How to Write an Analysis Essay: Top 7 Rules for a Good Analysis

External auditors follow a set of standards different from that of the company or organization hiring them to do the work. The biggest difference between an internal and external audit is the concept of independence of the external auditor. External audits can include a review of both financial statements and a company’s internal controls.

How to Audit Revenue

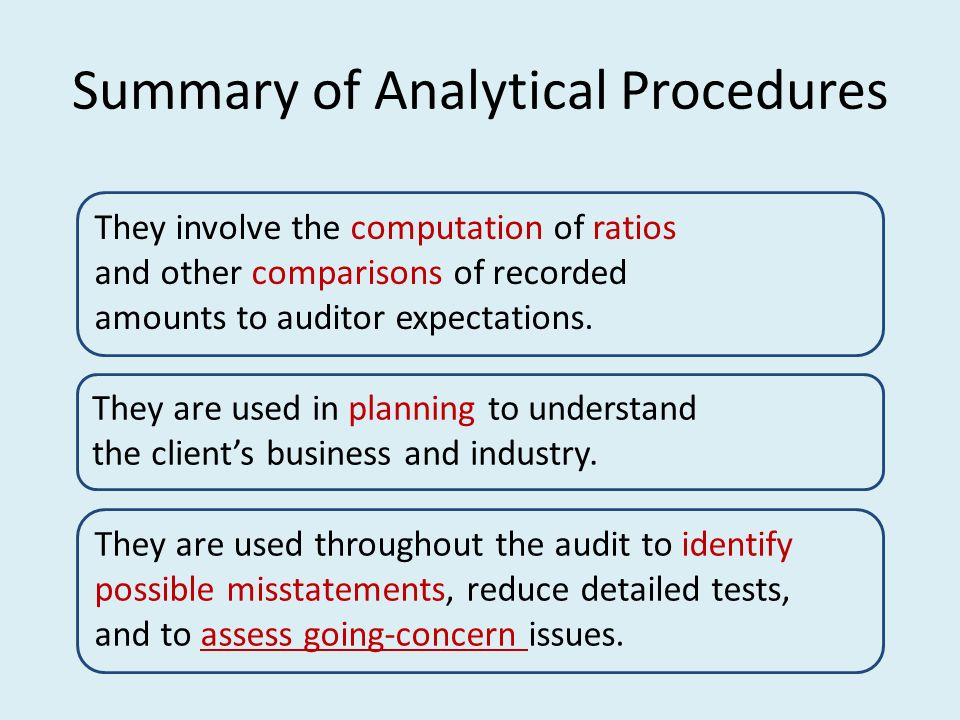

Within the risk assessment standards auditors are required to perform risk assessment procedures that include analytical procedures and management inquiries. Preliminary analytical review therefore entails a significant component of the risk assessment process. Within a review engagement audit evidence consists solely of analytical procedures and management inquiry procedures. There is a common denominator between review engagement procedures and preliminary analytical review procedures. Analytical procedures should be applied to some extent for the purposes referred to in (a) and (c) above for all audits of financial statements made in accordance with generally accepted auditing standards.

What is the purpose of analytical procedures in an audit?

Analytical procedures are a type of evidence used during an audit. Analytical procedures involve comparisons of different sets of financial and operational information, to see if historical relationships are continuing forward into the period under review.

For example, management may elect to defer advertising expense based on the results of operations for the period. An analytical review might detect a sharp drop in advertising expense from the prior year or budget the auditor would need to investigate. Analysis of the current year financial information with the prior years’ data can also be effective in discerning potential audit problems. Suppose your company has had stable gross margins in the last several years, and this year margin has increased significantly.

A wide variety of analytical procedures may be useful for this purpose. Results of an overall review may indicate that additional evidence may be needed. Different financial statement relationships have varying degrees of reliability.

Analytical Procedures in Planning the Audit

What are some examples of analytical procedures?

Analytical procedures are performed as an overall review of the financial statements at the end of the audit to assess whether they are consistent with the auditor’s understanding of the entity. Final analytical procedures are not conducted to obtain additional substantive assurance.

An analytical review in accounting is used by auditors to assess the reasonableness of account balances. Within those two broad areas, analytical procedures examples can include balance sheet and leverage ratios, cash flow statement analysis and rates of return and profitability analysis. The auditor investigates any unusual or unexpected variation from expected results the analytical procedures reveal. These variations could be caused by several factors in your company including, but not limited to, new products and lines of business, unusual transactions, changes in business or accounting methods, or even accounting errors or irregularities. The usual method of investigating unexpected fluctuations is asking management to explain the variances.

When a satisfactory explanation for the variance cannot be obtained, the auditor should perform other audit work to obtain evidence about the correctness of the balance in question. The objective of analytical procedures used in the overall review stage of the audit is to assist the auditor in assessing the conclusions reached and in the evaluation of the overall financial statement presentation.

