Intercompany eliminations

If so, this would save months of time that our staff spends on chasing down the net effect of reclasses being made. Moreover, it looks like we’d be able to put controls as far as reclasses having to be matched, explained by a reason code, etc. before they’re booked to the system. It sounds crazy, but for a company of this size I don’t think anyone here on the US side has those controls in place. And the last question….is there any way to run this report in Oracle 11i itself of using Oracle Discoverer.

The process often takes place monthly or quarterly and involves various general ledgers of child companies eliminating intercompany transactions. When you set up the Multicompany feature, you create intercompany accounts that are available to all companies in your enterprise.

At any rate, the company has been slow in adopting new upgrades so we still use the 11i release. In the tax group, we often waste weeks/months of time analyzing intercompany reclasses by the French parent in an attempt to trace exactly what ends up hitting the P&L and what is just a series of balance sheet reclasses.

Latest Posts

What is intercompany journal entry?

Intercompany Transactions. Definition: An intercompany transaction is one between a parent company and its subsidiaries or other related entities. Unintended consequences: Intercompany transactions often cause problems with the relationship between a parent company and its bankers and lenders.

To balance the entry, debit “Cash” for $1,140 and debit “Sales Discounts and Allowances” for $60. Acumatica Intercompany Accounting lets you automate financial reporting, inventory transfers, vendor, payments, cash management, and inter-company transfers across multiple related companies.

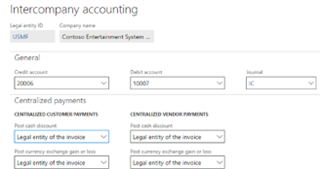

Intercompany accounting

Record the difference as a debit to the sales discount ledger account. For example, if the customer paid a $1,200 invoice with a 5 percent sales discount, credit “Accounts Receivable” for $1,200.

Intercompany transactions must be adjusted correctly in consolidated financial statements in order to show their impact on the consolidated entity instead of its impact on the parent or subsidiaries solely. Understanding how intercompany transactions are recorded in each concerning entity’s journal entries and the impact of the transaction on each entity is necessary to determine how to adjust intercompany transactions in the consolidated financial statement.

The first step is to eliminate the effects of any inter-company transactions. This entry eliminates both the asset and the stockholders’ equity accounts for the parent company’s ownership of the subsidiary. Consolidated financial statements are required when there are two or more affiliated companies. When a parent company either directly or indirectly controls a majority interest of a subsidiary, consolidated financial statements must be presented. Consolidated financial statements present the results of operations, statement of cash flows, and financial position of the combined entity.

- The above examples (Expenses, COGS, Accounts Payable, Staff, Cash, Sales) are a just few of the complexities of intercompany transactions with related parties (a parent company and its subsidiaries or related entities).

- Simply stated, the joys of creating subsidiary companies and/or investing in related entities may become nightmares unless strategic planning is made to solve the complexities of such relationships.

The above examples (Expenses, COGS, Accounts Payable, Staff, Cash, Sales) are a just few of the complexities of intercompany transactions with related parties (a parent company and its subsidiaries or related entities). These complexities become even more compounded with the topics of intercompany eliminations, proper income tax reporting, proper sales or use tax reporting, etc. Simply stated, the joys of creating subsidiary companies and/or investing in related entities may become nightmares unless strategic planning is made to solve the complexities of such relationships. An owner may not want to assume that its existing accounting and operational staff have sufficient experience to properly handle these complexities. When one company acquires another company, a consolidated balance sheet needs to be prepared.

The process of intercompany elimination is helpful in managing eliminations of operations among companies within a single group. Besides, intercompany eliminations encourage and establish controls in multifaceted corporate environments.

Intercompany accounting is a set of procedures used by a parent company to eliminate transactions occurring between its subsidiaries. For example, if one subsidiary has sold goods to another subsidiary, this is not a valid sale transaction from the perspective of the parent company, since the transaction occurred internally. Consequently, the sale must be removed from the books at the point when the consolidated financial statements of the parent company are being prepared.

What are the journal entries for inter company accounts?

You can track financials and create reports for an unlimited number of related companies within your organization. Related companies can share charts of accounts, calendars, and currencies, as well as non-financial data. Intercompany accounting is a crucial process for any company that has at least one subsidiary. It involves removing from the financial books any transactions that occurred between the company’s entities. This intercompany reconciliation greatly reduces the chance of inaccuracies in the company’s financial statements.

Separate accounting records are kept for each separate company, but not for the consolidated entity. To determine the consolidated amounts, the amounts for the individual affiliated companies are added together. Elimination entries are made to remove the effects of inter-company transactions. Intercompany accounting involves recording financial transactions between different legal entities within the same parent company. Because these entities are related, the transactions between them are not “independent” and companies can’t include a profit or loss from these transactions on consolidated financial statements.

Vision uses these accounts for processing labor and expense charges for intercompany transactions. Intercompany elimination refers to the process for removal of transactions between companies included in a group in the preparation of consolidated accounts.

However, the process involves a lot of reporting and paperwork for intercompany relationships can be quite complicated. Modify your journal entry slightly if the customer takes advantage of a cash discount. Post the entire amount of the invoice to the receivables account as a credit, reducing the receivable. Post the actual amount received to the cash account as a debit, reflecting the physical payment deposited into the bank.

Having a report to summarize account transfers would make it so much easier to prepare a number of our book to tax adjustments each year without people having to chase down items entry by entry in Oracle. IC reconciliation is when two branches of a parent company reconcile figures as a result of engaging in a transaction. One child company is the seller to the other child company is the purchaser. Thus, in order to ensure that the correct figures appear on financial statements, the figures need to be reconciled.

What are the intercompany transactions?

Intercompany accounting is a set of procedures used by a parent company to eliminate transactions occurring between its subsidiaries.

Some examples of intercompany transactions and how to account for them will be discussed below. Intercompany eliminations (ICE) are made to remove the profit/loss arising from intercompany transactions. No intercompany receivables, payables, investments, capital, revenue, cost of sales, or profits and losses are recognised in consolidated financial statements until they are realised through a transaction with an unrelated party. I was wondering if you, Jake or any of you other experts would be willing to take a step back in time. I work in the tax department for a domestic subsidiary of a very large multinational corporation whose parent is located in France.