Immediate Annuities Explained: Convert Assets to Income

Valuation of life annuities may be performed by calculating the actuarial present value of the future life contingent payments. Life tables are used to calculate the probability that the annuitant lives to each future payment period. If provided by an insurance company, the company guarantees a fixed return on the initial investment. Fixed annuities are not regulated by the Securities and Exchange Commission. The annuitization method is an annuity distribution structure providing periodic income payments for the annuitant’s life, or a specified period of time.

This is due to the concept known as the time value of money, which states that money available today is worth more than the same amount in the future because it has the potential to generate a return and grow. An annuity is a financial investment that generates regular payments for a set time period. In modern times, an annuity is most often purchased through an insurance company or a financial services company.

Still, as a way to guarantee a stream of income for as long as you live, an immediate annuity can be extremely useful. An immediate annuity is the easiest type of annuity for most people to understand, because in its most common form, it has very basic provisions.

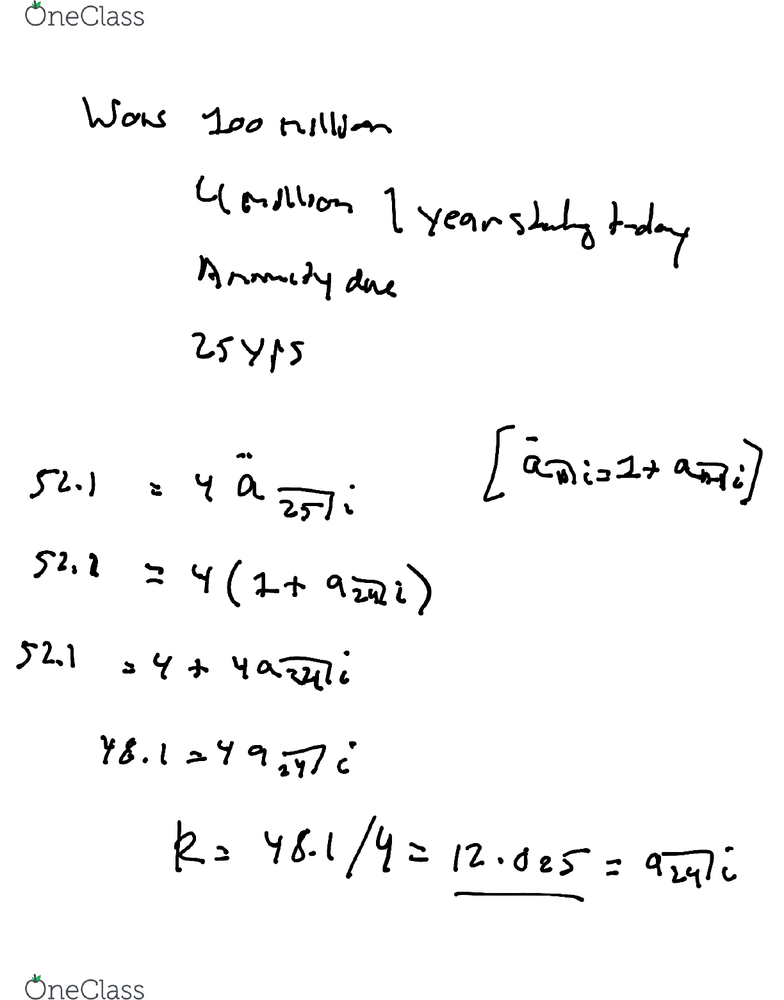

Annuity Due Overview

If you die before your entire premium is returned to you, the insurance company keeps the remainder. You can reduce the likelihood of such a scenario by purchasing a life annuity with period certain. With animmediate annuity, also known as a SPIA, you begin receiving payments within a year of purchasing the annuity. If you’re about to retire, it can be a good way to use a part of your retirement savings to create an income stream.

