How to Prepare a Cash Flow Statement

Steps two through four involve calculating the incoming and outgoing cash for operating, investing, and financing activities. Operating activities are the actions the business undertakes as a normal course of doing business. Investing activities include buying and selling securities as well as property, plant, and equipment. Financing activities involve borrowing cash from a bank, bondholders, or stockholders and repayment or dividends. Step five is to calculate net cash and, finally, in step six, we notate disclosures.

It includes all the cash brought in from sales, but not sales made on credit that haven’t actually been paid for. Similarly, it won’t show raw materials and other items that have been purchased on credit but not paid for. In short, cash flow statements are a measurement of how well a company is able to generate cash to fund operating expenses and pay debt obligations. Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements include the balance sheet, income statement, and cash flow statement.

This Business Builder assumes that you will be working through both methods in order to choose which method will work b est for you. Information on financing and investing activities included in the description of the direct method is important for both types of cash flow statements. Put all balance sheet changes on your statement of cash flows – Next, you should look at all the changes you recorded in the previous step and enter them into a blank cash flow statement.

With either method, the investing and financing sections are identical; the only difference is in the operating section. The direct method shows the major classes of gross cash receipts and gross cash payments. The indirect method, on the other hand, starts with the net income and adjusts the profit/loss by the effects of the transactions. In the end, cash flows from the operating section will give the same result whether under the direct or indirect approach, however, the presentation will differ.

US GAAP (FAS 95) requires that when the direct method is used to present the operating activities of the cash flow statement, a supplemental schedule must also present a cash flow statement using the indirect method. The International Accounting Standards Committee (IASC) strongly recommends the direct method but allows either method. The IASC considers the indirect method less clear to users of financial statements. Cash flow statements are most commonly prepared using the indirect method, which is not especially useful in projecting future cash flows. In short, a cash flow statement (also called a statement of cash flows) is a financial report that shows how cash has moved in and out of your business during a specific period of time.

How to Prepare a Statement of Cash Flows Using the Indirect Method

The indirect method reconciles net income to cash flow from your operations. We will look at each section of the statement of cash flows and put them all together at the end.

AccountingTools

The statement of cash flows is one of the core financial statements, along with the income statement and balance sheet, used to evaluate a business’s financial health. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. The statement of cash flows is one of the components of a company’s set of financial statements, and is used to reveal the sources and uses of cash by a business. It presents information about cash generated from operations and the effects of various changes in the balance sheet on a company’s cash position. A statement of cash flows provides details on incoming and outgoing cash transactions and explains net increases or decreases in cash.

Step 5: Make Adjustments for Non-cash Items from Other Information

Examples include cash receipts from customers, cash paid out to vendors, labor costs, and other operating expenses. The indirect method is widely used because the information is the easiest to gather.

- International Accounting Standard 7 (IAS 7) is the International Accounting Standard that deals with cash flow statements.

- Essentially, the cash flow statement is concerned with the flow of cash in and out of the business.

Cash Flow from Investing Activities

Some examples of cash receipts you use for the direct method are cash collected from customers, as well as interest and dividends the company receives. Examples of cash payments are cash paid to employees and other suppliers and interest paid on notes payable or other loans. There are three sections to a cash flow statement, operating activities, investing activities and financing activities. Together, the three sections of the cash flow statement work together to show the net change in cash for the period. The operating section of the statement of cash flows can be shown through either the direct method or the indirect method.

How to Prepare Statement of Cash Flows in 7 Steps

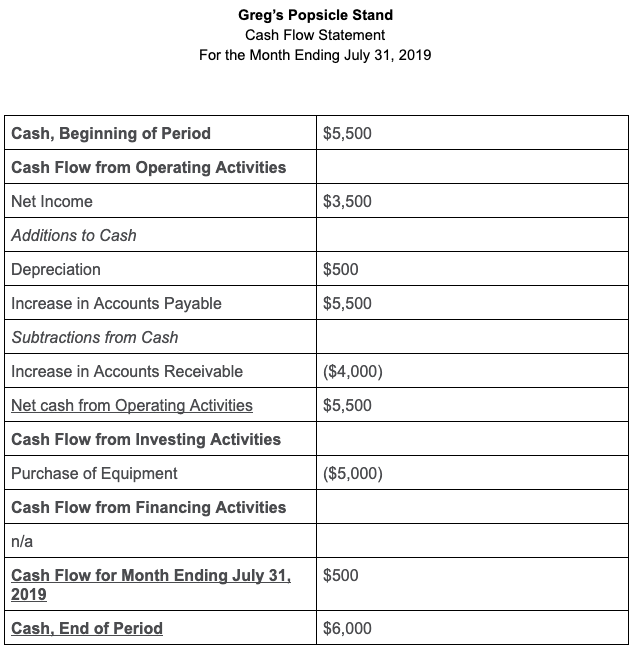

The Dells Company is preparing their annual financial statements for the year ended June 30, 2015. They have prepared the income statement, statement of retained earnings, and balance sheet. The statement of cash flows, also called the cash flow statement, is the fourth general-purpose financial statement and summarizes how changes inbalance sheetaccounts affect the cash account during the accounting period. It also reconciles beginning and ending cash and cash equivalents account balances. A cash flow statement is a financial statement that summarises the amount of cash that enters and leaves your business, giving you more information about the amount of working capital that’s available over a given period.

The first step is to calculate the new cash balance by subtracting beginning cash from ending cash. The difference will become beginning cash for the following year.

As such, the cash flow statement is used to evaluate how much cash your business brings in, and therefore, how your business manages both expenses and debts. In this way, the statement of cash flows reconciles the income statement and the balance sheet—serving along with those two reports as one of the three core financial statements for any business. Tracking your company’s cash balance can feel like an overwhelming task—but it doesn’t have to be. Preparing a cash flow statement on a regular basis gives you a clear, organized look into your cash flow position, a crucial piece in your business finances.

In fact, along with your income statement and balance sheet, a cash flow statement, also known as a statement of cash flows, is one of the three major financial statements in business accounting. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included. However, purchases or sales oflong-term assetsare not included in operating activities. We will continue working through the preparation of a cash flow statement using the direct method.

Before you start working on your statement, determine whether the indirect method or the direct method to prepare a cash flow statement makes the most sense, given your needs. Keep in mind that the method you select will only affect the operating activities section of your statement—as the investing and financing activities sections will look the same regardless of the method used. The indirect method of preparing a cash flow statement begins with your net income number, which is a measure of your profitability. Following net income, cash and non-cash items are reconciled from your business activities.

Be sure to place them in the appropriate section (i.e. operating activities, investing activities, or financial activities). The direct method of preparing the statement of cash flows shows the net cash from operating activities.

Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7) is the International Accounting Standard that deals with cash flow statements. A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time. This report shows how much cash a company receives and spends on operating, investing, and financing activities.