Leverage

Financial Leverage Formula

As the proportion of debt to assets increases, so too does the amount of financial leverage. Financial leverage is favorable when the uses to which debt can be put generate returns greater than the interest expense associated with the debt. Many companies use financial leverage rather than acquiring more equity capital, which could reduce the earnings per share of existing shareholders.

How a business makes sales is also a factor in how much leverage it employs. On the other hand, a firm with a high volume of sales and lower margins are less leveraged. Leverage is used as a funding source when investing to expand a firm’s asset base and generate returns on risk capital; it is aninvestment strategy.

One can calculate the equity multiplier by dividing a firm’s total assets by its total equity. Once figured, one multiplies the financial leverage with the total asset turnover and the profit margin to produce the return on equity. For example, if a publicly traded company has total assets valued at $500 million and shareholder equity valued at $250 million, then the equity multiplier is 2.0 ($500 million / $250 million). This shows the company has financed half its total assets by equity. While carrying a modest amount of debt is quite common, highly leveraged businesses face serious risks.

What is financial leverage and why is it important?

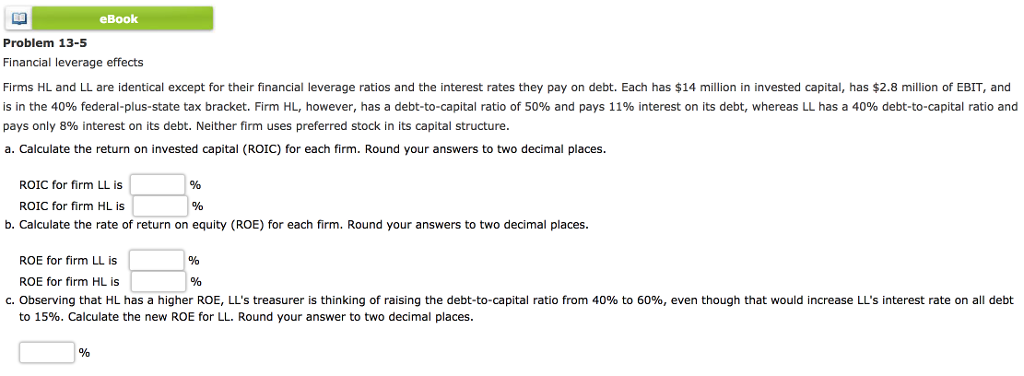

Leverage = total company debt/shareholder’s equity. Count up the company’s total shareholder equity (i.e., multiplying the number of outstanding company shares by the company’s stock price.) Divide the total debt by total equity. The resulting figure is a company’s financial leverage ratio.

In other words, instead of issuing stock to raise capital, companies can use debt financing to invest in business operations in an attempt to increase shareholder value. The financial leverage formula is measured as the ratio of total debt to total assets.

In order to borrow substantial amounts of capital, firms must pursue a variety of financial sourcing and be able to back up their debts with valuable assets ( collateral ). Even with a great deal of collateral, borrowing big means risking big. Interest rates ensure that the strategic discussions around expanding leverage take into account the risk and return trade offs. DuPont analysis uses the “equity multiplier” to measure financial leverage.

Large debt payments eat away at revenue and, in severe cases, put the company in jeopardy of default. Active investors use a number of different leverage ratios to get a broad sense of how sustainable a firm’s borrowing practices are. In isolation, each of these basic calculations provides a somewhat limited view of the company’s financial strength. But when used together, a more complete picture emerges—one that helps weed out healthy corporations from those that are dangerously in debt. Companies can merge both financial leverage and operating leverage, a combination business experts call combined leverage.

What Is Leverage in Finance and What Is the Formula?

What is financial leverage ratio formula?

Financial leverage is the use of debt to buy more assets. Leverage is employed to increase the return on equity. However, an excessive amount of financial leverage increases the risk of failure, since it becomes more difficult to repay debt.

High operating leverage implies that a firm is making few sales but with high margins. This can pose significant risks if a firm incorrectly forecasts future sales. If a future sales forecast is slightly higher than the actual, this could lead to a huge discrepancy between actual and budgeted cash flow, which will have a significant effect on a firm’s future operating ability. If a company’s variable costs are higher than its fixed costs, the company is using less operating leverage.

