How to calculate inventory purchases

The difference between the methods is the timing of when the inventory cost is recognized, and the cost of inventory sold is posted to the cost of sales expense account. The first in, first out (FIFO) method assumes the oldest units are sold first, while the last in, first out (LIFO) method records the newest units as those sold first.

Because the average cost is being re-calculated and is different for each transaction, this method is often referred to as a moving average. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs. Those who favor LIFO argue that its use leads to a better matching of costs and revenues than the other methods. When a company uses LIFO, the income statement reports both sales revenue and cost of goods sold in current dollars.

What is a perpetual inventory system?

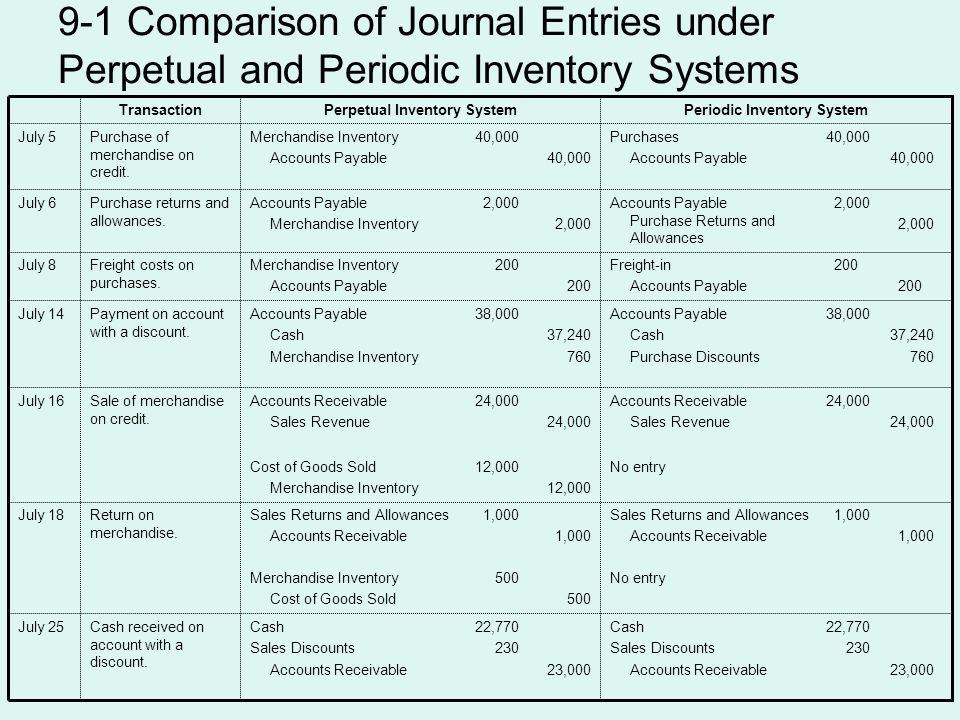

What is the difference between a perpetual inventory system and a periodic inventory system?

A perpetual inventory system keeps continual track of your inventory balances. Updates are automatically made when you receive or sell inventory. Purchases and returns are immediately recorded in your inventory accounts. For example, a grocery store may use a perpetual inventory system.

Businesses can simplify the inventory costing process by using a weighted average cost, or the total inventory cost divided by the number of units in inventory. A perpetual inventory system, or continuous inventory system, is an inventory control system that allows businesses to keep a real-time account of inventory on hand. The widespread use of computers after the 1970s increased this systems popularity because businesses were able to more easily keep track of inventory as it sold.

The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods.

What differentiates a periodic from a perpetual inventory management system, and which makes the most sense for your company? The calculations for perpetual inventory are typically done as you go versus waiting until the end of the accounting period, like with periodic inventory. The Weighted-Average Method of inventory costing is a means of costing ending inventory using a weighted-average unit cost.

Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method. The FIFO (first-in, first-out) method of inventory costing assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods.

Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software. Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand. Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database.

The resulting gross margin is a better indicator of management ‘s ability to generate income than gross margin computed using FIFO, which may include substantial inventory (paper) profits. To illustrate, assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase. The company computes the ending inventory as shown in; it subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Note that you can also determine the cost of goods sold for the year by recording the cost of each unit sold.

- Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

- Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand.

This method assumes the first goods purchased are the first goods sold. In some companies, the first units in (bought) must be the first units out (sold) to avoid large losses from spoilage. Such items as fresh dairy products, fruits, and vegetables should be sold on a FIFO basis. In these cases, an assumed first-in, first-out flow corresponds with the actual physical flow of goods. Companies can choose from several methods to account for the cost of inventory held for sale, but the total inventory cost expensed is the same using any method.

Inventory costing systems

Effectively, the cost of goods sold includes such elements as direct labor and materials costs and direct factory overhead costs. With a real-time system updating constantly, there are many advantages to the business owner. It is a proactive way to prevent stock from running out as when stock is low it can be instantly identified and stock can be reordered. It also gives business owners a better understanding of customer buying patterns and their purchasing behavior.

Barcodes, radiofrequency identification scanners (known as RFID), and point of sale systems (also known as POS) provided support for this system by quickly inputting inventory information as customers purchase items. Perpetual inventory systems provide the business owner with a record of detailed sale transactions by item, including where, when, and at what price items were sold. As a result, businesses can have inventory spread over more than one physical location while maintaining a centralized inventory management system.

Inventory Management Software for your growing business

Companies most often use the Weighted-Average Method to determine a cost for units that are basically the same, such as identical games in a toy store or identical electrical tools in a hardware store. Since the units are alike, firms can assign the same unit cost to them. Inventory cost flow assumptions are necessary to determine the cost of goods sold and ending inventory. Companies make certain assumptions about which goods are sold and which goods remain in inventory (resulting in different accounting methodologies).

Investigating stock level discrepancies

This is for financial reporting and tax purposes only and does not have to agree with the actual movement of goods (companies typically choose a method because of its particular benefits, such as lower taxes). It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The LIFO method assumes that the most recent products added to a company’s inventory have been sold first. The costs paid for those recent products are the ones used in the calculation. The selection of the inventory system determines when the cost of goods sold is calculated.

What is the perpetual inventory system example?

A perpetual inventory system is a method of inventory management that records real-time transactions of received or sold stock through the use of technology – generally considered a more efficient method than a periodic inventory system.

Overall, this automated system is more accurate and accurate information can be very valuable to a business owner. It can assess if customers were responsive to discounts, their purchasing habits, and if they returned any items. Unlike periodic inventory systems, the perpetual module reduces the need for frequent, physical inventory counts. Companies that use a perpetual inventory system update the inventory account whenever inventory is purchased or sold. If inventory is sold again later in that same period, the company must calculate another average cost that will be used to calculate the Cost of Goods Sold to be recognized on that transaction.

A more accurate understanding of customer preferences can guide which items a business stocks and when they place them on the sales floor. If a company has several locations, a perpetual inventory system centralizes this management. It amalgamates all information and places it in one consolidated and accessible place.