Independent Contractor Unemployment

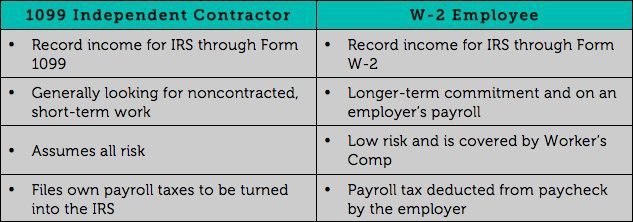

They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return. The employer withholds income taxes from the employee’s paycheck and has a significant degree of control over the employee’s work. Definitely, if you don’t get compensated for your extra expenses as a contractor (such as health insurance), then contracting is worse. But, I’ve found that employers generally are willing to pay contractors more than employees in recognition of those extra expenses.

How does w2 contract work?

Contract – Independent means they hire you directly, as a 1099 which is the designation of the tax code of you you report your income. Contract – W2 means they hire you directly, as W2. W2’s are typically full time employees with benefits, but could be a contractor.

For this reason, a contractor shouldn’t accept the same top-line pay as the employee. Typically, a contractor receives his full pay without any taxes withheld from his paycheck. Instead of receiving a W-2, your employer provides you with Form 1099 showing your gross annual salary.

In order to collect unemployment benefits, an individual must have been employed by an employer who was paying into unemployment insurance. That is, the person must have been an actual employee of someone (a “W2 employee” or “W2 worker”). However, sinceindependent contractors are not employees and no one pays unemployment insurance for them, it is not likely that an independent contractor will be eligible for unemployment benefits.

You must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to employees. You do not usually withhold taxes for a contractor or pay toward other benefits; they take care of that themselves. Employee misclassification happens when workers are mislabeled as independent contractors, rather than employees.

If you misclassify employees, you aren’t paying unemployment and other taxes on your workers when you really should be. And you aren’t covering them with workers’ comp and unemployment insurance when you should be. For example, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee.

And driving has only become more prevalent in the past three years. Not the happiest news for those not being reimbursed or being under-reimbursed for the business use of their personal vehicles. Many employers don’t realize the burden this imposed on their employees.

Some independent contractors may also have to pay state sales taxes, depending on the product they are producing. In 2017, President Trump signed the Tax Cuts and Jobs Act into law. This law, which impacted taxes filed in 2019 for 2018, is still in effect today. One of the many impacts this law had on employees was removing tax deductions for unreimbursed business mileage and other itemized expense deductions.

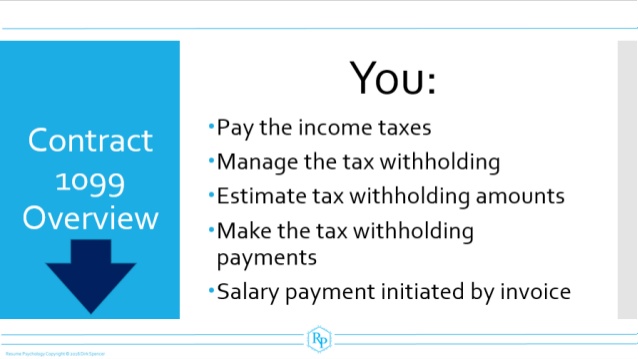

As a self-employed person, you are responsible for paying 15.3 percent self-employment tax, which is your contribution to Medicare and Social Security tax. Regular employees also pay Medicare and Social Security tax, which amounts to 7.65 percent. The IRS advises the self-employed to pay the FICA and income taxes throughout the year, thereby reducing the tax liability when it’s time to file taxes. If you’re an independent contractor, freelancer or business owner, you have a unique tax situation that can make tax time a little more difficult compared to your counterparts who are employees. Understanding how much you’ll pay in taxes as an independent contractor can be confusing.

As a rule of thumb, an employee costs a company about 120 – 150% of the employee’s salary. For example, an employee with a salary of $100k actually costs the company about $120k – $150k, after you consider things like SS taxes, workers comp insurance, and benefits.

A 1099-MISC, for instance, is typically used to report payments made to independent contractors (who cover their own employment taxes). A W-2 form, on the other hand, is used for employees (whose employer withholds payroll taxes from their earnings). Except for federal unemployment benefits, both self-employed individuals and employees pay the same taxes – federal income taxes and taxes for Social Security and Medicare.

That being said, you’re limited in what business expenses you’re able to deduct from your taxes and how much money you can defer to your 401(k). While the traditional employment route may be more convenient, you’re likely able to make a larger paycheck in one of the following contractor positions. Unemployment benefits are designed for employees whose employers pay state and federal unemployment taxes to fund the unemployment system. Ordinarily, when you’re an independent contractor, you can’t collect unemployment if you’re out of work. Neither independent contractors, nor their clients or customers, pay state or federal unemployment taxes.

