IFRS Vs GAAP: Balance Sheet and Income Statement

The balance sheet is a formal document that follows a standard accounting format showing the same categories of assets and liabilities regardless of the size or nature of the business. Accounting is considered the language of business because its concepts are time-tested and standardized. Even if you do not utilize the services of a certified public accountant, you or your bookkeeper can adopt certain generally accepted accounting principles ( GAAP ) to develop financial statements.

The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets. Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset. Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetary value of the assets owned by that firm.

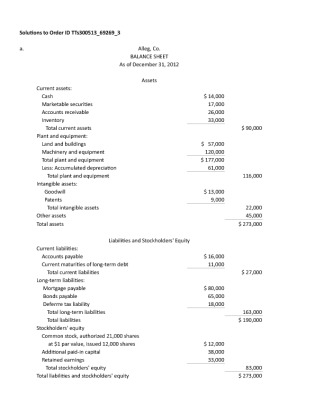

A balance sheet is a financial statement that reports a company’s assets, liabilities and shareholders’ equity at a specific point in time. In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid.

Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle. An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales. An example of a current liability is money owed to suppliers in the form of accounts payable.

There are three primary limitations to balance sheets, including the fact that they are recorded at historical cost, the use of estimates, and the omission of valuable things, such as intelligence. Some of the current assets are valued on estimated basis, so the balance sheet is not in a position to reflect the true financial position of the business. Intangible assets like goodwill are shown in the balance sheet at imaginary figures, which may bear no relationship to the market value. The International Accounting Standards Board (IASB) offers some guidance (IAS 38) as to how intangible assets should be accounted for in financial statements. In general, legal intangibles that are developed internally are not recognized, and legal intangibles that are purchased from third parties are recognized.

As you study about the assets, liabilities, and stockholders’ equity contained in a balance sheet, you will understand why this financial statement provides information about the solvency of the business. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased. This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded.

It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. Accounts payable is typically one of the largest current liability accounts on a company’s financial statements, and it represents unpaid supplier invoices. Companies try to match payment dates so that their accounts receivables are collected before the accounts payables are due to suppliers.

A current asset on the balance sheet is an asset which can either be converted to cash or used to pay current liabilities within 12 months. Typical current assets include cash and cash equivalents, short-term investments, accounts receivable, inventories and the portion of prepaid liabilities which will be paid within a year. Current assets include resources that are consumed or used in the current period.

Understanding GAAP and IFRS guidelines can be an asset, no matter your profession or industry. Generally accepted accounting principles (GAAP) refer to a common set of accounting principles, standards, and procedures issued by the Financial Accounting Standards Board (FASB). Public companies in the United States must follow GAAP when their accountants compile their financial statements. GAAP is a combination of authoritative standards (set by policy boards) and the commonly accepted ways of recording and reporting accounting information. GAAP aims to improve the clarity, consistency, and comparability of the communication of financial information.

What is the difference between a balance sheet and a classified balance sheet?

A classified balance sheet is a financial statement that reports asset, liability, and equity accounts in meaningful subcategories for readers’ ease of use. In other words, it breaks down each of the balance sheet accounts into smaller categories to create a more useful and meaningful report.

What a Business Owns

The balance sheet, sometimes called the statement of financial position, lists the company’s assets, liabilities,and stockholders ‘ equity (including dollar amounts) as of a specific moment in time. That specific moment is the close of business on the date of the balance sheet. A balance sheet is like a photograph; it captures the financial position of a company at a particular point in time.

Also, merchandise inventory is classified on the balance sheet as a current asset. Current liabilities are typically settled using current assets, which are assets that are used up within one year. Current assets include cash or accounts receivables, which is money owed by customers for sales. The ratio of current assets to current liabilities is an important one in determining a company’s ongoing ability to pay its debts as they are due.

- The balance sheet is a formal document that follows a standard accounting format showing the same categories of assets and liabilities regardless of the size or nature of the business.

- Accounting is considered the language of business because its concepts are time-tested and standardized.

It covers money and other valuables belonging to an individual or to a business. Current liabilities are financial obligations of a business entity that are due and payable within a year. A liability occurs when a company has undergone a transaction that has generated an expectation for a future outflow of cash or other economic resources. The Working Capital Cycle for a business is the length of time it takes to convert the total net working capital (current assets less current liabilities) into cash.

Current assets are those assets which can either be converted to cash or used to pay current liabilities within 12 months. Current assets include cash and cash equivalents, short-term investments, accounts receivable, inventories and the portion of prepaid liabilities paid within a year.

Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets.

Classified Balance Sheet: Definition & Example

The strength of GAAP is the reliability of company data from one accounting period to another and the ability to compare the financial statements of different companies. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition. ” Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year.

Businesses typically try to manage this cycle by selling inventory quickly, collecting revenue quickly, and paying bills slowly, to optimize cash flow. There are some key differences between how corporate finances are governed in the US and abroad.

Assets Section

The reason why a classified balance sheet is so important is because it helps organize those assets into categories. Examples of current assets are cash, checking, and savings accounts and inventory. The current ratio measures a company’s ability to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables.

Equity Section

Therefore, there is a disconnect–goodwill from acquisitions can be booked, since it is derived from a market or purchase valuation. However, similar internal spending cannot be booked, although it will be recognized by investors who compare a company’s market value with its book value. In financial accounting, owner’s equity consists of the net assets of an entity. Net assets is the difference between the total assets of the entity and all its liabilities. Equity appears on the balance sheet, one of the four primary financial statements.

This can be compared with current assets such as cash or bank accounts, which are described as liquid assets. The current liabilities of most small businesses include accounts payable, notes payable to banks, and accrued payroll taxes. Accounts payable is the amount you may owe any suppliers or other creditors for services or goods that you have received but not yet paid for. Notes payable refers to any money due on a loan during the next 12 months. Accrued payroll taxes would be any compensation to employees who have worked, but have not been paid at the time the balance sheet is created.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Why is a classified balance sheet important?

accumulated depreciation definition. Accumulated Depreciation is a long-term contra asset account (an asset account with a credit balance) that is reported on the balance sheet under the heading Property, Plant, and Equipment.

We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. Sometimes, companies use an account called “other current liabilities” as a catch-all line item on their balance sheets to include all other liabilities due within a year that are not classified elsewhere. Current liability accounts can vary by industry or according to various government regulations. Adjustments are sometimes also made, for example, to exclude intangible assets, and this will affect the formal equity; debt to equity (dequity) will therefore also be affected. A non-current asset is a term used in accounting for assets and property which cannot easily be converted into cash.