How to Calculate Sales Revenue: Definition & Formula

In the real world, there are costs to take into account—everything from salaries and rent to production and shipping costs. Their gross revenue was $1.5 million and their COGS was $500,000, leading to a gross income of $1 million. But now the remainder of the business’s expenses have to be taken into account, and combined they total up to $400,000. That means their net income comes out to $600,000; significantly lower than the gross revenue, but still profitable.

No, sales cannot exist without revenue.Yes, separate existence of revenue without sales is possible. EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. EBIT is also sometimes referred to as operating income and is called this because it’s found by deducting all operating expenses (production and non-production costs) from sales revenue.

Non-operating revenue is money earned from a side activity that is unrelated to your business’s day-to-day activities, like dividend income or profits from investments. Non-operating revenue is more inconsistent than operating revenue. You make sales frequently, but you might not consistently earn money from side activities. Non-operating revenue is listed after operating revenue on the income statement.

Definition of Revenue

Therefore, the key difference between cash flow and profit is time. Profit can’t show you the whole picture of how your business is doing financially because profit doesn’t tell you when those inflows and outflows of cash are coming. In other words, it can’t give you a day-to-day understanding of your business’s financial well-being.

In accounting, revenue is the income that a business has from its normal business activities, usually from the sale of goods and services to customers. Some companies receive revenue from interest, royalties, or other fees.

The difference between net sales and net income is the difference between the top and bottom lines. Net sales, or net revenue, is the money your company earns from doing business with its customers. Net income is profit – what’s left over after you account for all revenue, expenses, gains, losses, taxes and other obligations. While terms like “revenue” and “sales” factor into a company’s profits, the correlation is less direct than a beginning investor might expect. Revenue would only directly translate into profit if it cost absolutely nothing to run the business.

Definition of Sales

That includes salaries and benefits for employees at the business. Travel expenses are deducted from revenue, as are expenses related to the company’s office.

How to Calculate Sales Revenue: Definition & Formula

Gross sales are calculated simply by adding up the value of all the invoices for products and services that have been sold — it does not matter whether the accounts are paid. Total revenues are based on actual funds received by the company; they are calculated by adding up the actual money received in cash or equivalents, from all sources. When people speak of the bottom line in business, they’re talking about net income. Net income is simply profit, and the whole income statement flows toward this number.

COGS refers to all expenses that you can fully and directly attribute to the production of goods sold by a company. For example, if you operate a retail company, COGS is the cost of inventory sold in your store. A company’s revenue usually includes income from both cash and credit sales.

The money spent on advertising, marketing, events and client-related expenses is also deducted. The most obvious, easily identifiable and broad numbers that affect your profit margin are your net profits, your sales earnings, and your merchandise costs. On yourincome statement, look at net revenues and cost of goods sold for a very general view of these major variables. Net profit margin is the ratio of net income relative to revenues, calculated by simply dividing profits by sales. This is a quick way to determine what percentage of your sale price that your company keeps after accounting for the costs that went into the sale.

Gross income is the revenue generated from a business’s sales or an individual’s labor. Net income is the profit made from that revenue when total expenses are taken out. For an individual, gross income is simply what your salary is while net income is what you actually take home in your paycheck.

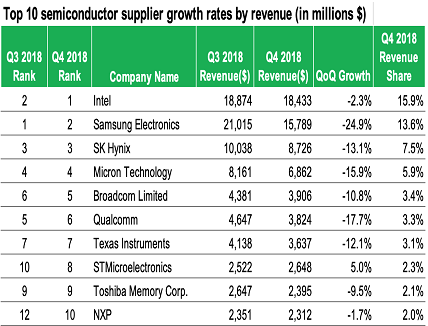

- Revenue may refer to business income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in “Last year, Company X had revenue of $42 million”.

- In accounting, revenue is the income that a business has from its normal business activities, usually from the sale of goods and services to customers.