Independent contractors have some easy-to-identify benefits for the bottom line. Because you aren’t paying employment taxes and providing benefits for them, contractors can often cost less than full-time employees.

However, as sole proprietors, independent contractors do not necessarily pay taxes on their gross earnings. Applicable business expenses can reduce their overall tax obligation. The difference between gross earnings and business expenses is the net income, the amount on which taxes are due. As of 2019 independent contractors pay 12.4% in Social Security contributions and 2.9% in Medicare payments on the first $132,900 of their net income, plus 2.9% on their net income in excess of $132,900.

- Since your level of oversight over independent contractors is relatively low, your level of financial and legal responsibility is low, as well.

- And, as their own business owners, 1099 workers aren’t eligible for the benefits you might offer your W2 employees, such as health insurance, paid time off, and overtime.

We’ve broken down what independent contractors can expect to pay in taxes this year and included some helpful tips to assist you in getting the most money possible from your deductions and credits. An independent contractor who becomes unable to find work is not eligible for unemployment benefits.

Becoming a W2 Contractor

Since your level of oversight over independent contractors is relatively low, your level of financial and legal responsibility is low, as well. 1099 workers pay both employee and employer self-employment taxes—so, if you choose to hire an independent contractor, your business doesn’t need to pay payroll taxes. And, as their own business owners, 1099 workers aren’t eligible for the benefits you might offer your W2 employees, such as health insurance, paid time off, and overtime. As an independent contractor, you’ll usually make more money than if you were an employee. Independent contractors also may deduct more business expenses than employees typically can claim.

Income up to $118,500 is subject to Social Security tax and all your income is subject to Medicare taxes. However, you don’t have to pay for benefits or Social Security, Medicare, or unemployment taxes when you hire a contractor. Because of that, many businesses find independent contractors to be more cost efficient. Generally, you have more control over the work that an employee does than you do with a contractor.

By law, employees are guaranteed at least minimum wage (set by both federal and state laws) for the time they’ve worked on a regular and ongoing basis. Companies withhold their W2 workers’ Social Security and Medicare taxes, and pay employer payroll taxes. In most cases, a company can let an employee go for poor performance or any other valid, non-discriminatory reason. An independent contractor, on the other hand, works and receives pay according to the terms of a signed contract between the parties. Because of the issues that can arise around whether a worker is an employee or a contractor, some skittish employers won’t hire contractors who use their social security numbers as taxpayer IDs.

While this change did not impact independent contractors, it’s still a lot of money. To put it into perspective, taxpayers deducted $35 billion dollars in unreimbursed business mileage in 2016.

Deciding between contracting and full time employment is no easy task, especially with ongoing changes to employment law. Reach out to a KORE1 team member today to discuss your options and which is the best fit for you.

What does contract on w2 mean?

Becoming a W2 Contractor Working as a W2 contractor is a comparable setup to that of a full-time employee, except on a temporary, contract basis. When it comes to filing taxes, your employer will withhold income taxes on your behalf, along with withholding and paying Social Security and Medicare.

Independent contractors pay a self-employment tax because the businesses they work with don’t withhold Social Security or Medicare taxes for them. The self-employment tax rate (made up of Social Security and Medicare taxes) is 15.3 percent.

As I said in the beginning, these are essentially the same taxes, just with different names. 1099 workers, or independent contractors, are self-employed.You can hire 1099 workers for specific projects, but you can’t control when or how they complete their jobs. You’re not responsible for covering their Medicare and Social Security taxes, and you won’t provide them with the same benefits as you would for a W2 worker. But thanks to the 2017 Trump tax reform, this is no longer the case.

As such, they must be ready to compete on the global market for work. Being an independent contractor has downsides, as they have no access to unemployment insurance or workers’ compensationpayments. As a W2 employee, your employer pays half of your Social Security and Medicare, which independent contractors are 100% responsible for. You’re also more likely to be eligible for a variety of benefits from your employer, such as healthcare, paid time off, and 401(k) options.

You don’t usually have to withhold or pay taxes on payments to an independent contractor. If you feel like your own job falls somewhere between contractor and employee, you’re not alone. The Treasury Department estimates that employers nationwide misclassify millions of workers as independent contractors instead of employees, thus avoiding having to pay employment taxes. Many small business owners choose to work with independent contractors because of the perceived cost savings. 1099 and W2s are the different tax forms used to deduct payroll taxes on different types of employees.

How H-1B Visa Uncertainty Affects U.S. Employers, Job Seekers, and Consumers

Unlike employees, independent contractors are required to withhold their own federal, state, and local taxes. In contrast, independent contractors must provide benefits for themselves, including paying both the employee and employer portions of Social Security and Medicare payments, among other expenses. The independent contractor must still meet the payer’s quality standard and time frame while producing the product. Independent contractors often work for employers who are physically far removed from their location.