How to Do Petty Cash Accounting & Recording in 4 Steps

It is important to keep accurate records of all petty cash expenditures for bookkeeping purposes. Once this transaction is saved, QuickBooks will record a debit (increase) to the Petty Cash Fund and a credit (decrease) to the Business Checking account. Since this transaction involves two asset accounts, the balance sheet will be the only financial report affected. Check out our complete QuickBooks course to learn how to use QuickBooks to manage your income and expenses.

When a petty cash fund is in use, petty cash transactions are still recorded on financial statements. The journal entry for giving the custodian more cash is a debit to the petty cash fund and a credit to cash. Petty cash is a system that funds and tracks small purchases such as parking meter fees that aren’t suitable for check or credit card payments.

A petty cash fund is a small amount of money, usually under $500, used to cover incidentals. Petty cash accounting involves establishing a petty cash policy, setting up a petty cash log, creating journal entries, and reconciling the petty cash account. Accounting can be done manually or made easier with bookkeeping software and employee expense cards.

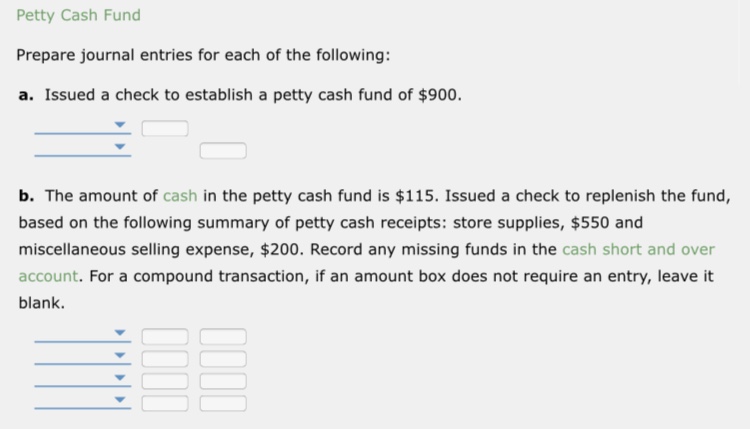

As discussed in the previous section, you generally withdraw money from your business checking account to fund petty cash. The journal entry that needs to be recorded is a debit (increase) to the petty cash fund and a credit (decrease) to the business checking account.

The accountant should write a check made out to “Petty Cash” for the amount of expenses paid for with the petty cash that month to bring the account back up to the original amount. The check should be cashed at the company’s bank and the cash placed back in the petty cash safe or lock box.

Establishing a petty cash fund

Petty cash transactions should be recorded at least once a month, if not more often. In the How to Set Up Petty Cash in QuickBooks section, we show you how QuickBooks records these purchases behind the scenes.

If you use Excel, head over to the How to Track Petty Cash with an Excel Spreadsheet to see how this works. While establishing a petty cash policy won’t eliminate common issues that may arise like theft, abuse of funds or lost receipts, it will help to minimize some of these issues. To further reduce these issues, many business owners are moving away from cash and instead using prepaid business cards.

Consider recording petty cash transactions in your books at least once per month. If you use an accounting software like QuickBooks, you can easily connect your business credit card account to the software and download all of your petty cash purchases with just a few clicks! If you use Excel, you can easily download your purchases to an Excel spreadsheet and the follow the instructions in Step 2 of the How to Record Petty Cash in Excel section.

Most companies keep a small amount of cash on hand to pay minor business-related expenses that don’t warrant the writing of a check or use of the corporate credit card. A petty cash fund is a convenient method to pay for small business transactions such as postage, delivery fees or emergency office supplies.

- When a petty cash fund is in use, petty cash transactions are still recorded on financial statements.

Petty cash accounting

Check out our How to Do Petty Cash Accounting with Business Credit Cards section for more details. The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund.

When petty cash is used for business expenses, the appropriate expense account — such as office supplies or employee reimbursement — should be expensed. That’s a long way of saying it’s “shoebox money” for expenses which are usually too small to bother using a credit card or writing a check. The petty cash account should be reconciled and replenished every month to ensure the account is balanced and any variances are accounted for.

A petty cash book is a ledger kept with the petty cash fund to record amounts that are added to or subtracted from its balance. Petty cash should be part of an overall business accounting system that documents how your business moves funds between one account and another and how it spends its money. Petty cash is a current asset and should be listed as a debit on the company balance sheet. To initially fund a petty cash account, the accountant should write a check made out to “Petty Cash” for the desired amount of cash to keep on hand and then cash the check at the company’s bank. The journal entry on the balance sheet should list a debit to the business bank account and a credit to the petty cash account.

How do you replenish petty cash journal entry?

At the same time, receipts are removed from the petty cash box and formally recorded as expenses. The journal entry for this action involves debits to appropriate expense accounts as represented by the receipts, and a credit to Cash for the amount of the replenishment.

Cash Short and Over

What is the journal entry for petty cash?

The petty cash journal entry is a debit to the petty cash account and a credit to the cash account. The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund. The cashier creates a journal entry to record the petty cash receipts.

The cashier creates a journal entry to record the petty cash receipts. This is a credit to the petty cash account, and probably debits to several different expense accounts, such as the office supplies account (depending upon what was purchased with the cash). The balance in the petty cash account should now be the same as the amount at which it started. Managing your petty cash funds begins as soon as the first check has been cashed to create the petty cash float. For example, if you have decided on a petty cash fund for $100, your petty cash account book entry will show a debit of $100 to your petty cash fund and a credit of $100 to your bank account.

For petty cash accounting, you must create a log detailing your transactions. And, you must record a petty cash journal entry when you put money into the petty cash fund and when money leaves the fund.

Petty cash tax deduction

Withdrawals made to the petty cash fund will be recorded as expenses. The journal entry that needs to be recorded is a debit (increase) to the appropriate expense accounts and a credit (decrease) to petty cash.