How to create a business budget: How to Prepare a Budget for an Organization: 4 Steps

Your budget should never be set in stone, but instead a living plan that can be adapted. Now that you have all your general numbers in front of you, it’s time to do the math to analyze your cash flow and create a smarter budget. You can find this by subtracting all expenses from your total revenue to determine profit. One of the main advantages of preparing a budget in your accounting software application is that you can track budget versus actual revenue and expenses.

This paints a clear picture of how they fluctuate depending on business performance so you can make accurate predictions. For example, you might increase production costs to get more raw materials to match the increasing popularity of certain products. Or if you are running a SaaS business, you might need to invest more budget in certain seasons to get more clients. So take some time to identify any other fixed costs necessary to run your business. Once you’ve identified them, sum them up to get a precise figure of your fixed costs on a month-to-month basis. Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

Examine your revenue

Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic. Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process.

- The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

- Here are a couple of steps you can take when creating your budget.

- Small business owners can often get a sense of what to expect by visiting other businesses that are for sale and asking questions about weekly revenue and traffic patterns.

- You can copy budget details from actuals for the prior year, copy data from an existing budget, or create a new budget from scratch.

- Download our free Strategic Budgets Field Guide here for more budgeting information or demo Divvy today.

- Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold.

Instead of thinking of the two documents as competing, view them as complementary, with each playing a role in driving your business’s performance. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. WordStream’s guest authors are experts, entrepreneurs, and passionate writers in the online marketing community who bring diverse perspectives to our blog on a wide range of topics.

Next PostHow to choose the right bank account for your business

An operating budget is a forecast and analysis of projected income and expenses over the course of a specified time period. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter—just give it your best guess. Better to set aside money for an emergency that doesn’t happen than to be blindsided.

- Constantly live out a spirit of generosity and encourage it in your team.

- Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

- You may, for example, move the money into a rainy day fund you can access should your actual income fall short of projections.

- To allocate funds for business expenses, you first need to determine your income and cash flow for the period to the best of your ability.

- So when planning for business growth, be sure to factor in your increased expenses as well.

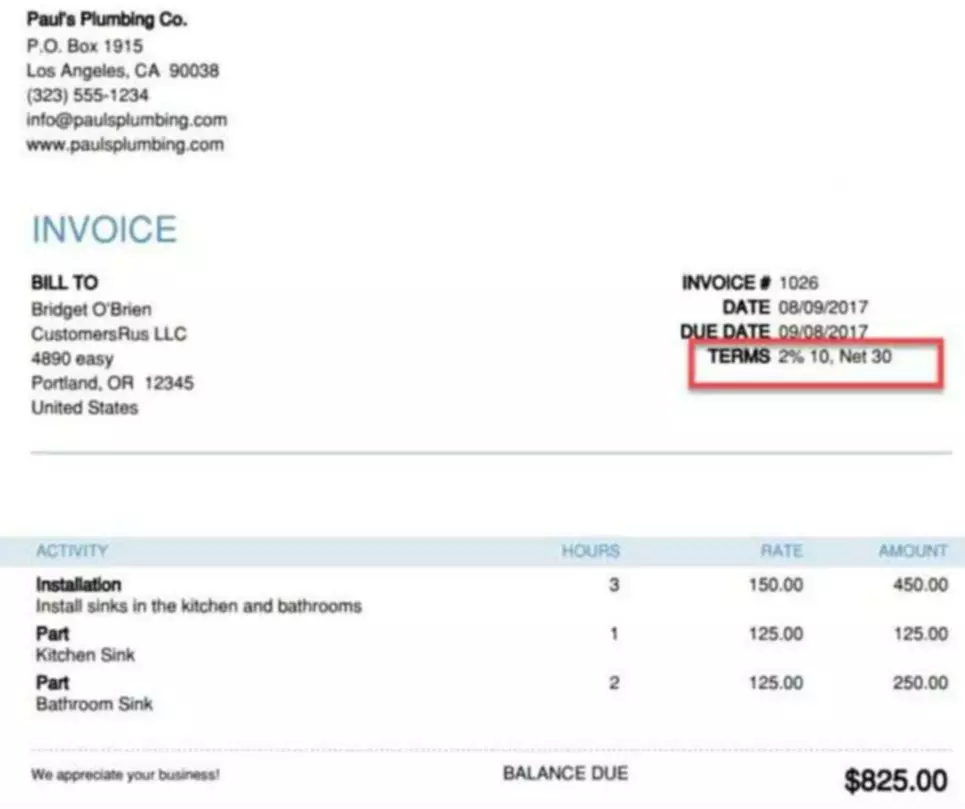

Include your due dates for reference, since the timing of payments can affect your cash flow. You can copy budget details from actuals for the prior year, copy data from an existing budget, or create a new budget from scratch. Adjustments can be made for each budget period, so you can adjust the amount each month to increase budgeted totals by a set amount or by percentage. When planning for revenue growth, be conservative as well, perhaps budgeting for a 5%-10% growth for the year. But if you don’t, you’ll end up with a loss, which is not where you want your business to be.

How to Create a Business Budget

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. You may also need to include the cost of storage solutions or disposal of leftover stock. No, all of our programs are 100 percent online, and available to participants regardless of their location. We offer self-paced programs (with weekly deadlines) on the HBS Online course platform.

Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets. Income is based on projections and estimates for the periods they cover, as are expenses.

How to create a business budget in 6 steps

A clear budget plan outlines what you expect to spend on all these costs. Both fixed expenses and variable expenses are recurring in nature, making it easy to account for them (even if variable expenses must be projected). One-time expenses, also called “one-time spends,” don’t recur and happen more rarely.

How to Create a Budget for a Small Business in 10 Steps

Beyond income from sales activity, you should include other income sources, such as returns on investments, asset sales, and bond or share offerings. LocaliQ’s Complete Guide to Marketing Budgets not only provides you with a marketing budget template, but also walks you through the marketing budget basics. Murphy’s law states, “Anything that can go wrong will go wrong.” That’s why you should set aside a contingency fund for your business. Here are a couple of steps you can take when creating your budget. Budgeting is your window into the health and priorities of your business. Divvy wants to provide you with budgeting options that work for your business.

How to make a budget for your small business

Now you’re ready to find your net profit—or what’s referred to as the bottom line. Total up the rest of your upcoming expenses for the month and subtract that number from your gross profit to find your net profit. You don’t have to be a numbers and spreadsheets person to build the skills you need to make a solid business budget and manage your company’s finances with confidence.

Create a profit and loss statement

The good news is that it is possible to come up with a budget (or at least a good estimation of what will be needed in terms of dollars and cents) fairly easily. This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start. When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate. While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.