How to Calculate Sales Mix Variance

Revenue is the money that a business actually receives from its customers for the provisions of goods and services during a particular period. Discounts and deductions have already been adjusted, which means it is the gross income from which various costs are later deducted in order to calculate profit or loss. Total revenue can be calculated by multiplying the price at which goods or services are sold by number units sold.

This concept is used when a major proportion of sales are likely to decline or in period of recession or economic turn down. Managers can better make better production and sales decision if they know the margin of safety for a particular product or service. When the margin of safety is large, the business would want to try new pricing, marketing and take risks hoping to further increase sales and revenues. On the other hand, if the margin of safety is meager, managers are likely not to change anything, since any small change could trigger losses. In such a situation managers would want to reduce costs, so that margin of safety can be increased.

The contribution margin should be relatively high, since it must be sufficient to also cover fixed expenses and administrative overhead. Also, the measure is useful for determining whether to allow a lower price in special pricing situations. The ratio is also useful for determining the profits that will arise from various sales levels (see the following example).

The break-even analysis also assumes that all units produced are also sold, which is not always the case. This tool fails to take into account the demand-side situation, since not all units produced are sold at the assumed price.

Contribution margin may also be used to compare individual product lines and also be estimated to set sales goals. Break-even diagram (also known as break-even chart, see above) is a line graph used for break-even analysis to determine the break-even point, the point where business will make a profit or loss.

The diagram clearly shows how a change in cost or selling price can impact the overall profitability of the business. Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business. For example, a production line with positive contribution margin should be kept even if it causes negative total profit, when the contribution margin offsets part of the fixed cost. However, it should be dropped if contribution margin is negative because the company would suffer from every unit it produces.

In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas Price and Variable Costs are stated as per unit costs—the price for each product unit sold. Variable costs also change as material, labor and other indirect variable expenses could increase or decrease as quantity changes. For Example, Labor rates will increase due to overtime if more units are produced.

Contribution margin can be calculated by subtracting variable expenses from the revenues. The contribution margin shows how much of the company’s revenues will be contributing towards covering the fixed costs.

This calculation requires the business to determine selling price, variable costs and fixed costs. Once these numbers are determined, it is fairly easy to calculate break-even point in units or sales value. In the previous example, the break-even point was calculated in terms of number of units.

Production managers tend to focus on the number of units it takes to recover theirmanufacturingcosts. It calculates the number of units that need to be produced and sold in a period in order to make enough money to cover the fixed andvariable costs.

How do you calculate break even point in sales mix?

Definition: A sales mix is the variety of products sold by a company. A company’s sales mix can also be considered the ratio of sales for each product compared with the overall sales volume of all products.

One application is using the contribution margin as a quick measure for break even analysis. The break even point for a company is when its revenues equal its expenses, leaving the company with neither a net profit nor net loss. For example, suppose that a company does a quick calculation for the contribution margin and finds that it is $3 per product sold. If the company has $30,000 in fixed costs for the period, then the break-even would be to sell 10,000 units for that same period.

The denominatorof the equation, price minus variable costs, is called the contribution margin. After unit variable costs are deducted from the price, whatever is left—the contribution margin—is available to pay the company’s fixed costs.

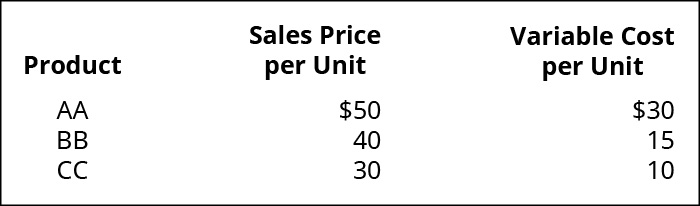

To calculate sales-mix variance, start with the actual number of units your business sold of each product. Multiply that number by the actual sales mix percentage for the product minus the budgeted sales-mix percentage. Remember that the sales mix percentage is the product’s percentage of total sales. Multiply that by the budgeted contribution margin per unit, where the contribution margin is the selling price per unit minus the unit’s variable costs. Contribution margin is used by companies to simplify decisions regarding its operations.

- To calculate sales-mix variance, start with the actual number of units your business sold of each product.

- Multiply that number by the actual sales mix percentage for the product minus the budgeted sales-mix percentage.

Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. “Contribution” represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. This concept is one of the key building blocks of break-even analysis.

Calculating the breakeven point is a key financial analysis tool used by business owners. Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point. Small business owners can use the calculation to determine how many product units they need to sell at a given price pointto break even. To better understand contribution margin, consider that the net income of a company is its revenues minus expenses.

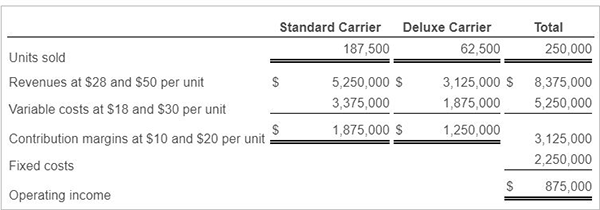

Sales mix

Number of units are plotted on the horizontal (X) axis, and total sales/costs are plotted on vertical (Y) axis. Using the diagrammatical method, break-even point can be determined by pinpointing where the two (revenue and total costs) linear lines intersect. The total revenue and total cost lines are linear (straight lines), since prices and variable costs are assumed to be constant per unit. The Break-even diagram can be modified to reflect different situation with various prices and costs.

Chapter 5: Cost Behavior and Cost-Volume-Profit Analysis

The term revenues is synonymous with sales, and expenses include fixed costs and variable costs. Fixed costs are expenses that typically do not change and are not heavily influenced by the quantity of products sold. The simplest way to calculate revenue when volume price changes is to multiply the number of units sold at each price level.

It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low. This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. Higher-level management might tend to focus on the actual sales dollars instead of the number of units needed to recover costs. The break-even point in dollars formula is calculated by dividing fixed costs by the contribution margin ratio for the period.

This can be done by dividing company’s total fixed costs by contribution margin ratio. The contribution margin for this example would be the difference of $1,000,000 and $400,000, which is $600,000. A ‘per product’ margin can be found by dividing $600,000 by the number of units sold.

Published by Business Intelligist

If you sell an additional 5,000 widgets at 75 cents each, your total revenue for the 15,000-widget sale is $10,000 plus $3,750, or $13,750. You can then divide your 15,000 widgets by your overhead and manufacturing costs to get your profit margin per unit and gross profit for the order. Margin of safety is a tool which complements break-even analysis, since these two tool are interrelated.

What is sales mix ratio?

Follow these steps to calculate it at the individual product level: Subtract budgeted unit volume from actual unit volume and multiply by the standard contribution margin. Do the same for each of the products sold. Aggregate this information to arrive at the sales mix variance for the company.

The break-even point in units equation is calculated by dividing the fixed costs by thecontribution margin per unit. Break-even analysis is widely used to determine the number of units the business needs to sell in order to avoid losses.