Intermediate Accounting Test 1 Conceptual Questions Ch. 7-9 Flashcards

Similarly, recognizing inventory at the net realizable value is a departure from historical cost. Inventory items are especially subject to lost value due to damage, spoilage, obsolescence, or lower demand resulting in discounted items.

The lower of cost or market method is used to protectretailersand other businesses from fluctuations in inventory purchase prices. Since inventory is a significant number on a retailer’sbalance sheet, a large fluctuation in the value of these assets could affect the company’s financial position. Rising replacement costs indicate increasing selling prices, which is the underlying logic of LCM valuation.

When the items are sold in the future, unrealistic profits over the normal profit margin are prevented. The ceiling and floor maintain normal profit margins and prevent the reporting of exaggerated losses and gains in the future respectively when the newly valued inventory items are later sold. Valuation should be the cost to replace the inventory either through manufacturing or purchase for resale. Generally Accepted Accounting Principles also places a ceiling and floor on this method of valuation.

Valuing at the price you could sell at retail is not allowed because retail prices are inflated to cover selling costs. If this calculation does result in a loss, charge the loss to the cost of goods sold expense with a debit, and credit the inventory account to reduce the value of the inventory account. If the loss is material, you may want to segregate it in a separate loss account, which more easily draws the attention of a reader of a company’s financial statements. Net realizable value is the estimated selling price of goods, minus the cost of their sale or disposal.

The lower of cost or market method lets companies record losses by writing down the value of the affected inventory items. The amount by which the inventory item was written down is recorded under cost of goods sold on the balance sheet. For example, if a company purchased inventory at the cost of $100,000 but the market value of the inventory is $20,000, users of financial statements would want the lower value to be reflected in the books.

Accounting Simplified

It is used in the determination of the lower of cost or market for on-hand inventory items. The deductions from the estimated selling price are any reasonably predictable costs of completing, transporting, and disposing of inventory. Gross profit method Method of determining inventory amount, often used when it is impossible or impractical to take a physical inventory. In cases where the selling price falls disproportionately to the replacement cost, the gross profit relationship, typically 70% for Sunny Sunglasses Shop, is no longer valid.

You normally apply the lower of cost or market rule to a specific inventory item, but you can apply it to entire inventory categories. In the latter case, an LCM adjustment can be avoided if there is a balance within an inventory category of items having market below cost and in excess of cost. The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue.

If the net realizable value of an item is lower than its cost, however, then the item’s balance-sheet value must be “written down” to NRV. Cost-of-goods-sold method A method of valuing inventory in which cost of goods sold is debited for the write-down of inventory to market. As a result, the company does not report a loss in the income statement because the cost of goods sold already includes the amount of loss. Similarly, a floor is put in place to prevent unrealistic profits in the future when the replacement cost is falling faster than the selling price. Normally, Sunny would receive 70% gross profit on average for Item C. The replacement cost fell below the normal profit margins of 70%, so the NRV “floor” is put in place as a more accurate measure of inventory utility.

GAAP requires an annual test to adjust the balance to the lower of cost or market, or LCM. The test is required so that losses on inventory are matched with earnings for the same period. This prevents the reporting of inflated earnings for the same period discounted inventory items are sold. On a company’s balance sheet, inventory is typically listed “at cost,” meaning the value reported is whatever it cost the company to acquire the inventory.

Lower of cost or market (LCM)

- The lower of cost or market method lets companies record losses by writing down the value of the affected inventory items.

- For example, if a company purchased inventory at the cost of $100,000 but the market value of the inventory is $20,000, users of financial statements would want the lower value to be reflected in the books.

At year end, remaining inventory items are measured at the lower of cost or market, or LCM. This means that any items remaining are compared to the current replacement value. If the current replacement value is less than the historical cost, the items are adjusted down to the replacement cost, or market, to account for the lost value. If the current replacement cost is greater than the historical cost, the items remain at historical cost, acquiring the name Lower of Cost or Market.

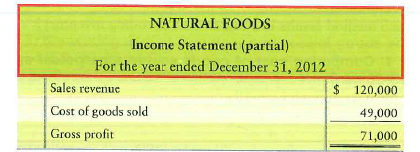

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. Gross profit will appear on a company’s income statement and can be calculated by subtracting the cost of goods sold (COGS) from revenue (sales).

When Should a Company Use Last in, First Out (LIFO)?

The ceiling prevents additional losses from occurring in the future when the selling price is falling faster than the replacement cost. For example, Sunny would not pay $35 to sell an item for $30 as in item D, so the value of inventory would not be greater than its NRV of $30 in future periods when the items is sold. In the context of inventory valuation and lower of cost or market, net realizable value takes on a meaning very specific to inventory.

Application of the Lower of Cost or Market Rule

What is lower of cost or market?

The lower of cost or market rule states that a business must record the cost of inventory at whichever cost is lower – the original cost or its current market price. Net realizable value is defined as the estimated selling price, minus estimated costs of completion and disposal.

If the inventory value was not reassessed to the appropriate value, it would overstate assets of the company and mislead users. However, as will be discussed below, the lower of cost or market inventory valuation method is not as simple as just comparing cost and market. Generally accepted accounting principles require that inventory be valued at the lesser amount of its laid-down cost and the amount for which it can likely be sold—its net realizable value(NRV). This concept is known as the lower of cost and netrealizable value, or LCNRV. The lower of cost or market (LCM) method relies on the fact that when investors value a company’s inventory, those assets shall be recorded on the balance sheet at either the market value or the historical cost.

Lower of Cost or Market Method

The lower of cost or market (LCM) method states that when valuing a company’s inventory, it is recorded on the balance sheet at either the historical cost or the market value. Historical cost refers to the cost at which the inventory was purchased.

It is defined as the estimated selling price minus all estimated selling costs and costs to complete the product. For example, if Sunny sells sunglasses for $50 and estimates that each sale costs $1.18 in advertising costs, the net realizable value for a pair of sunglasses is equal to $48.82.