How to convert cash basis to accrual basis accounting

This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid. If he uses the cash-basis accounting method, because no cash changes hands, the carpenter doesn’t have to report any revenues from this transaction in 2004. In this case, his bottom line is $1,200 less with no revenue to offset it, and his net profit (the amount of money the company earned, minus its expenses) for the business in 2004 is lower. This scenario may not necessarily be a bad thing if he’s trying to reduce his tax hit for 2004. As a church auditor; I find that most ministries prepare their internal financial statements on a cash basis which is most similar to how we all handle our own personal finances.

Cash Basis

Similarly, the company receives a $500 invoice from a supplier on July 10, and pays the bill on August 10. The expense is recognized on the date of payment, which is August 10. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out.

For instance; revenue is recorded when a sale is made rather than when cash is received and expenses are recorded in the period incurred – not paid. In a practical sense; churches and Christian ministries won’t typically have accrual issues with revenue since sales activities are not common. However; expense recognition timing is a significant issue since expenses are frequently incurred in one period and paid in the next.

What is difference between cash and accrual accounting?

Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out. This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid.

We recognize income when we receive cash and recognize an expense when we actually pay a bill. This makes sense to most ministry leaders since they too are able to relate to how they conduct their own personal finances. I believe that internally prepared financial statements should be useful to the users of the financial statements, so cash basis reporting is perfectly acceptable for internal financial reporting. However; many times ministries will need to provide accrual basis financial statements to external users such as mortgage lenders.

What is accrual accounting in Oracle Apps?

The cash method is simple in that the business’s books are kept based on the actual flow of cash in and out of the business. Income is recorded when it’s received, and expenses are reported when they’re actually paid. The cash method is used by many sole proprietors and businesses with no inventory. From a tax standpoint, it’s sometimes advantageous for a new business to use the cash method of accounting.

Accrual accounting is based on the matching principle, which is intended to match the timing of revenue and expense recognition. By matching revenues with expenses, the accrual method is intended to give a more accurate picture of a company’s true financial condition. Under the accrual method transactions are recorded when they are incurred rather than awaiting payment. This means a purchase order is recorded as revenue even though fund are not received immediately.

Disadvantages of Cash Basis Accounting

That way, recording income can be put off until the next tax year, while expenses are counted right away. When transactions are recorded on a cash basis, they affect a company’s books upon exchange of consideration; therefore, cash basis accounting is less accurate than accrual accounting in the short term. The Tax Reform Act of 1986 prohibits the cash basis accounting method from being used for C corporations, tax shelters, certain types of trusts, and partnerships that have C Corporation partners. In cash-basis accounting, cash earnings include checks, credit-card receipts, or any other form of revenue from customers.

The cash accounting method is, of course, the method most of us use in managing personal finances and it is appropriate for businesses up to a certain size. If a business generates more than $5 million in annual sales, however, it must use the accrual method, according to Internal Revenue Service rules. The value of accrual accounting becomes more evident for large, complex businesses. A construction company, for example, may undertake a long-term project and may not receive complete cash payments until the project is complete.

- The primary difference between cash and accrual basis – as it relates to churches – is when revenue and expenses are recognized (recorded in the financial statements).

- Cash basis accounting allows recognition/recording of the transaction when cash is physically received and/or released.

The same goes for expenses in that they are recorded even though no payment has been made. Accounting method refers to the rules a company follows in reporting revenues and expenses. The two primary methods are accrual accounting and cash accounting.

For instance; utilities are typically paid in arrears which means that you pay your utility bill in January for December use. Cash accounting is an accounting method in which payment receipts are recorded during the period they are received, and expenses are recorded in the period in which they are actually paid. In other words, revenues and expenses are recorded when cash is received and paid, respectively. Otherwise, an outside auditor will not sign off on its financial statements. However, these changes are fewer than what would be required if a business were to make a full transition from the cash basis to the accrual basis of accounting.

The primary difference between cash and accrual basis – as it relates to churches – is when revenue and expenses are recognized (recorded in the financial statements). Cash basis accounting allows recognition/recording of the transaction when cash is physically received and/or released. For instance; revenue is recorded when received and expenses are recorded when payment is made either by cash, check or credit card. There are also tax consequences for businesses that adopt the cash accounting method of recognizing cash inflows and outflows. In general, businesses can only deduct expenses that are recognized within the tax year.

