How to Calculate Variable Cost per Unit

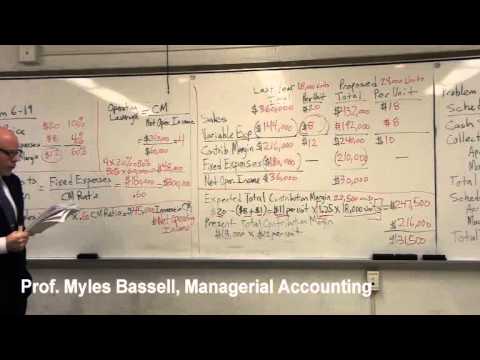

The contribution margin calculates the profitability for individual items that the company manufactures and sells. Specifically, the contribution margin is used to review the variable costs included in the production cost of an individual item.

Company

Gross profit is your income or sales less cost of goods sold (COGS), which are all fixed costs (above the line on your income statement). Contribution margin analyzes sales less variable costs, such as commissions, supplies and other back office expenses (costs listed below the line on the income statement). The contribution margin for this example would be the difference of $1,000,000 and $400,000, which is $600,000. A ‘per product’ margin can be found by dividing $600,000 by the number of units sold. If you’re an owner or CEO of a small or mid-sized business, in order to have your fingers on the pulse of your business’s financials, and closely manage the bookkeeping and accounting, you need actionable financial intelligence.

ACCOUNTING

Contribution margin concept establishes a relationship between cost, sales, and profit. For the calculation of Contribution margin, the firm refers to its net sales and total variable expenses. It refers to the amount left over after deducting from the revenue or sales, the direct and indirect variable costs incurred in earning that revenue or sales.

Contribution margin is the amount of sales left over to contribute to fixed cost and profit. Contribution margin can be expressed in a number of different ways, including per unit and as a percentage of sales (called thecontribution margin ratio). In the contribution margin income statement, we calculate total contribution margin by subtracting variable costs from sales.

Moreover, the statement indicates that perhaps prices for line A and line B products are too low. This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period.

Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth. Contribution margin is a product’s price minus all associated variable costs, resulting in the incremental profit earned for each unit sold. The total contribution margin generated by an entity represents the total earnings available to pay for fixed expenses and to generate a profit.

Contribution margin is used by companies to simplify decisions regarding its operations. One application is using the contribution margin as a quick measure for break even analysis. The break even point for a company is when its revenues equal its expenses, leaving the company with neither a net profit nor net loss. For example, suppose that a company does a quick calculation for the contribution margin and finds that it is $3 per product sold. If the company has $30,000 in fixed costs for the period, then the break-even would be to sell 10,000 units for that same period.

BUSINESS OPERATIONS

The contribution margin concept is useful for deciding whether to allow a lower price in special pricing situations. If the contribution margin at a particular price point is excessively low or negative, it would be unwise to continue selling a product at that price. It is also useful for determining the profits that will arise from various sales levels (see the example).

Contribution margin may also be used to compare individual product lines and also be estimated to set sales goals. Contribution margin is the amount left-over after deducting from the revenue, the direct and indirect variable costs incurred in earning that revenue. This left-over value then contributes to paying the periodic fixed costs of the business with any remaining balance contributing profit to the owners.

- However, it should be dropped if contribution margin is negative because the company would suffer from every unit it produces.

- Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business.

What is the formula of a contribution margin?

Total contribution margin (CM) is calculated by subtracting total variable costs TVC from total sales S. Contribution margin per unit equals sales price per unit P minus variable costs per unit V or it can be calculated by dividing total contribution margin CM by total units sold Q.

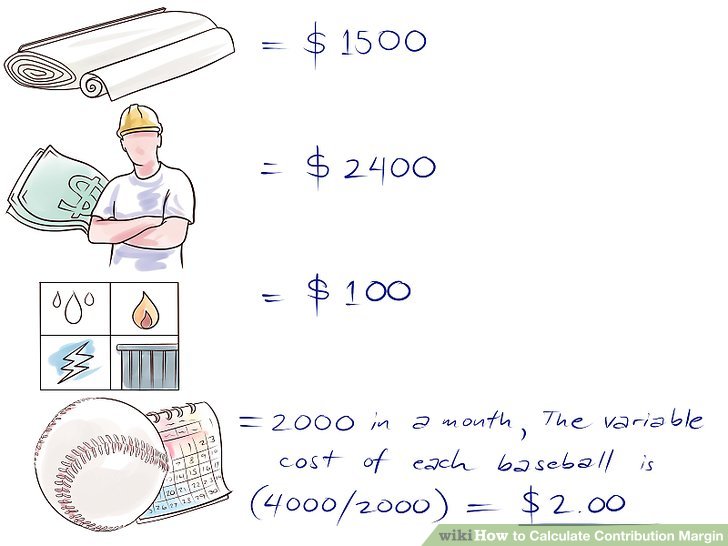

Hence, we can calculate contribution margins by deducting the total variable cost from the total sales. To better understand contribution margin, consider that the net income of a company is its revenues minus expenses. The term revenues is synonymous with sales, and expenses include fixed costs and variable costs. Fixed costs are expenses that typically do not change and are not heavily influenced by the quantity of products sold.

Further, the concept can be used to decide which of several products to sell if they use a common bottleneck resource, so that the product with the highest contribution margin is given preference. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated.

When calculating an accurate contribution margin, defining your variable costs vs. your fixed costs is essential. However, it should be calculated as direct variable expenses to see gross profit and indirect variable expense to see contribution margin. You need both because if any expenses are in the wrong category on your income statement, then you will not be able to calculate an accurate contribution margin or ratio.

How to Determine the Average Contribution Margin per Hour

In comparison with the gross profit margin, it is a per-item profit metric, as opposed to the total profit metric given by gross margin. Both ratios are useful management tools, but reveal different information.

This left-over value then contributes to paying the periodic fixed costs of the business with any remaining balance contributing profit to the firm. The contribution margin represents the portion of a product’s sales revenue that isn’t used up by variable costs, and so contributes to covering the company’s fixed costs. It’s a variable cost because you would not have that, but it’s not direct.

When calculating your contribution margin, be careful to subtract only variable costs from your revenue or sales. These are items located below the line (i.e. below “gross profit”) on your company’s income statement. It appears that Beta would do well by emphasizing Line C in its product mix.

How do you calculate contribution margin percentage?

The unit contribution margin is $8. To find the contribution margin ratio, divide the contribution margin by sales. The contribution margin ratio formula is: (Sales – variable expenses) ÷ Sales.

However, it should be dropped if contribution margin is negative because the company would suffer from every unit it produces. Contribution margin per unit is the difference between the price of a product and the sum of the variable costs of one unit of that product. Examples of variable costs are raw materials, direct labor (if such costs vary with sales levels), and sales commissions. The contribution margin is the revenue remaining after subtracting the variable costs involved in producing a product.

BUSINESS PLAN

Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business. For example, a production line with positive contribution margin should be kept even if it causes negative total profit, when the contribution margin offsets part of the fixed cost.