Job Costing Definition

The purpose of any business is to make money, and job costing is the most effective way to ensure that occurs. In a job costing system, costs may be accumulated either by job or by batch.

The record may also show work-in-progress inventory and the finished goods inventory. Costing is an accounting technique used to determine the exact expenses for materials, labor and overhead incurred in operations.

Different methods of cost finding are used because businesses vary in their nature and the type of products or services they produce. There are two main types of costing systems/methods based on actual cost.

The best run businesses use their accounting systems to track direct labor and expenses incurred to deliver services. To efficiently allocate labor costs, a company must automate and integrate its employee time tracking, expense management and payroll systems with its accounting system. The most important decision that you, as a small business owner, will ever make is how to price jobs and services.

Job Costing

For a typical job, direct material, labor, subcontract costs, equipment, and other direct costs are tracked at their actual values. Overhead or “burden” may be applied either by using a rate based on direct labor hours or by using some other Activity Based Costing cost driver. In either case, once overhead/burden is added, the total cost for the job can be determined. Of course, in the days of computerized job costing software, journaling costs manually is an obsolete process.

Proper project costing leads to better profitability, project estimating, management decisions, and timely financial reporting. Job costing, also called project-based accounting, is the process of tracking costs and revenue for each individual project. Job costing looks at each project in detail, breaking down the costs of labor, materials and overhead. If a business creates the same product or offers the same service regardless of customer, job costing doesn’t make a lot of sense.

How do you calculate job costing?

Job costing involves the accumulation of the costs of materials, labor, and overhead for a specific job. For example, job costing is appropriate for deriving the cost of constructing a custom machine, designing a software program, constructing a building, or manufacturing a small batch of products.

Job costing is calculated by accumulating the cost of labor, materials and overhead for a specific project. Product Costs Similarities Product costs consist of direct materials, direct labor, and manufacturing overhead.

Responses to Job Costing

Job Costing is the process of determining the labor and materials cost for each job in a systematic way, and then using this information to create a quote for the customer. Job costing or cost accounting can be used in virtually any industry (especially service industry) to ensure that the product pricing covers actual costs, overhead and provides a profit.

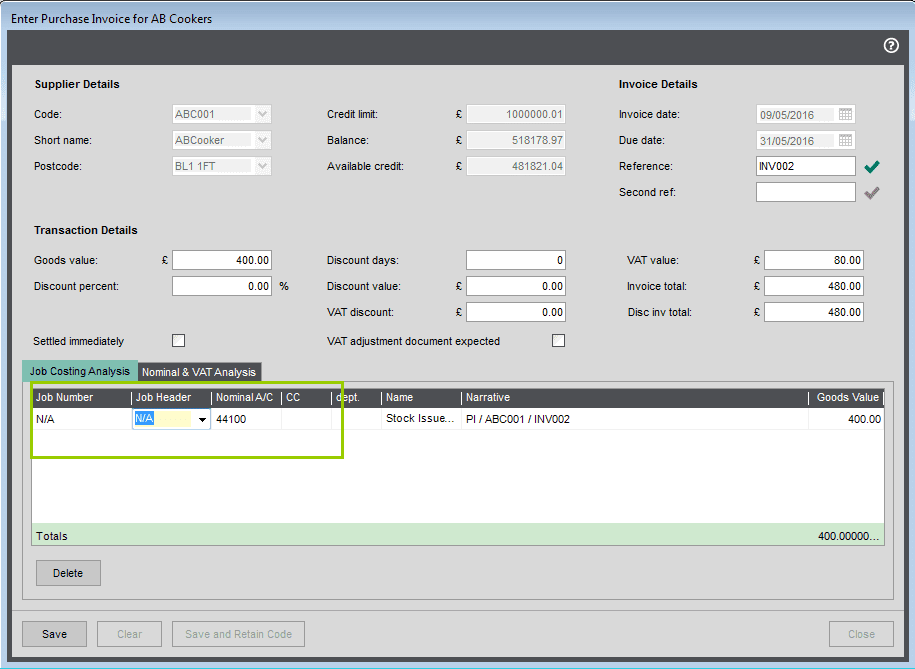

For an accounting system to support job costing, it must allow job numbers to be assigned to individual items of expenses and revenues. A job can be defined to be a specific project done for one customer, or a single unit of product manufactured, or a batch of units of the same type that are produced together. Every construction company, regardless of whether they are a general contractor, subcontractor, or something in between, must be able to win and complete jobs efficiently.