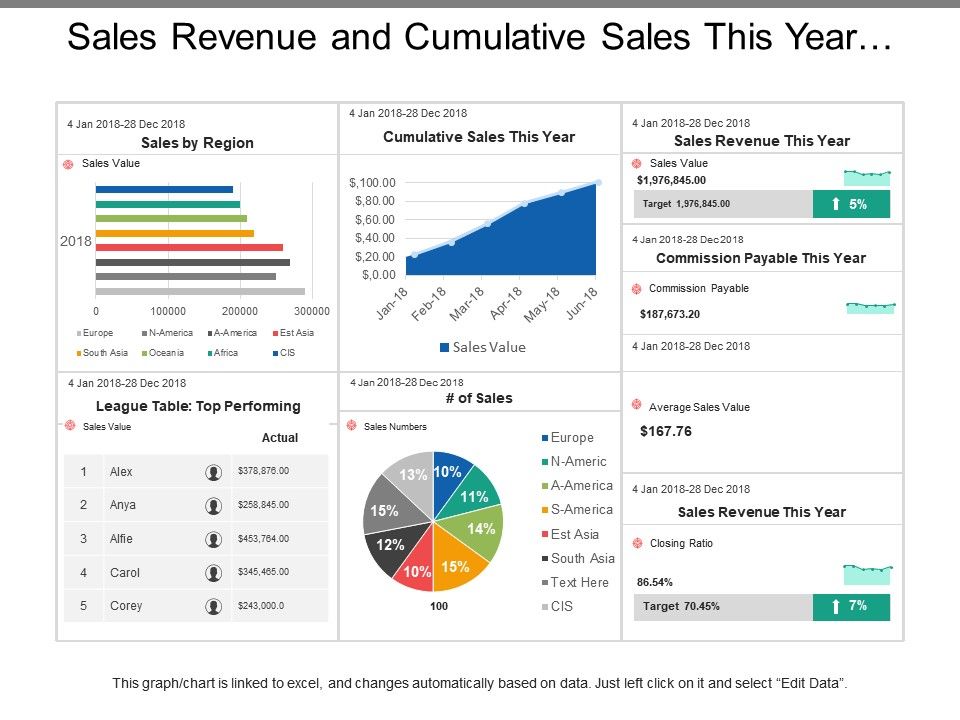

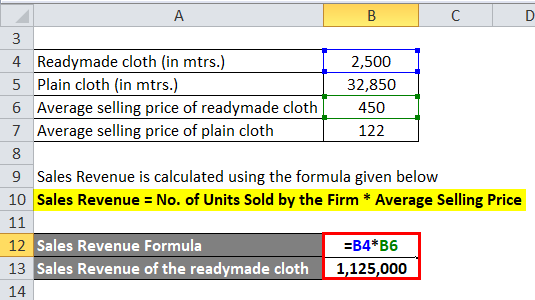

How do you calculate sales revenue?

Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms “sales” and “revenue” can be, and often are, used interchangeably to mean the same thing. It is important to note that revenue does not necessarily mean cash received.

If sales revenue goes down, it can affect all aspects of the company. If the amount of money coming into the business decreases, other cuts must be made in payroll, expenses, and resources. Likewise, when sales revenue increases, more money is coming into the business, and extra cash flow may be available for debt reduction, expansion, and perks for the employees. This means that a credit in the revenue T-account increases the account balance.

Sales Revenue

Allowances are price reductions or rebates offered to customers to persuade them to keep an item rather than return it. The net sales figure also includes subtractions for certain sales discounts. On the other hand, revenue indicates the total amount of cash generated by the company from its diverse range of activities. It delineates the income earned from selling goods, delivering services or using capital in any other way, related to the core activities of the business, before giving effect to the expenses and costs.

As shown in theexpanded accounting equation, revenues increase equity. Unlike other accounts, revenue accounts are rarely debited because revenues or income are usually only generated. Unearned revenue accounts for money prepaid by a customer for goods or services that have not been delivered.

More specifically, profit is the amount of income that remains after all expenses, costs and taxes are accounted for. Whereas sales revenue only considers the amount of income a business generates through the sale of its goods or services, profit considers both income and expenses when it is calculated. Gross profit is the direct profit left over after deducting the cost of goods sold, or “cost of sales”, from sales revenue. It’s used to calculate the gross profit margin and is the initial profit figure listed on a company’s income statement.

The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. From an accounting standpoint, the company would recognize $50 in revenue on itsincome statementand $50 in accrued revenue as an asset on its balance sheet. When the company collects the $50, the cash account on the income statement increases, the accrued revenue account decreases, and the $50 on the income statement will remain unchanged. As long as you have those first two figures you can calculate your company’s gross profits. If revenue totaled $1,500,000 and the cost of goods sold (COGS) were $500,000, your business’s gross income would be $1,000,000.

A company’s gross profit is the profit it makes after deducting the costs directly associated with making its products or providing its services. It is calculated by subtracting your business revenue from the “cost of goods sold” (COGS).

Revenue may refer to business income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in “Last year, Company X had revenue of $42 million”. Profits or net income generally imply total revenue minus total expenses in a given period. This is to be contrasted with the “bottom line” which denotes net income (gross revenues minus total expenses). Profit is a business’s total revenues minus total costs and is often referred to as its bottom line.

Additional Problems of Calculating Sales Revenue

Government revenue may also include reserve bank currency which is printed. It’s the total amount earned from sales, called gross revenue, minus the value of product returns and allowances.

What is difference between sales and revenue?

Sales revenue is generated by multiplying the number of a product sold by the sales amount using the formula: Sales Revenue = Units Sold x Sales Price. The more sales a company makes, the more money available within the business.

Revenue is the total amount of income generated by the sale of goods or services related to the company’s primary operations. Profit, typically called net profitor the bottom line, is the amount of income that remains after accounting for all expenses, debts, additional income streams and operating costs.

There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received. Net income, in deducting other expenses, involves more than just the most direct expenses related to the product sold. Selling expenses, aka expenses required for the labor in selling your product, is taken into account.