Income Statement

Cash flows provide more information about cash assets listed on a balance sheet and are related, but not equivalent, to net income shown on the income statement. But combined, they provide very powerful information for investors.

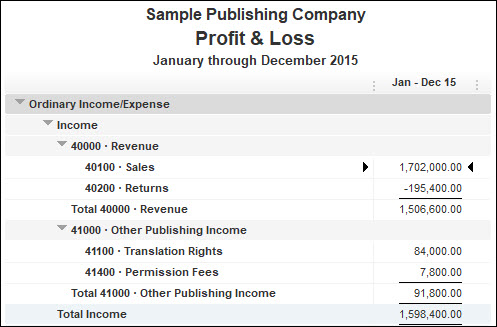

It’s usually assessed quarterly and at the end of a business’s accounting year. Business owners use profit and loss statements to determine whether they should improve the bottom line by increasing revenues, cutting costs, or both.

Even if you don’t need money for your small business startup from a bank or other lender, you will need several financial statements to help you make some decisions. The most important financial statement any business needs is a profit and loss statement (called a “P&L”). Balance sheets are built more broadly, revealing what the company owns and owes, as well as any long-term investments. Unlike an income statement, the full value of long-term investments or debts appears on the balance sheet.

Although this brochure discusses each financial statement separately, keep in mind that they are all related. The changes in assets and liabilities that you see on the balance sheet are also reflected in the revenues and expenses that you see on the income statement, which result in the company’s gains or losses.

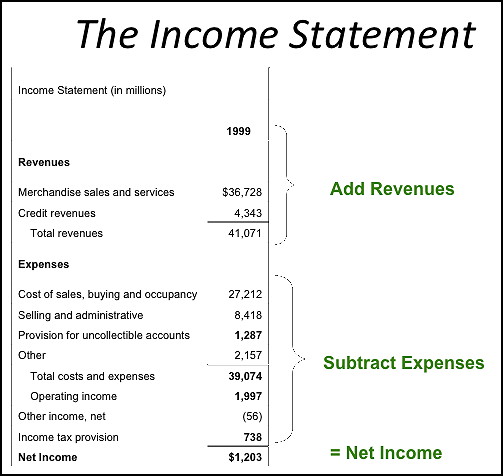

The income statement lists revenue and expenses for a given period of time, but at the end of the reporting period, those accounts are zeroed out. An income statement is comprised of a business’s income and expenses over a period of time.

The name balance sheet is derived from the way that the three major accounts eventually balance out and equal each other. All assets are listed in one section, and their sum must equal the sum of all liabilities and the shareholders’ equity.

The P&L statement reveals the company’s realized profits or losses for the specified period of time by comparing total revenues to the company’s total costs and expenses. Over time, it can show a company’s ability to increase its profit, either by reducing costs and expenses, or by increasing sales.

Save yourself the time and effort and just review the company’s statement of cash flows, included with its financial statements. The statement of cash flows includes the cash impact of changes to accounts payable and accounts receivable, as well as every other material impact on cash from both the income statement and balance sheet. A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The P&L statement shows a company’s ability to generate sales, manage expenses, and create profits.

Do accounts payable go on the income statement?

One of the major differences between the balance sheet and the P&L statement involves their respective treatments of time. The balance sheet summarizes the financial position of a company for one specific point in time. The P&L statement shows revenues and expenses during a set period of time. The length of the period of time covered in the P&L statement may vary, but common intervals include quarterly and annual statements. The balance sheet is often much more detailed than the income statement, as it requires a full inventory of every asset and liability a company has on its books at any given time.