The job costing process tracks the true costs to deliver a service or job, so a business can charge the right price to achieve its target gross profit margin. Job order costing or job costing is a system for assigning and accumulating manufacturing costs of an individual unit of output. The job order costing system requires a separate job cost record which reports each item’s direct materials and director labor that were used and assigned amount of manufacturing overhead.

- Job Costing is the process of determining the labor and materials cost for each job in a systematic way, and then using this information to create a quote for the customer.

- The purpose of any business is to make money, and job costing is the most effective way to ensure that occurs.

Inventory Accounts Similarities Inventory accounts include raw materials inventory, work-in-process inventory, and finished goods inventory. Differences Process Costing Job Costing Several different work-in-process inventory accounts are used—one for each department (or process). One work-in-process inventory account is used—job cost sheets track costs assigned to each job. Recall the three components of product costs—direct materials, direct labor, and manufacturing overhead. Assigning these product costs to individual products remains an important goal for process costing, just as with job costing.

Once you understand how to calculate gross profit you understand the accounting behind job costing. You are now ready to set up the business systems that will quickly and easily provide you with the costs and expenses to allocate to jobs and projects. Methods of cost accounting signify the systems used to assign cost elements to cost objects. These are the procedures by which product costs are accumulated.

What is an example of job costing?

Job costing is defined as a method of recording the costs of a manufacturing job, rather than process. With job costing systems, a project manager or accountant can keep track of the cost of each job, maintaining data which is often more relevant to the operations of the business.

However, instead of assigning product costs to individual jobs (shown on a job cost sheet), process costing assigns these costs to departments (shown on a departmental production cost report). Job costing, generally, means a specific accounting methodology used to track the expense of creating a unique product. Job costing forms have spaces to include direct labor, direct materials, and overhead.

Differences Process Costing Job Costing Product costs are assigned to departments (or processes). Unit Cost Information Similarities Unit cost information is needed by management for decision-making purposes. Differences Process Costing Job Costing Unit cost information comes from the departmental production cost report.

How to Calculate Job Costing

Business owners and project managers need information to accurately bid and estimate projects. It is imperative that the company generates accurate and timely reports. While some project managers rely solely on experience, the most successful project managers know how to best utilize the job schedule. The job schedule tells the story of construction projects at a point in time by providing a summary of all contracts the company has in process or has completed on a contract by contract basis. The job schedule relies on several factors, however, the most important is proper job costing.

Such hand-journaling is mandatory for companies that continue to use general accounting software to do job costing. Enlightened accountants are moving forward and using job costing software, thereby improving cost control, reducing risk, and increasing the chance of profitability. Job costing is an accounting tool that allows businesses to track costs by individual jobs.

In cost management, job costing is a method you use when your customers incur unique amounts of costs. Job costing assesses costs by the job and allows you to provide detailed price estimates based on the product constructed or service provided.

Instead, businesses like these use process costing, which means they break down expenses by process. If your bakery produces the same type and amount of croissants every morning or your furniture company sells only premade chairs instead of custom orders, use process costing, not job costing. Job costing is particularly useful for businesses which provide services or products varying in cost depending on the customer specifications. For example, a custom home building contractor might work with a client to nail down the specific expectations for the finished product. Once the details are known, the contractor would use a job costing system to approximate the cost of building the home specified by the customer.

What Is Job Costing?

A job profitability report is like an overall profit & loss statement for the firm, but is specific to each job number. Job costing is accounting which tracks the costs and revenues by “job” and enables standardized reporting of profitability by job.