Indirect costs

The flow is from direct materials, direct labor, and manufacturing overhead to Work in Process. As goods are completed, their cost is removed from Work in Process and transferred to Finished Goods.

Such materials are called indirect materials and are accounted for as manufacturing overhead. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs.

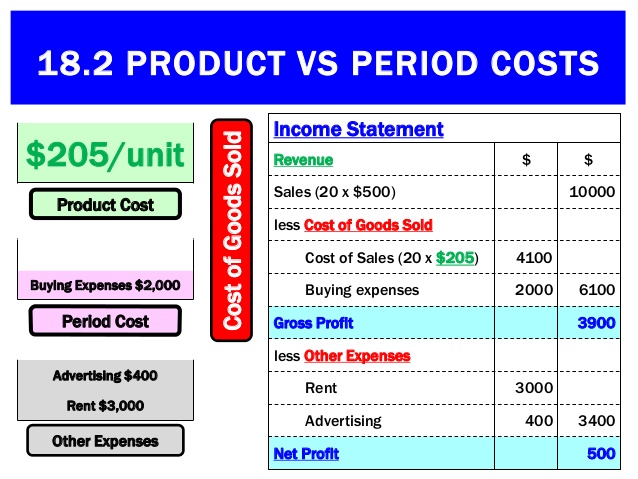

The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. 2-5The schedule of cost of goods manufactured lists the manufacturing costs that have been incurred during the period. These costs are organized under the three major categories of direct materials, direct labor, and manufacturing overhead. The total costs incurred are adjusted for any change in the Work in Process inventory to determine the cost of goods manufactured (i.e. finished) during the period.

Using the actual costing method, you can determine your small business’s overall product costs and product costs per unit based on the actual costs you incurred during a period. Knowing your product costs can help you price your products and budget your small business’s money. The reported net operating income for the year will differ depending on how the salary cost is classified. If the salary cost is classified as a selling expense all of it will appear on the income statement as a period cost.

What is a product cost?

A period cost is any cost that cannot be capitalized into prepaid expenses, inventory, or fixed assets. A period cost is more closely associated with the passage of time than with a transactional event. Instead, it is typically included within the selling and administrative expenses section of the income statement.

The difference between product costs and period costs

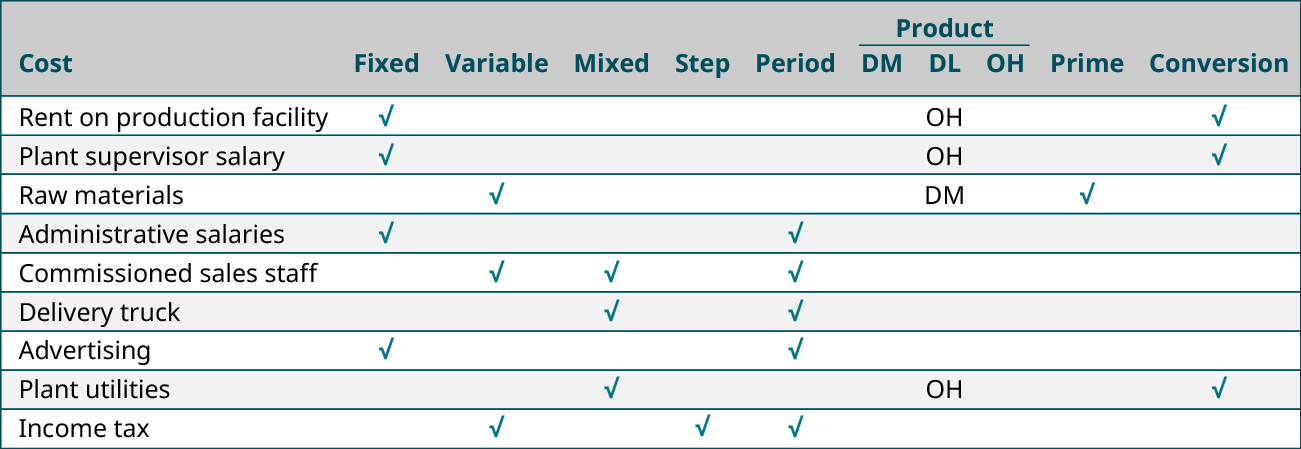

These other expenses are considered manufacturing overhead expenses and are included in the calculation of the conversion cost. The conversion cost takes labor and overhead expenses into account, but not the cost of materials. Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. Some materials used in making a product have a minimal cost, such as screws, nails, and glue, or do not become part of the final product, such as lubricants for machines and tape used when painting.

In accounting, all costs can be described as either fixed costs or variable costs. Variable costs are inventoriable costs – they are allocated to units of production and recorded in inventory accounts, such as cost of goods sold. Fixed costs, on the other hand, are all costs that are not inventoriable costs.

Product costs in managerial accounting are those that are necessary to manufacture a product. Product costs equal the sum of your direct materials costs, direct labor costs and manufacturing overhead costs.

The $226,000 figure also does not recognize that some costs incurred during the period are in the ending Raw Materials and Work in Process inventory accounts, as explained in part above. The insurance company’s liability is probably just $156,000, which is the amount of cost associated with the ending Finished Goods inventory as shown in part above.

Costing Terminology

- In accounting, all costs can be described as either fixed costs or variable costs.

- Fixed costs, on the other hand, are all costs that are not inventoriable costs.

- Variable costs are inventoriable costs – they are allocated to units of production and recorded in inventory accounts, such as cost of goods sold.

What is a period cost?

The key difference between product costs and period costs is that product costs are only incurred if products are acquired or produced, and period costs are associated with the passage of time. Examples of product costs are direct materials, direct labor, and allocated factory overhead.

As goods are sold, their cost is removed from Finished Goods and transferred to Cost of Goods Sold. No, the insurance company probably does not owe Solar Technology $226,000. The key question is how “cost” was defined in the insurance contract. The $226,000 figure is overstated since it includes elements of selling and administrative expenses as well as all of the product costs.

In like manner, to the extent that goods are unsold at the end of the period, part of the salary cost will remain with these goods in the Finished Goods Inventory account. Only the portion of the salary that has been assigned to finished units that are sold during the period will appear on the income statement as an expense (part of Cost of Goods Sold) for the period. The remainder of the salary costs will be on the balance sheet as part of inventories.

Understanding the Costs in Product Costs

However, if the salary cost is classified as a manufacturing (product) cost, then it will be added to Work In Process Inventory along with other manufacturing costs for the period. To the extent that goods are still in process at the end of the period, part of the salary cost will remain with these goods in the Work in Process Inventory account. Only that portion of the salary cost that has been assigned to finished units will leave the Work In Process Inventory account and be transferred into the Finished Goods Inventory account.

What are Product Costs?

Variable costs include direct labor, direct materials, and variable overhead. No distinction has been made between period expenses and product costs on the income statement filed by the company’s accountant. Since there were ending inventories, some of the product costs should appear on the balance sheet as assets rather than on the income statement as expenses. 2-7Since product costs accompany units of product into inventory, they are sometimes called inventoriable costs.

All costs that do not fluctuate directly with production volume are fixed costs. Fixed costs include various indirect costs and fixed manufacturing overhead costs.

Direct labor costs are the same as those used in prime cost calculations. Because prime cost only considers direct costs, it does not capture the total cost of production. As a result, the prime cost calculation can be misleading if indirect costs are relatively large. A company likely incurs several other expenses that would not be included in the calculation of the prime cost, such as manager salaries or expenses for additional supplies needed to keep the factory running.

Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs.