How to Correct Accounting Errors

Swift action must be done as soon as an accounting error has been spotted. To know how to fix and/or correct the mistake that is considered adequate by Generally Accepted Accounting Principles (GAAP), figuring out what kind of error has been committed. In addition, other factors of the error include how it affects the information in the financial statement and if the financial statement offsets the error. Here, we will show the procedures on how to fix an accounting error.

First off, to correct the error and provide the correct data for a financial statement, there are three things you will have to look out for and ask yourself.

- Question #1: What is the nature and type of the found error?

- Question #2: What action would be needed to correct it?

- Question #3: Does the financial statement need to be restated?

Question #1: What type of error is it?

This is a fairly simple question as once the error has been found and determined, you may ask yourself the second question.

Question #2: What is needed to correct it?

For a small error, having it documented in a journal entry is more than adequate as that itself already acts as a notification. A larger, more complex error would oftentimes require a different procedure of correction to retained earnings for a prior-period adjustment that can be found on the accounting menu.

Question #3: Does the financial statement need to be restated?

A restatement usually means that a financial statement issued before has been revised to correct the error. If the error is material or if the financial statement issued before have been released with the year, a restatement of the financial statement is imperative.

How to restate the financial statements

If the financial statement does need to undergo a restatement, these are the following steps to follow:

- Modify the balances of any assets or liabilities at the start of the latest financial data displayed in the comparative statement for the summative effect of the error.

- The other part needs to correct the error that will be located in retained earnings.

- Finally, once you’re done with that, you will have to administer the correction of the error on all of the comparative-year financial statements. Most intermediary accounting textbooks usually define this as a period-specific effect.

Walk through for error correction

To understand this properly, we shall look into this through an example. In this scenario, a fictional corporation says, the VertexTwo Corporation in January 2013 finds more than one error in a financial statement pertaining to the accounting year of 2012. The books for the year’s twelve months remain open. All books before the year 2012 are closed.

As far as the errors concerned, let’s say in this scenario that:

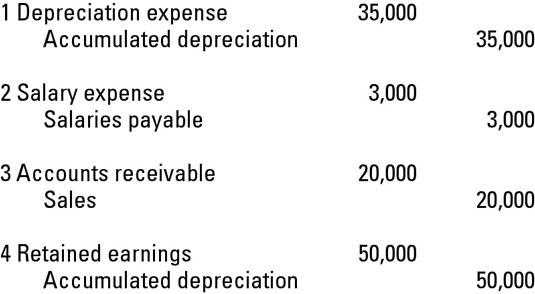

- A math error was rendered, resulting in depreciation expense to be understated by $35,000.

- The VertexTwo Corporation made an error in that it had not been able to recognize and accumulate salaries payable of $3,000.

- The VertexTwo Corporation had switched from the use of the cash method toward the accrual method. Later, it moved to a book revenue eventually leading to an error of understated net sales of $20,000

- The VertexTwo Corporation later found out an error that the depreciation expenses for the period before January 1, 2012, is understated by a further $50,000.

Below is the journal entry that will have to be made by the VertexTwo Corporation to correct the error on December 31, 2012.

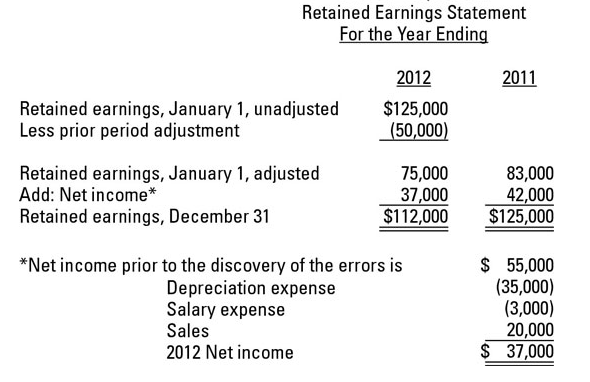

The VertexTwo Corporation shows two comparative years, which are 2011 and 2012, on its financial statement of retained earnings. The below displays how to render the adjusting journal entries.