How to Calculate the Employee Labor Percentage

Keep reading to find out how to find your profit margin and what is the gross margin formula. You can calculate a product’s unit price by taking the item’s total price and dividing it by the quantity listed on the package.

How to calculate the unit price?

The quantity can be measured as individual items or as a unit of measurement, such as a gram or pound. You can use the unit price to compare items to find the best value.

Learning how to calculate the cost-per-unit will guide you through many key business decisions and, hopefully, help you grow revenue. Our price / quantity calculator – also called unit price calculator – lets you compare products of various different quantities and prices. Imagine that you’re in a shop and you want to work out which product has the best deal (that is it is sold with the lowest margin), but are not sure how, then this tool is for you. You will need to add a margin or mark-up to your break-even point. This is usually expressed as a percentage of break-even.

Unit Price Calculator

The shelf tag shows the total price (item price) and price per unit (unit price) for the food item. Research suggests that unit price information in supermarkets can lead shoppers to save around 17-18% when they are educated on how to use it, but that this figure drops off over time. Unit cost is a very important pricing and selling tool for any company, because it’s hard to set a profitable price when you don’t know what it costs you to produce a product.

Calculate the unit price of the items you’re planning to buy. Divide the total cost of each product by the quantity in the package.

By entering the shop name and item’s brand, number of pieces and price information in the respective fields, users can determine the price per piece or item. By default, the price is in dollars; but results can be applied to any other decimal currency. It is now easy to calculate the unit price online!

Look for the unit cost on the product label for an easier option. Most stores include the product’s unit price on the shelf label for that product. Typically, the unit price is printed in small type in the top or lower left corner and may have a box around it.

The food cost is the cost of the ingredients used in a dish. To calculate the food cost, you need to know the cost of your ingredients, along with how much of each ingredient is used in your dish. You take the cost of your ingredients and then you break it down into units, such as per ounce or per egg.

