Journalizing

What is posting in accounting?

The general ledger is more of a summary at the account level of every business transaction which comes from various journals containing chronological accounting entries. This information entered into the journal and summarised into the ledger is then aggregated further into a trial balance, which is used to generate the financial statements of the business entity.

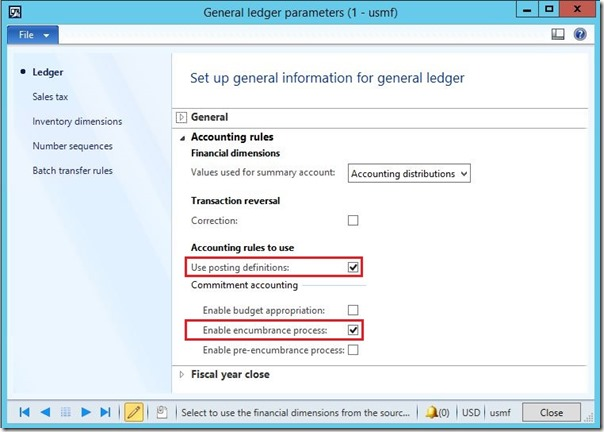

In this step of the accounting cycle an accountant takes total credits and debits recorded in categorized sub-ledgers and posts them into the general ledger to be used for official accounting statements. With the abundance of technological advancements in the fields of software, there are numerous accounting solutions provided by many technology giants like Oracle Suite, Tally, etc. Most of such software products provide a centralized repository to log entries into journals and ledger. Due to such accountancy software products, recording transactions have become far easier. There is no need to maintain all the books separately and reconcile manually as this software help in automating such redundant manual tasks.

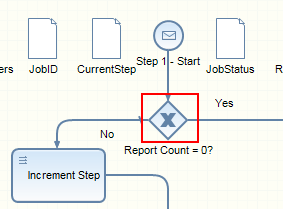

In this process, all adjusting entries to the various subledgers and general journal must be made, after which their contents are posted to the general ledger. It is customary at this point to set a lock-out flag in the accounting software, so that no additional changes to the subledgers and journals can be made for the accounting period being closed.

However, this does not mean there are no errors in a company’s accounting system. For example, transactions classified improperly or those simply missing from the system could still be material accounting errors that would not be detected by the trial balance procedure.

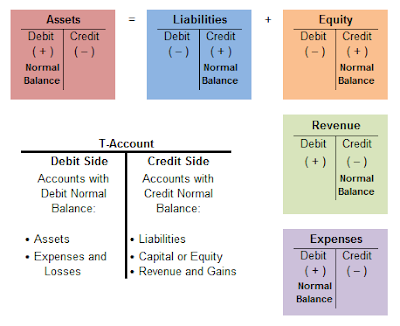

It must be noted that there is a concept of duality in accounts that results in a double-entry accounting system. Hence, every business transaction is recorded in such a way that it affects two accounts in terms of credit and debit entry. In the world of finance, accountancy is one stickler field in which all the norms and laws are required to be followed both in spirit and text. The main financial statements include an income statement, balance sheet, and cash flow statement.

Companies initially record their business transactions in bookkeeping accounts within the general ledger. Depending on the kinds of business transactions that have occurred, accounts in the ledgers could have been debited or credited during a given accounting period before they are used in a trial balance worksheet. Furthermore, some accounts may have been used to record multiple business transactions.

What is Journalizing and posting in accounting?

May 21, 2019. Posting in accounting is when the balances in subledgers and the general journal are shifted into the general ledger. Posting only transfers the total balance in a subledger into the general ledger, not the individual transactions in the subledger.

In order to compile the financial statements of a business entity, there are numerous stages of measuring, recording and presenting the reconciled form of every business transaction. Now, the starting point of all of this process is at recording the business transactions in the general journal.

Why is posting important in accounting?

Journalizing is the process of recording a business transaction in the accounting records. This activity only applies to the double-entry bookkeeping system. This calls for the identification of the general ledger accounts that will be altered as a result of the transaction.

However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes. Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double-entry accounting system. If the total debits equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers.

The last two steps in the accounting process are preparing a trial balance and then preparing the balance sheet and income statement. This information is provided in order to communicate the financial position of the entity to interested parties. It is the entry point for any kind of business transaction to make its way into the books of accounts of the company before it flows to the next level of classification of transactions in accountancy.

- Companies initially record their business transactions in bookkeeping accounts within the general ledger.

- Furthermore, some accounts may have been used to record multiple business transactions.

- Depending on the kinds of business transactions that have occurred, accounts in the ledgers could have been debited or credited during a given accounting period before they are used in a trial balance worksheet.

BUSINESS IDEAS

At the end of a period, the T-account balances are transferred to the ledger where the data can be used to create accounting reports. At the end of an accounting period, the accounts of asset, expense or loss should each have a debit balance, and the accounts of liability, equity, revenue or gain should each have a credit balance. On a trial balance worksheet, all the debit balances form the left column, and all the credit balances form the right column, with the account titles placed to the far left of the two columns.

ACCOUNTING

A trial balance is a list and total of all the debit and credit accounts for an entity for a given period – usually a month. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other. The trial balance is prepared after all the transactions for the period have been journalized and posted to the General Ledger.

A trial balance is a list of accounts and their balances at a given time. Its primary purpose is to prove the equality of debits and credits after posting. A trial balance also uncovers errors in journalizing and posting and is useful in preparing financial statements. As business transactions occur during the year, they are recorded by the bookkeeper with journal entries. After an entry is made, the debit and credit are added to a T-account in the categorized journal.

DOCUMENTS FOR YOUR BUSINESS

As a result, the ending balance of each ledger account as shown in the trial balance worksheet is the sum of all debits and credits that have been entered to that account based on all related business transactions. It is important to note that just because the trial balance balances, does not mean that the accounts are correct or that mistakes did not occur. There might have been transactions missed or items entered in the wrong account – for example increasing the wrong asset account when a purchase is made or the wrong expense account when a payment is made. Nevertheless, once the trial balance is prepared and the debits and credits balance, the next step is to prepare the financial statements. Such uniformity guarantees there are no unequal debits and credits that have been incorrectly entered during the double-entry recording process.

Journals record transactions in chronological order, while ledgers summarize transactions by account. From the perspective of closing the books, posting is one of the key procedural steps required before financial statements can be created.

Posting From Journal to Ledger Accounts

Debits increase balance sheet asset accounts, such as cash and inventory, and increase income statement expense accounts, such as marketing and salary expenses. Debits decrease balance sheet liability accounts, such as notes payable, and shareholders’ equity accounts, such as retained earnings. Transaction analysis and journal entries are the first two stages of the accounting cycle. Posting is the transfer of journal entries to a general ledger, which usually contains a separate form for each account.