year’s time, and they are listed on the balance sheet beneath current assets.