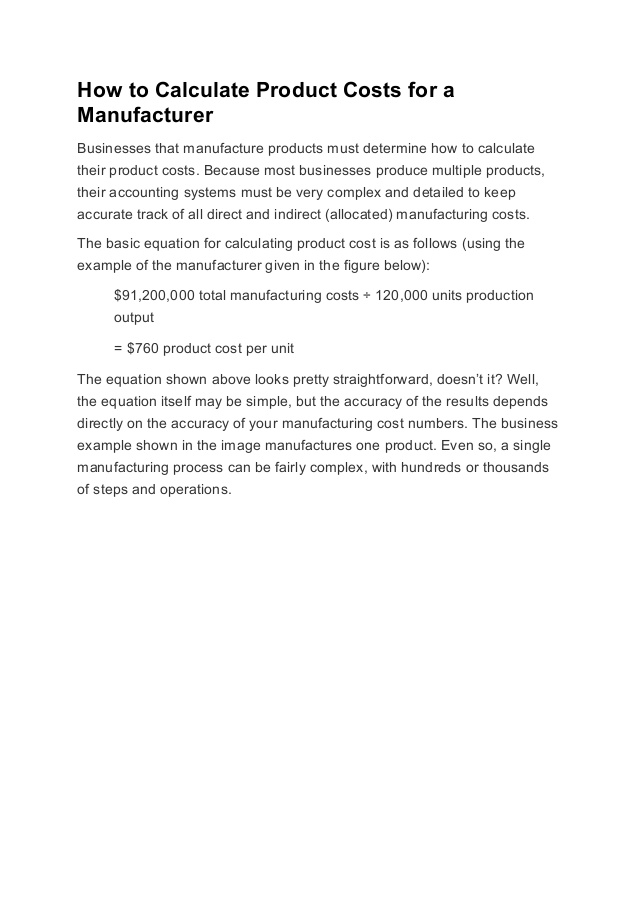

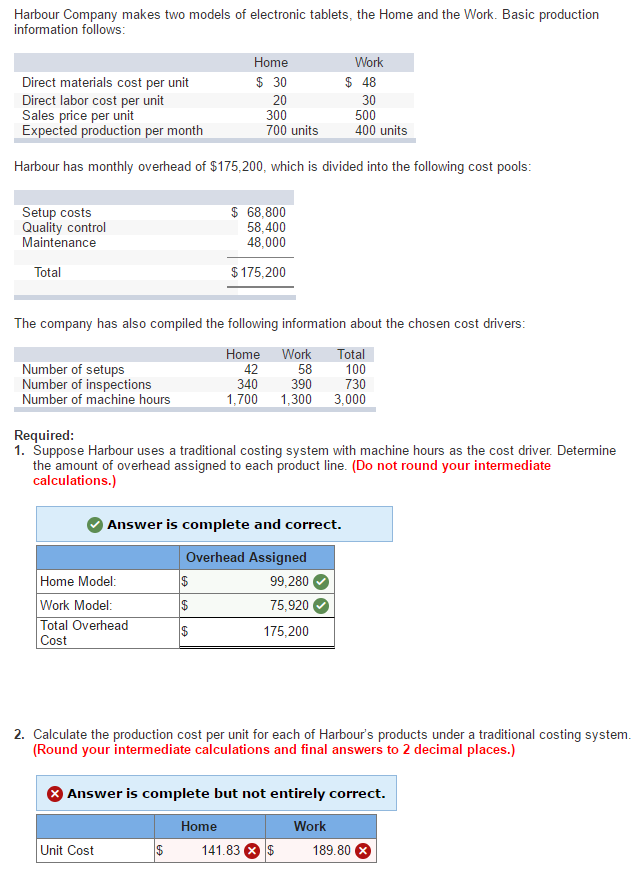

Look at the price tag or use a price scanning tool to find the total price of the product. Add the cost of direct materials, direct labor and manufacturing overhead within a given time period, such as one month, to determine the total manufacturing costs for a product line. Determine how many items were produced within the same time period. Divide the total manufacturing costs by the number of items produced to arrive at the production cost per unit.

If the price per unit on your major products can be reduced, your profits go up. When your profits increase, you may need to discontinue certain product lines or reduce production, until your costs stabilize.

Compare multi-item packages – soda cans vs. soda bottles

You then multiply these per-unit prices by the number of units you use. You then add up all these individual prices to find the total food cost for your dish. Sometimes it’s hard to tell if a bigger package is really a better value when you’re shopping for items at a store.

- You take the cost of your ingredients and then you break it down into units, such as per ounce or per egg.

- The food cost is the cost of the ingredients used in a dish.

Fortunately, checking the item’s unit price can help you figure out which package provides the most product for the cost. The unit price is the cost per quantity of item you’re receiving. The quantity might be per item or per unit of measurement, such as ounces, grams, gallons, or liters. To calculate the unit price, simply divide the cost of the product by the quantity you’re receiving or check the store’s shelf label.

Industry norms, experience or market knowledge will help you decide the level of mark-up. If the price looks too high, trim your costs and reduce the price accordingly. Be aware of the limitations of cost-plus pricing, because it works on the assumption you will sell all units. The difference between gross margin and markup is small but important.

For example, if you see a 24 oz bottle of shampoo for $13.79. Divide $13.79 by 24, to find a unit price of $0.57. The unit price is typically a fraction of the total cost of the product.

How do you calculate cost per unit?

Unit cost is determined by adding fixed costs and variable costs (which are direct labor costs and direct material costs lumped together), and then dividing the total by the number of units produced.

Coded in HTML and JavaScript, the price comparison app is easy-to-use. Users can access the app using desktops, laptops, netbooks, tablets or mobile devices to compute the unit price.

First, fill out all fields and “Calculate”

Then, compare the unit prices of 2 or more packages of the same product to see which is the better value. Generally, the product with the lowest unit cost is the best value. Compare the unit prices that you calculated to see which one is lower.

Check the shelf label to see if the unit price is there. The unit price is the cost per ounce, per pound, per kilogram, per liter, or other units of weight or volume of an item you want to buy. With the unit price calculator, you can compare items with different price per pound, price per ounce, or any other weight or volume unit. How to count the unit price of goods sold in multi-packs? – PricePerPiece.com is a web app for comparing the cost per item or price per piece of goods.

Fixed costs do not change with production levels, while variable costs do fluctuate. This margin calculator will be your best friend if you want to find out an item’s revenue, assuming you know its cost and your desired profit margin percentage. In general, your profit margin determines how healthy your company is – with low margins you’re dancing on thin ice and any change for the worse may result in big trouble. High profit margins mean there’s a lot of room for errors and bad luck.

PRICEPERPIECE.COM

The former is the ratio of profit to the sale price and the latter is the ratio of profit to the purchase price (Cost of Goods Sold). In layman’s terms, profit is also known as either markup or margin when we’re dealing with raw numbers, not percentages. It’s interesting how some people prefer to calculate the markup, while others think in terms of gross margin. It seems to us that markup is more intuitive, but judging by the number of people who search for markup calculator and margin calculator, the latter is a few times more popular. The per unit price, or the unit price, is the cost per quantity of an item.