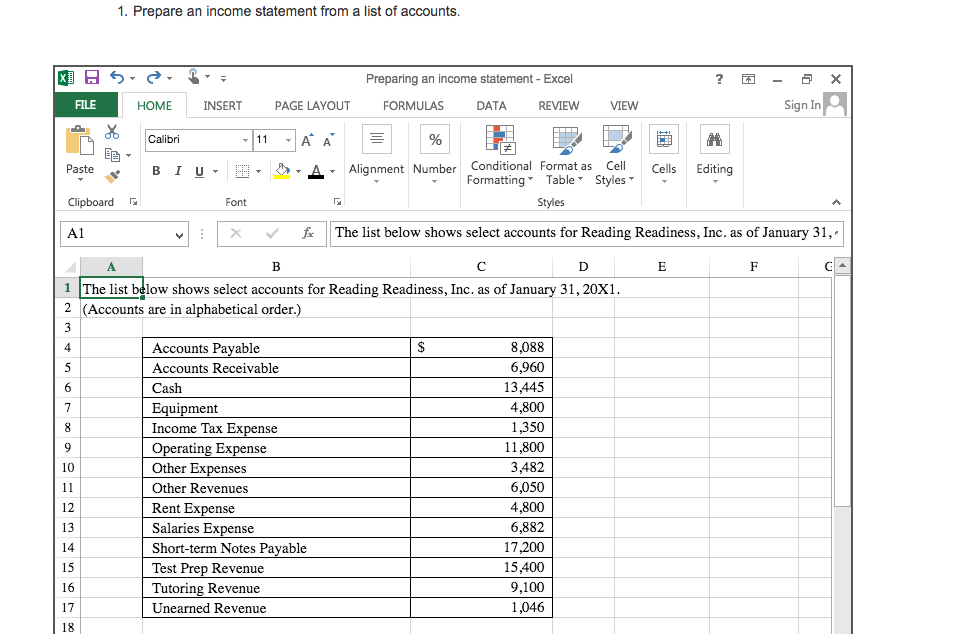

What accounts go on the income statement?

A few of the many income statement accounts used in a business include Sales, Sales Returns and Allowances, Service Revenues, Cost of Goods Sold, Salaries Expense, Wages Expense, Fringe Benefits Expense, Rent Expense, Utilities Expense, Advertising Expense, Automobile Expense, Depreciation Expense, Interest Expense,

- Companies publish income statements annually, at the end of the company’s fiscal year, and may also publish them on a quarterly basis.

- The P&L statement reveals the company’s realized profits or losses for the specified period of time by comparing total revenues to the company’s total costs and expenses.

Regulatory groups, standards boards, and tax authorities allow or require companies to use conventions such as depreciation expense, cost allocation, and accrual accounting on the Income statement. Direct reports of actual cash flow gains and losses for the period appear on another reporting instrument, the Statement of changes in financial position (or Cash flow statement). A profit and loss statement, also called an income statement, shows a business’s revenue, expenses, and net income over a specific period of time.

How to Prepare an Income Statement? A Simple 10 Step Business Guide

Note by the way, that reports of “Income,” “Revenues,” and “Expenses” do not necessarily represent real cash inflows or outflows. Not all of these signal the presence of “cash flow” for the following reason.

These records provide information about a company’s ability—or lack thereof—to generate profit by increasing revenue, reducing costs, or both. The P&L statement is also referred to as the statement of profit and loss, the statement of operations, the statement of financial results, and the income and expense statement. are both important financial statements that detail the financial accounting of a company. The balance sheet details a company’s assets and liabilities at a certain period of time, while the income statement details income and expenses over a period of time (usually one year). The income statement, also called theprofit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

An income statement can be run at any time during the fiscal year to determine profitability. A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses.

Free Financial Statements Cheat Sheet

This period is usually a year, or annually, but can also be monthly or quarterly. The income statement is often referred to as the profit and loss statement (P&L).

Generate a Trial Balance Report

Companies publish income statements annually, at the end of the company’s fiscal year, and may also publish them on a quarterly basis. Accountants, analysts, and investors study a P&L statement carefully, scrutinizing cash flow and debt financing capabilities. For public companies, there’s a much easier way to find the end result instead of doing all the math yourself.

AccountingTools

And information is the investor’s best tool when it comes to investing wisely. Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions. Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities.

A full set of financial statements should also provide some clues to the overall soundness of your bookkeeping. If your profit and loss statements show that you consistently make a profit, yet your balance sheet shows that you’re chronically short on cash, a savvy lender will rightfully have some questions to ask. Similarly, if your income statement shows you losing money year after year, yet you have incurred no debt, lenders and investors will want to know how you’ve covered your losses. Your net income or net loss equals your total revenues minus your total expenses for an accounting period. Net income or loss is represented on the income statement and statement of owner’s equity in year-end or quarterly financial statements.