AccountingTools

The analytical review procedure would reveal this change, and the auditor would need to investigate the cause of the increased gross margin. The purpose of applying analytical procedures in planning the audit is to assist in planning the nature, timing, and extent of auditing procedures that will be used to obtain evidential matter for specific account balances or classes of transactions. Thus, the objective of the procedures is to identify such things as the existence of unusual transactions and events, and amounts, ratios and trends that might indicate matters that have financial statement and audit planning ramifications. Financial statement analysis is the process of analyzing a company’s financial statements for decision-making purposes. Example of analytical review of financial statements requires understanding.

- The auditor considers the level of assurance, if any, he wants from substantive testing for a particular audit objective and decides, among other things, which procedure, or combination of procedures, can provide that level of assurance.

Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited. For material financial statement accounts analytical procedures will be used in conjunction with other substantive tests. However where an item is not material the auditor may solely rely on analytical procedures.

The objective of analytical procedures in the overall review at the end of audit is to evaluate reasonableness of financial statements as a whole. As a result of planning and the knowledge gained through audit procedures the auditor would not normally expect to find any major unexpected variations. However, in those cases where variations are revealed it may be necessary to perform additional procedures or re perform the original procedures. In review engagements, analytical procedures are used to help provide limited assurance that the financial statements don’t require material adjustments. Analytical procedures are effective tests of balances in which misstatements cannot be detected from examining the detailed evidence.

For other assertions, however, analytical procedures may not be as effective or efficient as tests of details in providing the desired level of assurance. When designing substantive analytical procedures, the auditor also should evaluate the risk of management override of controls. As part of this process, the auditor should evaluate whether such an override might have allowed adjustments outside of the normal period-end financial reporting process to have been made to the financial statements. Such adjustments might have resulted in artificial changes to the financial statement relationships being analyzed, causing the auditor to draw erroneous conclusions. For this reason, substantive analytical procedures alone are not well suited to detecting fraud.

A stable environment usually produces more predictable relationships than a changing environment. Income statement relationships tend to be more predictable than balance sheet accounts relationships because the income statement represents transactions over a period of time. Balance sheet accounts represent amounts at a single point in time and are therefore less reliable in an analytical review. Accounts subject to management discretion are also less predictable.

If not, it can imply that the client’s financial records are incorrect, possibly due to errors or fraudulent reporting activity. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls. The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

In addition, in some cases, analytical procedures can be more effective or efficient than tests of details for achieving particular substantive testing objectives. Analytical procedures are an important part of the audit process and consist of evaluations of financial information made by a study of plausible relationships among both financial and nonfinancial data. Analytical procedures range from simple comparisons to the use of complex models involving many relationships and elements of data. A basic premise underlying the application of analytical procedures is that plausible relationships among data may reasonably be expected to exist and continue in the absence of known conditions to the contrary. Particular conditions that can cause variations in these relationships include, for example, specific unusual transactions or events, accounting changes, business changes, random fluctuations, or misstatements.

For example, comparisons of total salaries expense with headcount (an example of comparing your company’s financial information with its non-financial information) may indicate unauthorized payments not apparent from testing individual transactions. These procedures can indicate possible problems with the financial records of a client, which can then be investigated more thoroughly. Analytical procedures involve comparisons of different sets of financial and operational information, to see if historical relationships are continuing forward into the period under review. In most cases, these relationships should remain consistent over time.

According to the Association for Financial Professionals, there are six steps to developing an effective analysis of financial statements. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials.

Analytical review assumes these financial relationships are stable from period to period. After performing the analytical review, the auditor must investigate and explain any significant deviations from the expected values. The ordinary process is to ask management to explain the fluctuation and then to corroborate the explanations with additional work. Analytical procedures used in planning the audit generally use data aggregated at a high level. Furthermore, the sophistication, extent and timing of the procedures, which are based on the auditor’s judgment, may vary widely depending on the size and complexity of the client.

What Is Analytical Review in Auditing?

Analytical review procedures are one of two types of substantive audit procedures. They evaluate the relationship among financial data to determine if financial statement information is materially correct.

For some entities, the procedures may consist of reviewing changes in account balances from the prior to the current year using the general ledger or the auditor’s preliminary or unadjusted working trial balance. In contrast, for other entities, the procedures might involve an extensive analysis of quarterly financial statements. In both cases, the analytical procedures, combined with the auditor’s knowledge of the business, serve as a basis for additional inquiries and effective planning. Preliminary analytical review has been defined as both analytical procedures and management inquiry procedures applied during the planning stage of the audit.

The auditor considers the level of assurance, if any, he wants from substantive testing for a particular audit objective and decides, among other things, which procedure, or combination of procedures, can provide that level of assurance. For some assertions, analytical procedures are effective in providing the appropriate level of assurance.