Annuity’s Present Value

Ordinary annuities are seen in retirement accounts, where you receive a fixed or variable payment every month from an insurance company, based on the value built up in the annuity account. In a fixed annuity account, your monthly payment is based on a fixed interest rate applied to the account balance at the start of payments. Variable annuity account payments are based on the investment performance of your account. How to fund your retirement and protect yourself financially is an important part of planning your future. Basing your entire retirement plan on assumptions about future rates of return can be dangerous, leaving you seriously underfunded when you need income the most.

An annuity account is meant to pay you money each month for either a fixed number of years or until you die, according to your contract with the insurance company. The largest insurance carriers are likely to make all payments on time, but annuities from smaller carriers carry some risk that the insurer will default on its payments. An annuity is a series of payments at a regular interval, such as weekly, monthly or yearly. Fixed annuities pay the same amount in each period, whereas the amounts can change in variable annuities.

Similarly, when a company pays dividends, which typically happens quarterly, it is paying at the end of the period during which it retained enough excess earnings to share its proceeds with its shareholders. One instance where the difference between an annuity in advance and an annuity in arrears matters is in the valuation of income properties. If payments are received at the beginning of the rental period rather than at the end of the rental period, the present value of those payments increases. It is also possible to use mathematical formulas to compute the present and future values of an annuity in advance or an ordinary annuity. One of the big selling points for a fixed annuity is that it is actually an insurance contract, and as such, it is based upon guarantees made by the insurance company.

That’s because insurance companies pool your money with other policyholders’ money, invest it, and then distribute annuity payments to everyone. An ordinary annuity is a series of equal payments made at the end of consecutive periods over a fixed length of time. While the payments in an ordinary annuity can be made as frequently as every week, in practice, they are generally made monthly, quarterly, semi-annually, or annually. The opposite of an ordinary annuity is an annuity due, in which payments are made at the beginning of each period.

The first and last payments of an annuity due both occur one period before they would in an ordinary annuity, so they have different values in the future. Period certain annuities are similar to straight-life annuities, but they include a minimum time period for the payments — say 10 or 20 years — even if the annuitant dies. If the annuity holder dies before the end of the period, the payments for the rest of that time will go abeneficiaryor the annuitant’s estate. Also known as a straight-life or life-only annuity, a single-life annuity allows you to receive payments your entire life. Unlike some other options that allow for beneficiaries or spouses, this annuity is limited to the lifetime of the annuitant with no survivor benefit.

What is the difference between an annuity and an annuity due?

An annuity due is a repeating payment that is made at the beginning of each period, such as a rent payment. It has the following characteristics: All payments are in the same amount (such as a series of payments of $500). All payments are made at the same intervals of time (such as once a month or year).

The Present Value (PV) of an annuity can be found by calculating the PV of each individual payment and then summing them up. As in the case of finding the Future Value (FV) of an annuity, it is important to note when each payment occurs.

- In simple terms, you buy an annuity plan with one large payment or series of contributions.

- The money you put in grows through various investments made by the financial institution.

- From there, the financial institution distributes money back to you for a certain time frame, depending on what kind of annuity you purchase.

Two other common examples of ordinary annuities are interest payments from bonds and stock dividends. When a bond issuer makes interest payments, which generally happens twice a year, the interest is paid and received at the end of the period in question.

But if you die within two months of taking income and do not choose a “period certain” (such as 10 years), the insurance company keeps the principal that you put into the annuity. A fixed annuity is an annuity whose value increases based on stated returns within the annuity contract. Payouts on most immediate annuities are interest rate sensitive, and so when rates are low, the amount of future income you’ll get from an immediate annuity can be relatively small.

The valuation of an annuity entails concepts such as time value of money, interest rate, and future value. Annuities that provide payments that will be paid over a period known in advance are annuities certain or guaranteed annuities. A common example is a life annuity, which is paid over the remaining lifetime of the annuitant.