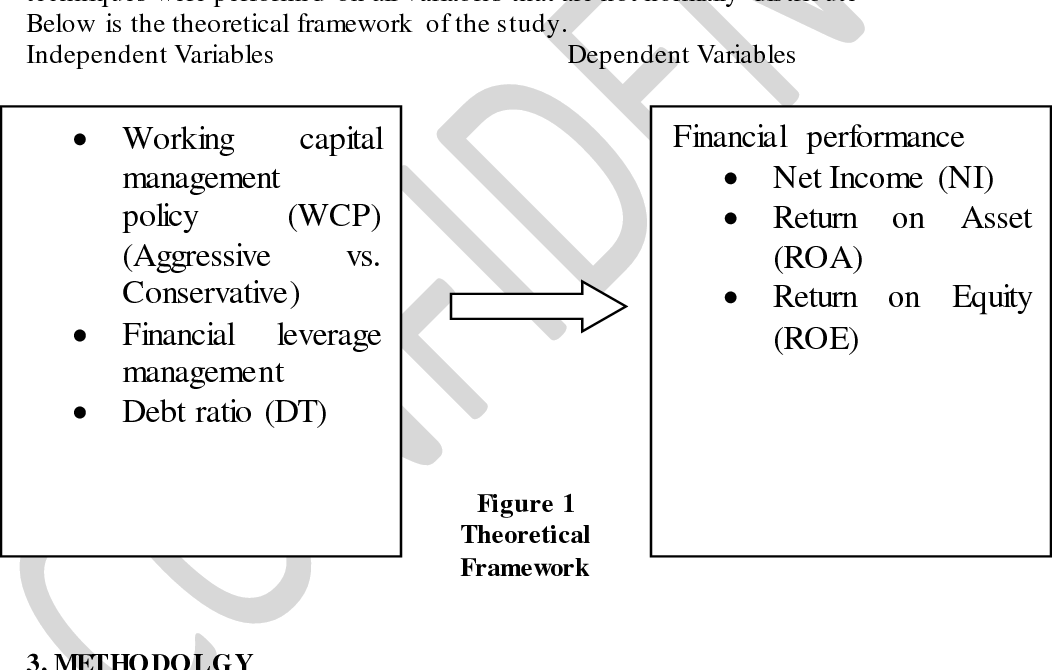

Financial leverage calibrates total company financial risks while operating leverage measures business operating risk. Merged together, combined leverage calculates total business risk. That’s especially problematic in lean economic times, when a company can’t generate enough sales revenue to cover high-interest rate costs.

Leverage results from using borrowed capital as a funding source when investing to expand the firm’s asset base and generate returns on risk capital. Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment. Leverage can also refer to the amount of debt a firm uses to finance assets. When one refers to a company, property or investment as “highly leveraged,” it means that item has more debt than equity.

If a firm is described as highly leveraged, the firm has more debt than equity. Companies can issue preferred stock and invest the money shareholders paid for the preferred stock. As long as the preferred dividends are less than the return on the invested capital, the company is said to have financial leverage. Common shareholders shouldn’t be opposed to financial leverage because their ownership share stays the same while increasing assets. The leverage ratio is the ratio of debt to equity in a company, bank, house, etc.

The more debt a company takes on, however, the more leveraged that company becomes. That’s primarily due to the higher interest payments owed to the lender by the borrowing business. Yet if the leverage leads to a higher investment return, compared to the rate of interest a company is paying on a loan, the level of leverage is reduced.

- Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment.

- Leverage can also refer to the amount of debt a firm uses to finance assets.

- Leverage results from using borrowed capital as a funding source when investing to expand the firm’s asset base and generate returns on risk capital.