The choice of revenue/expense recognition method can determine which year a business can deduct its expenses. Likewise, a company that receives payment from a client in 2018 for services rendered in 2017 will only be allowed to include the revenue in its financial statements for 2018. Cash accounting is an accounting method that is relatively simple and is commonly used by small businesses. In cash accounting, transaction are only recorded when cash is spent or received. In cash accounting, a sale is recorded when the payment is received and an expense is recorded only when a bill is paid.

Cash basis is a major accounting method by which revenues and expenses are only acknowledged when the payment occurs. Cash basis accounting is less accurate than accrual accounting in the short term.

Cash accounting reports revenue and expenses as they are received and paid; accrual accounting reports them as they are earned and incurred. Accrual basis accounting applies the matching principle – matching revenue with expenses in the time period in which the revenue was earned and the expenses actually occurred. This is more complex than cash basis accounting but provides a significantly better view of what is going on in your company. Cash accounting is an accounting methodology under which revenue is recognized when cash is received, and expenses are recognized when cash is paid.

For example, a company bills a customer $10,000 for services rendered on October 15, and receives payment on November 15. A sale is recorded on the cash receipt date, which is November 15.

The other is accrual accounting, where revenue and expenses are recorded when they are incurred. Small businesses often use cash accounting because it is simpler and more straightforward and it provides a clear picture of how much money the business actually has on hand. Corporations, however, are required to use accrual accounting under Generally Accepted Accounting Principles (GAAP).

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference?

Under cash accounting rules, the company would incur many expenses but would not recognize revenue until cash was received from the customer. So the book of the company would look weak until the revenue actually came in. If this company was looking for financing from a bank, for example, the cash accounting method makes it look like a poor bet because it is incurring expenses but no revenue. Accrual basis of reporting is distinctly different than cash basis in that revenue and expenses are recognized/recorded when either earned or incurred – not paid.

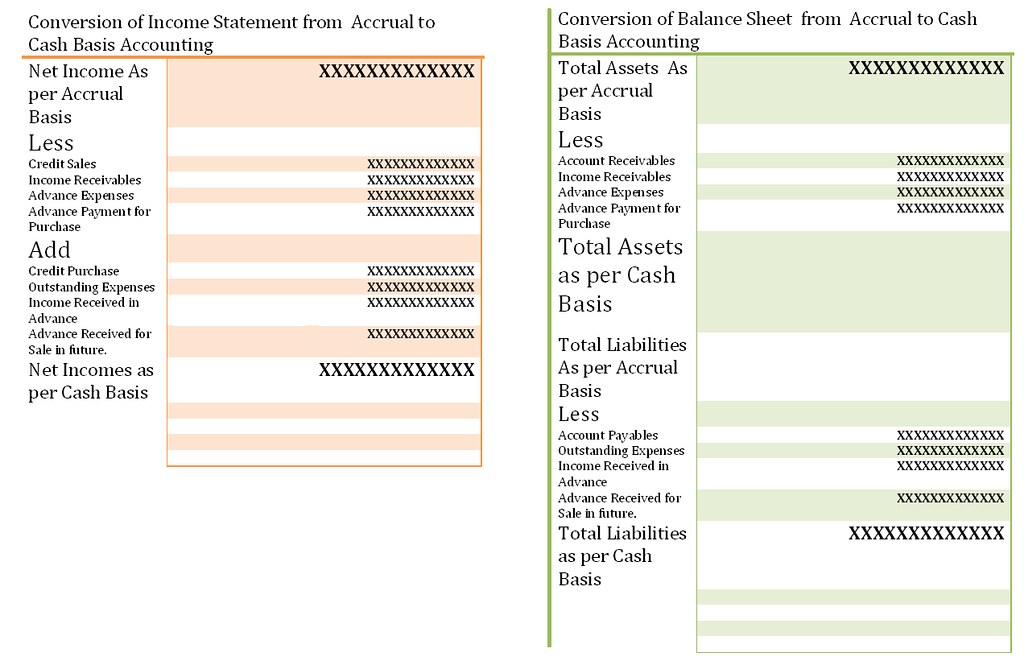

How do you calculate cash basis accounting?

The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your accounts. Cash accounting recognizes revenue and expenses only when money changes hands, but accrual accounting recognizes revenue when it’s earned, and expenses when they’re billed (but not paid).