A lifetime annuity is a cost effective, safe way to convert some of your finances into a guaranteed lifetime income stream. Either way, the fees and charges on annuities will conspire to diminish your retirement income. Since payments are made sooner with an annuity due than with an ordinary annuity, an annuity due typically has a higher present value than an ordinary annuity. On the other hand, when interest rates fall, the value of an ordinary annuity goes up.

Still another variation, the life with period-certain annuity, or period certain plus life annuity, combines the features of fixed-period and life annuities. With this type of plan, the annuitant is guaranteed payment for life but can also choose a fixed period of guaranteed payment. The answer is never simple, and it is almost impossible to calculate an accurate figure due to variables like healthcare costs, taxes, emergency expenses, and the performance of financial markets. Problems arise when you think you have enough money for retirement but you really don’t, especially you leave yourself vulnerable to running out of income. In some cases, buying a life annuity can be a simple yet effective part of the solution.

In simple terms, you buy an annuity plan with one large payment or series of contributions. From there, the financial institution distributes money back to you for a certain time frame, depending on what kind of annuity you purchase. The money you put in grows through various investments made by the financial institution. There are immediate annuities, meaning you would get your monthly payments immediately, as well as deferred annuities where the principal is held for a certain period of time before being distributed back to you. Fixed rate annuities guarantee a certain payment that does not fluctuate, while variable rate annuities’ income payout depends on the underlying investment performance.

On the other hand, spending $185,000 for a life annuity will guarantee your retirement income. This comes at a loss of access to this money, but you don’t have to worry about financial markets or predict how long you will live. Low returns can require more of a nest egg than you planned for, and what happens if you live longer than expected. The payments last your lifetime, are guaranteed, and can be a positive part of your retirement portfolio.

Annuity due

Certain and life annuities are guaranteed to be paid for a number of years and then become contingent on the annuitant being alive. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, monthly insurance payments and pension payments. The payments (deposits) may be made weekly, monthly, quarterly, yearly, or at any other regular interval of time. Annuitization is the process of converting an annuity investment into a series of periodic income payments, and is often used in life insurance payouts.

Annuity in Advance vs. Annuity in Arrears

This is the case withannuities, which provide guaranteed income in retirement but limit access to the money that funds those income payments for a period of time. Annuity purchasers have options regarding how the annuity payouts are structured. These include when payments begin, how long they last and whether money will go to a beneficiary when the annuitant dies.

In contrast, an annuity due features payments occurring at the beginning of each period. A big part of an annuity is a guarantee that you will continue to receive an income, no matter how the stock market performs or how long you will live. However, the insurance company will charge a large fee to make this guarantee and sometimes even keep any remaining funds if you die before the amount deposited has been fully paid out. So, if you are confident that you have sufficient funds to last during retirement and don’t need an insurance company sending you a guaranteed monthly income, there is no reason to buy an annuity. Valuation of an annuity entails calculation of the present value of the future annuity payments.

It seems that with annuity plans you are paying a lot with the hopes of reduced risk and guaranteed income. The opportunity cost of putting most of a retirement nest egg into an annuity is just too great. If you annuitize and choose lifetime payments, the payments usually stop at death (or the second death, if you chose joint lifetime payments). Whether or not you come out ahead depends on several factors, including how long you live. The insurance company is intimately familiar with statistics, so if you live an unexpectedly long life, you may end up receiving more than expected.

Two of the most common annuity payouts are period certain, which guarantees income for a specific time period, and guaranteed lifetime payments. The main sales pitch for annuities is that they provide a regular income stream in retirement that lasts for the rest of your life. If the money you invest in an annuity is depleted before you die, you will continue to receive the same amount of income.

A typical fixed immediate annuity involves your making a lump-sum payment to an insurance company upfront, in exchange for the right to receive payments from the insurer on a regular basis beginning immediately. You can structure an immediate annuity to pay for the rest of your life, for a fixed period of time, or for as long as you and another person you choose as a beneficiary are still living. Ordinary annuity payments are usually made monthly, quarterly, semiannually, or annually. When a homeowner makes a mortgage payment, it typically covers the month-long period leading up to the payment date.