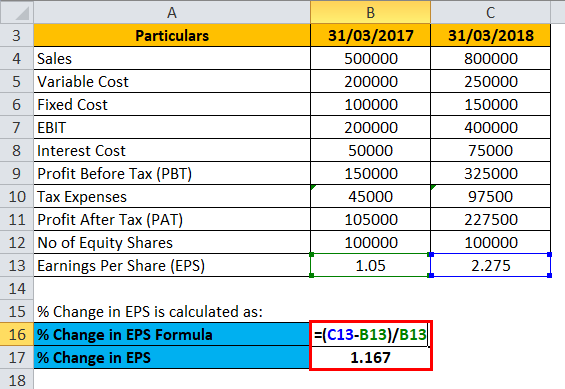

A degree of financial leverage (DFL) is a leverage ratio that measures the sensitivity of a company’s earnings per share (EPS) to fluctuations in its operating income, as a result of changes in its capital structure. The degree of financial leverage (DFL) measures the percentage change in EPS for a unit change in operating income, also known as earnings before interest and taxes (EBIT). Due to financial leverage’s effect on solvency, a company that borrows too much money might face bankruptcy during a business downturn, while a less-levered company may avoid bankruptcy due to higher liquidity.

Great Expectations: Cramer’s ‘Mad Money’ Recap (Thursday 5/7/

However, an excessive amount of financial leverage increases the risk of failure, since it becomes more difficult to repay debt. A firm that operates with both high operating and financial leverage can be a risky investment.

If the opposite occurs, and interest payments are higher than the return on investment, the company could possibly be put into a perilous risk situation – and may even face bankruptcy. The term financial leverage is also used to describe the overall debt load of a company by comparing debt to assets or debt to equity.

And a company’s degree of leverage, high versus low, translates directly into a measurement of risk for the shareholders. The standard way to accomplish leverage is through borrowing, via debt and equity, to invest at a much higher scale than one’s current assets would allow.

As long as the return on investments is greater than the interest paid on the issued bonds, the company will have effectively leveraged their finances. However, a high leverage ratio is not just a problem in the housing sector.

Benefits of Leverage

It had a leverage ratio of about 20, but it continued to borrow more money. So when Lehman Brothers’ assets fell in value very quickly, in 2008, they were underwater. That is, their assets were worth less than the debt that they owed and the company was insolvent. So leverage ratio is important because it measures how leveraged a company is.

Financial over-leveraging means incurring a huge debt by borrowing funds at a lower rate of interest and using the excess funds in high risk investments. If the risk of the investment outweighs the expected return, the value of a company’s equity could decrease as stockholders believe it to be too risky. Taking on debt, as an individual or a company, will always bring about a heightened level of risk due to the fact that income must be used to pay back the debt even if earnings or cash flows go down. From a company’s perspective, the use of financial leverage can positively – or sometimes negatively – impact its return on equity as a consequence of the increased level of risk.

A high leverage ratio indicates a company, bank, home or other institution is largely financed by debt. In other words, it becomes more difficult to meet financial obligations when a highly-levered company’s assets suddenly drop in value. The degree of financial leverage (DFL) is a leverage ratio that measures the sensitivity of a company’s earnings per share to fluctuations in its operating income, as a result of changes in its capital structure.

Companies usually choose one form of leverage over the other when analyzing potential investments. One that utilizes both forms of leverage undertakes a very high level of risk. At an ideal level of financial leverage, a company’s return on equity increases because the use of leverage increases stock volatility, increasing its level of risk which in turn increases returns. However, if a company is financially over-leveraged a decrease in return on equity could occur.

It is mostly used to boost the returns on equity capital of a company, especially when the business is unable to increase its operating efficiency and returns on total investment. Because earning on borrowing is higher than interest payable on debt, the company’s total earnings will increase, ultimately boosting the earnings of stockholders. Through balance sheet analysis, investors can study the debt and equity on the books of various firms and can invest in companies that put leverage to work on behalf of their businesses.

A highly leveraged company would have aleverage ratioclose to 1 or higher. These means that every dollar of assets or equity is matched by one dollar of debt. The same financial leverage principle applies the to debt just like preferred stock.

Statistics such as return on equity, debt to equity and return on capital employed help investors determine how companies deploy capital and how much of that capital companies have borrowed. To properly evaluate these statistics, it is important to keep in mind that leverage comes in several varieties, including operating, financial, and combined leverage. This type of leverage is the most pervasive used by companies and investors – it represents the use of debt to place a company in a more advantageous financial position.

Investors use leverage to significantly increase the returns that can be provided on an investment. They lever their investments by using various instruments that include options, futures and margin accounts.